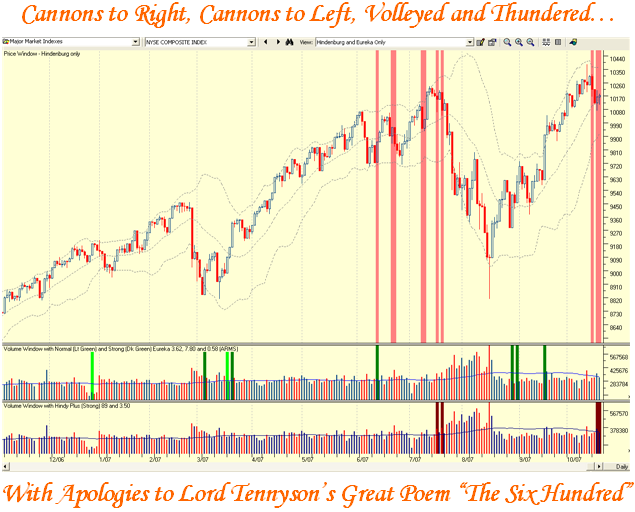

Late Breaking News as I go to Press – We have had a second Hindenburg signal today, on top of the one on Monday!

The U.S. economy slowed at the end of the third quarter and into the start of the fourth, while businesses grew even more uncertain about the future, the Federal Reserve said in its latest beige book released Wednesday. Housing continued to take a toll, meanwhile, and is expected to remain “subdued” for several months, the Fed said.

U.S. stocks pared gains on Wednesday, with the Dow turning negative as a disappointing outlook from United Technologies Corp (UTX) and lackluster hardware sales from IBM (IBM) tempered optimism about profits.

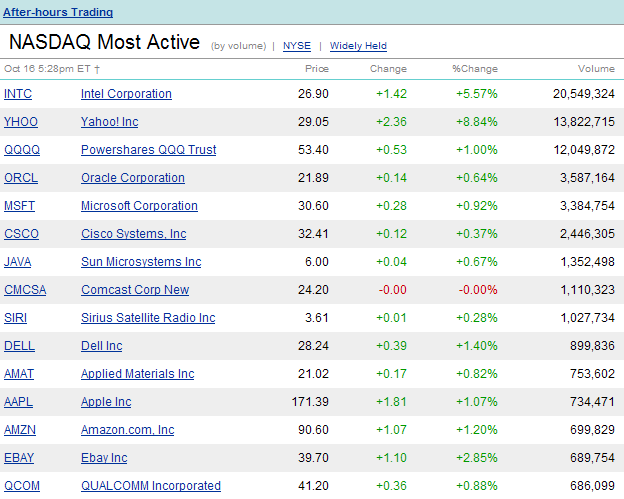

Needless-to-say, the Market took a beating mid-way through the session, but once the dust cleared the little engine that could…the Stock Market, rallied again to wind up positive for the day on the Nasdaq and only a paltry 20 points down on the DOW. This could have been the third distribution day in a row and that coupled with the one last Thursday would have suggested that we were heading for a correction today. We still may be, but the Bulls live to fight another day. Did you see the QID and the QLD change places as they each had a swing from positive to negative territory and back again? The VIX jumped 2 points and gave back as many (between friends) at the close. Volatility and Yo-Yo Market continue to be the key words of the moment.

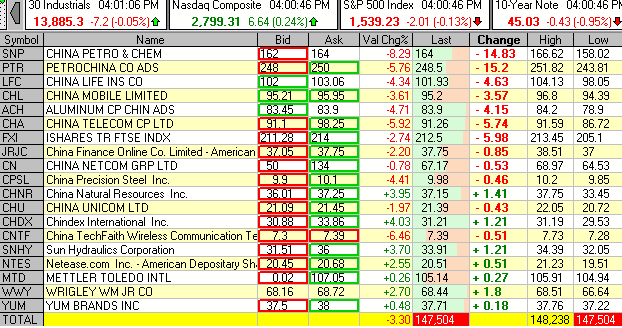

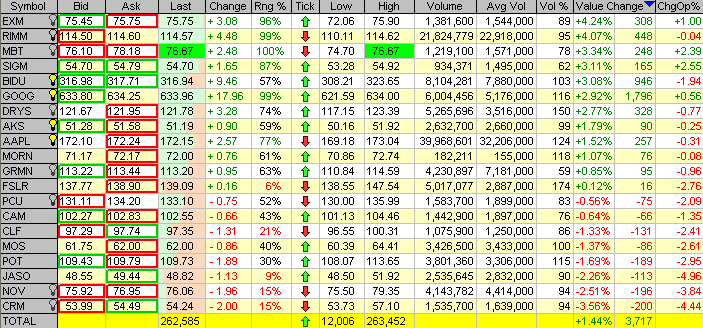

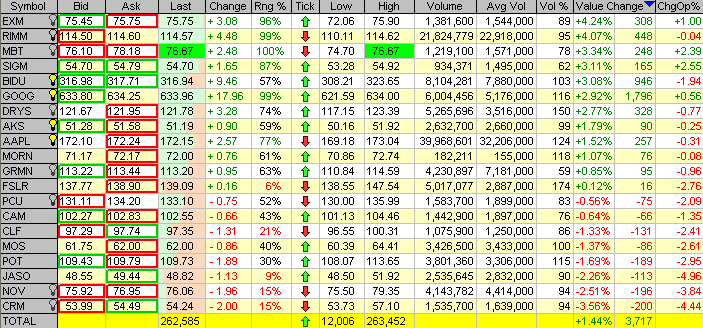

The Lesson learned today is to never panic, and if your stomach can bear the agony and the ecstasy, just wait till the market is closing to make your call, unless of course it is painfully obvious the market is headed for a disastrous day of >200 points on the DOW. The way I do that is to watch the Gorilla RonIandex I gave you in the Newsletter and although that Index got down to near zero gain for the day, it stayed positive and came roaring back to give us a 1.44% gain based on 100 share lots. Ron and I have emphasized it often to watch the Leaders, and here they are. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog