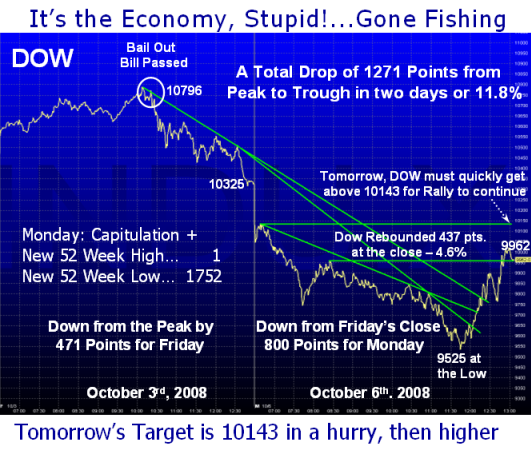

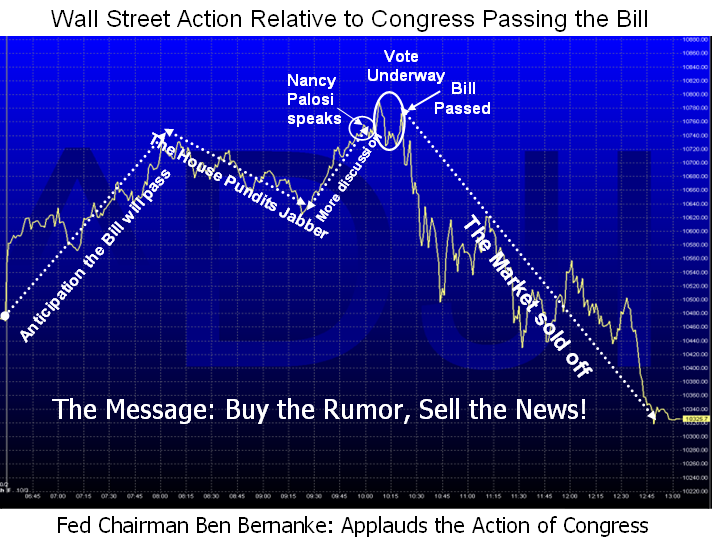

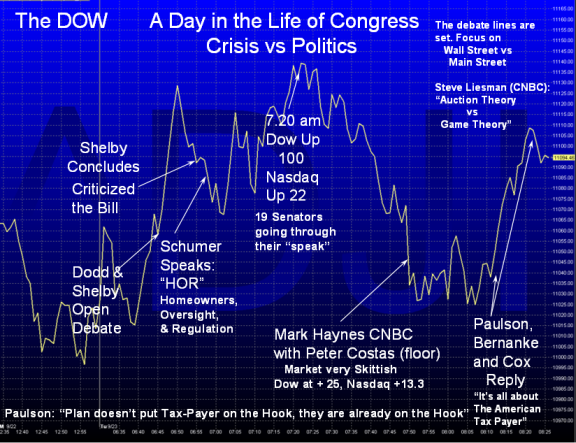

3 Responses to “Wall Street Reacts to a Day in the Life of Congress!”

LOL That was very interesting. It’s amazing to me really that the market is so emotional. But it is what it is.

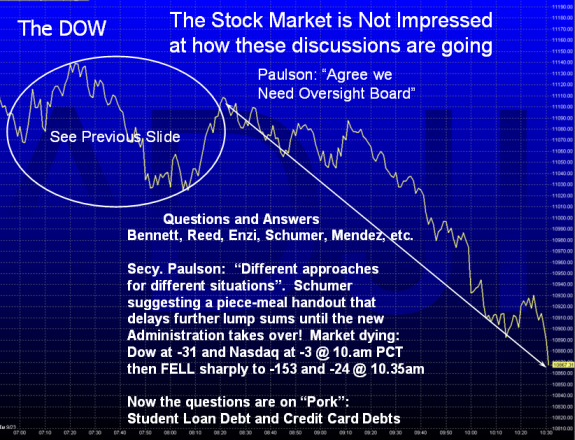

Ian, I don’t disagree with your assessment that things will get worse before they get better, but I think that, all things considered, it is good that the market has not over-reacted to the ongoing bad news and uncertainty. I think most of us agree that a measure of debate is good, rather than writing a $700B check with no questions asked.

Hi Steve: I couldn’t agree with you more. I suppose what triggered your comment is my last sentence on “pussy-footing” as my concern at the time was for an over-reaction by the markets ala 1929 and 1987, which fortunately for us all has not occurred so far. I certainly didn’t mean to imply that they write a blank check, and I am glad to see the subsequent urgency on all fronts to bring closure to a joint solution. I also agree a measure of debate is healthy, and as things have since unfolded there has been sufficient due diligence to buoy the market up from precipitous consequences. If “floodgate” action is avoided we will all be happy until the next time. My emphasis was on the “degree of a sense of urgency”, nothing else.

I have made it a principle of mine not to bring politics into the discussion on this blog, but as I have always maintained, one important aspect of Investing is to understand the reaction of the Stock Market to the action or inaction that the FOMC takes. If you take the time to look at past blog notes of mine, you will see that is the emphasis I apply. That is why I take the time on occasions like this to share five hours of my efforts just catching that reaction, leave alone the additional time to write the blog.

My question of you and the audience is “Was this particular blog note of value to understanding the reaction of the market to important FOMC, Administration and Congressional discussions in helping you be a better student of Investing?”

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog