Hey Captain! Are we headed into a Depression?

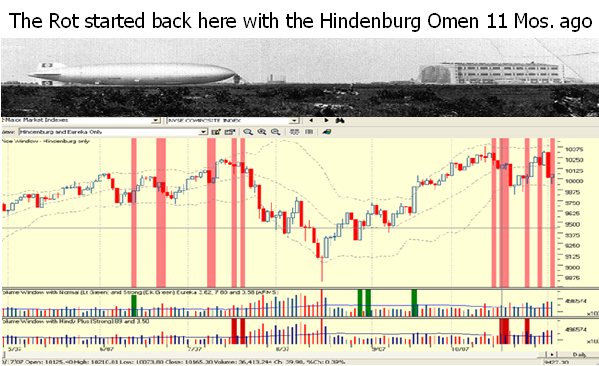

Monday, September 22nd, 2008I have updated this Blog Caption since I wrote the March 9th blog over six months ago and that time I did full treatment to using the Limbo Bar (the reverse of the High Jump) to take stock of where we stood relative to 2001. I’m sorry to express gloom and doom, but if today’s discussions between the Administration and the pussy-footing Congress are anything to go by, that is precisely where we are headed.

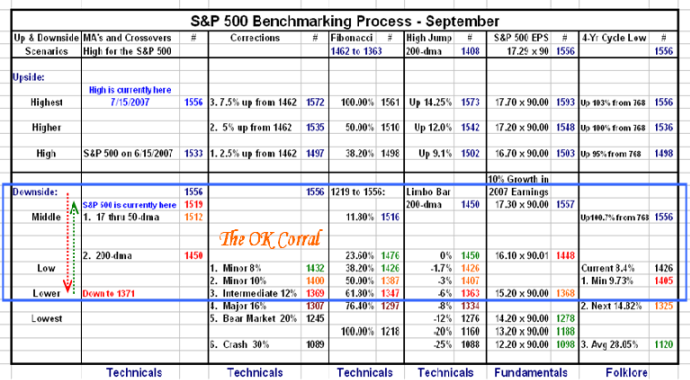

As I showed in the March 9th Blog which asks “Where are we Headed #2?” , I gave full treatment to how I use the High Jump and Limbo Bar to take stock of where we are and where we might be headed. It’s sad to say that History does repeat itself and what I said might happen has come to pass six months later when I felt we could be headed for a Recession. Today’s action by the Stock Market is a warning sign that if the talking heads in Congress don’t stop yapping and do something quickly, we will all be up the creek without a paddle, including them.

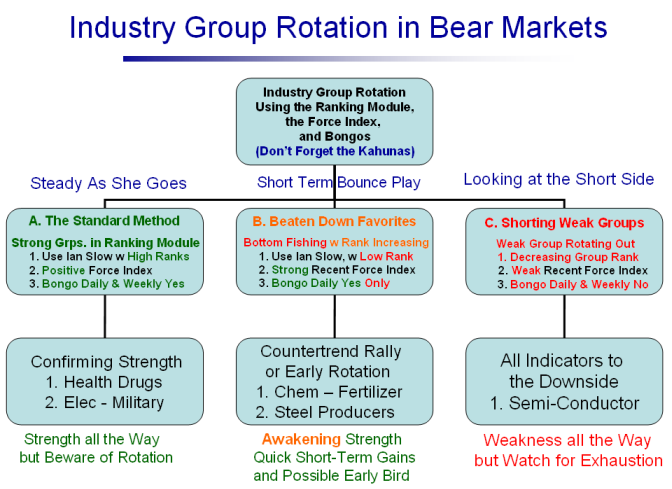

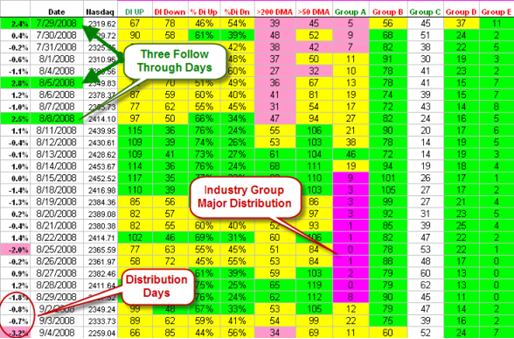

Forget Bounce Plays and Follow Through Days (FTD’s) for a moment until we see some action from Congress. What is important now is for me to remind you in four simple pictures of the Value I place on the High Jump and Limbo Bar at times like these to anticipate where we could be headed.

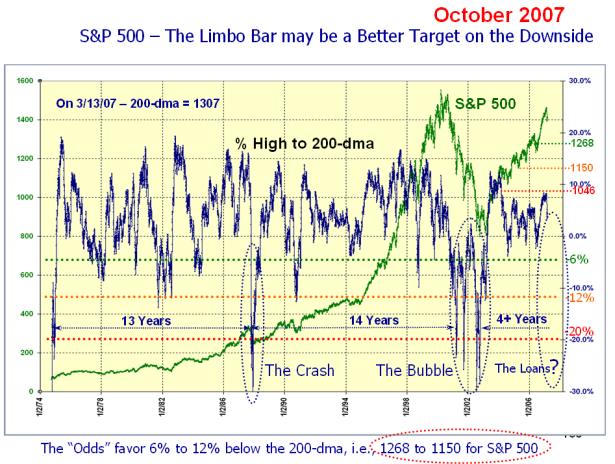

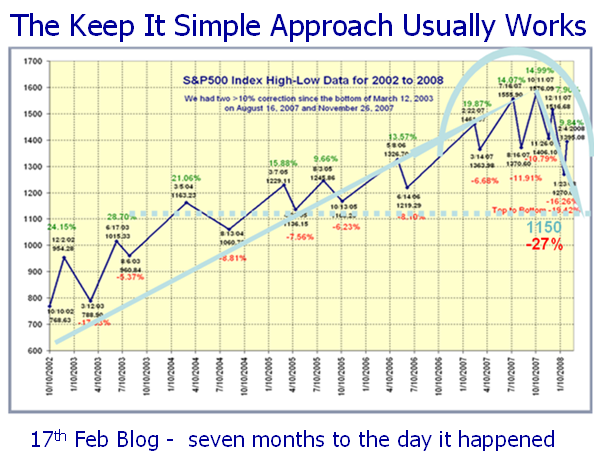

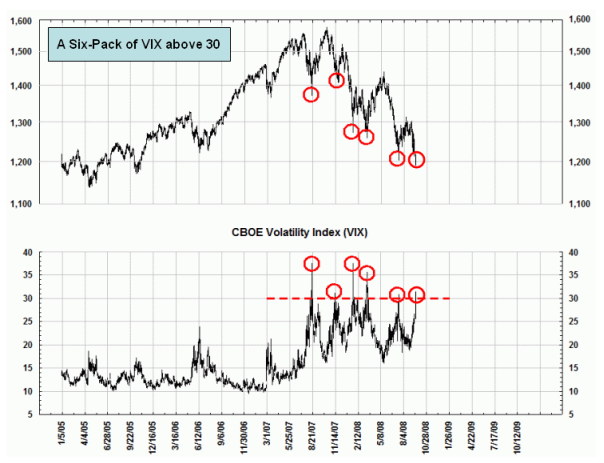

- It starts with a slide I used in the October 2007 Seminar where I first posed the thought that we could be headed down to 1150 on the S&P 500. I have shown that several times before in other discussions and in my most recent blog of a few days ago.

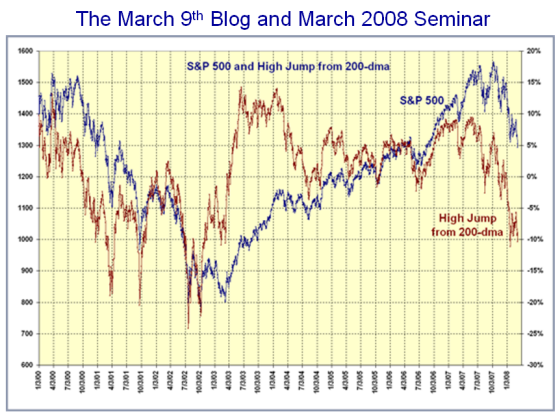

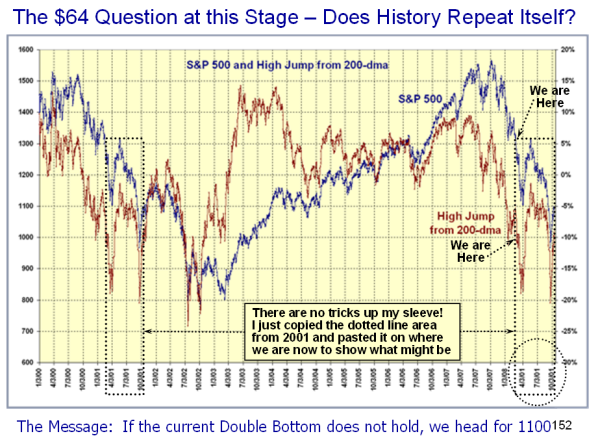

- We then fast forward six months to the March 9 Blog and the March 2008 Seminar to see the status then and the potential place we could end up in two slides from that blog.

- Now we can take note of the critical Line in the Sand we are at with the Limbo Bar having crossed the “Lower” Target of -15% down from the S&P 500 Index, and where we could end up at -25% down if the flood gates should open due to dilly-dallying by the powers that be.

Of course, if they save the day, we only breathe for a while longer before the next debacle in the Financial System unfolds. We will be reviewing these charts at the Seminar in October:

The above chart was in the March 9th, 2008 Blog…Sad to say we are at 1208 right now.

I’m not suggesting that we head down to 800 on the S&P 500 any time soon, but the odds of 1150 is now almost a certainty and again, if we see any signs of bickering in Congress we are headed for 1000 and possibly lower.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog