Stock Market – Mark to Market and Up Tick Rules

I am very busy preparing for the HGS Investor Seminar in less than two weeks,

so this will be short, but carries the message with the two pictures I have

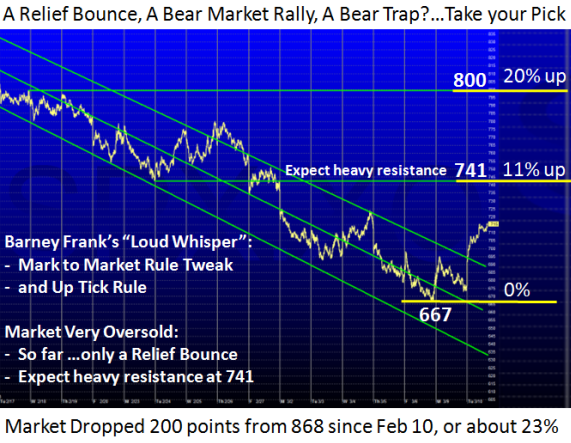

developed for your review. Since February 10th, 2009 the Market has spoken

and in a nutshell the key reasons are as follows:

Who can forget the 381 point drop when he had little to say but platitudes?

There has been no real solution to the banking crisis problem and this in turn has raised the stakes for Main Street: layoffs, Jobs, Jobs, Jobs and 401-K’s.

Of course there are several factors, but Rome has been burning since Feb 10.

Don’t ever forget that Main Street is locked at the hip to Wall Street, and what

we have seen this past month proves it yet again, as I have shown several times

last year and the year before on this very blog. What the Administration, the

Treasury Secretary, the Fed and the Congress say is vital to the daily moves

in the stock market regardless of whether it is a Democrat or Republican in

the White House. Is it any wonder there is no Confidence or Trust?

So what do we have today? Barney Frank to the rescue on the Mark to Market

and Up Tick Rules…which they have been considering for over a year and now

were forced to say something to prop this market up. Will his musings all be forgotten in a month? Where was Chris Cox all last year on this issue? Only intra-day traders need apply to make money in this crazy market.

The message is loud and clear. Clear your profits off the table DAILY, and just

play in the direction of the latest EVENT relating to the Economy and the Market,

but be ready to switch from Bull to Bear and vice-versa from moment to moment.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog