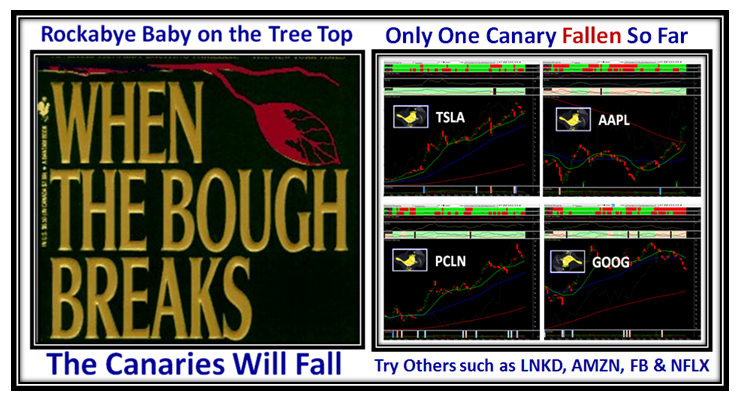

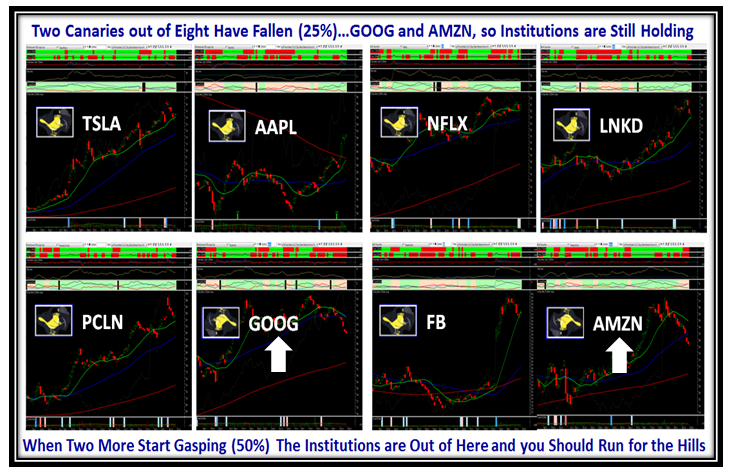

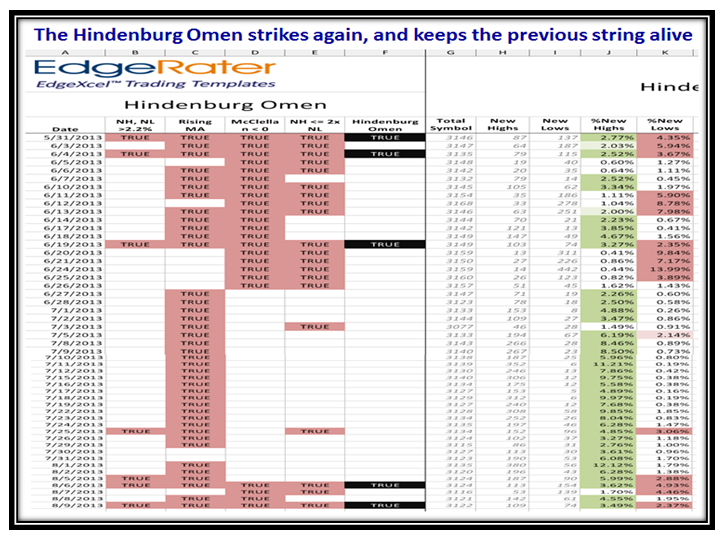

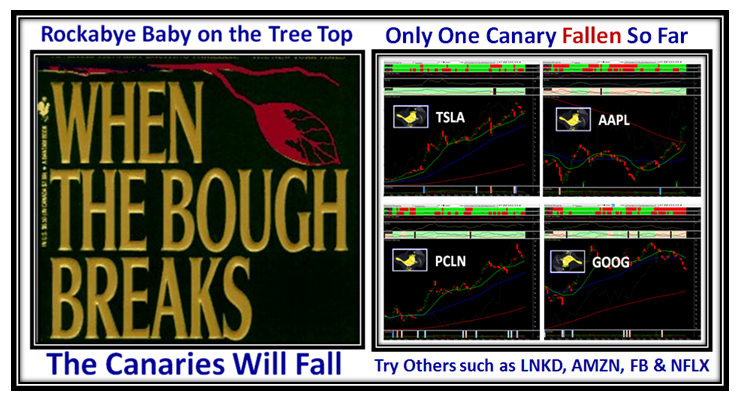

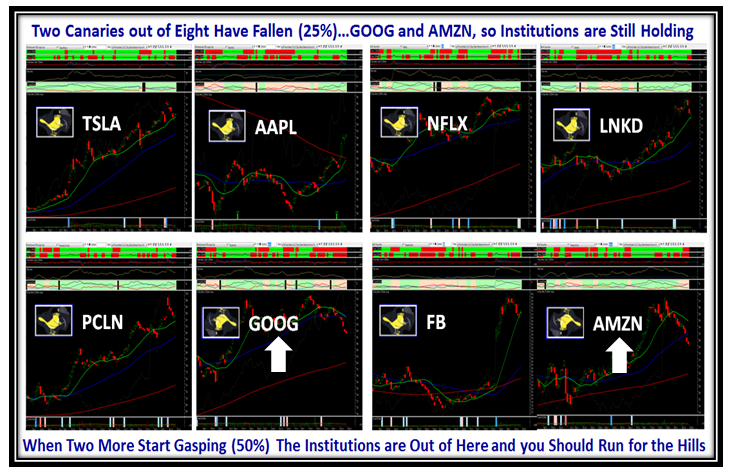

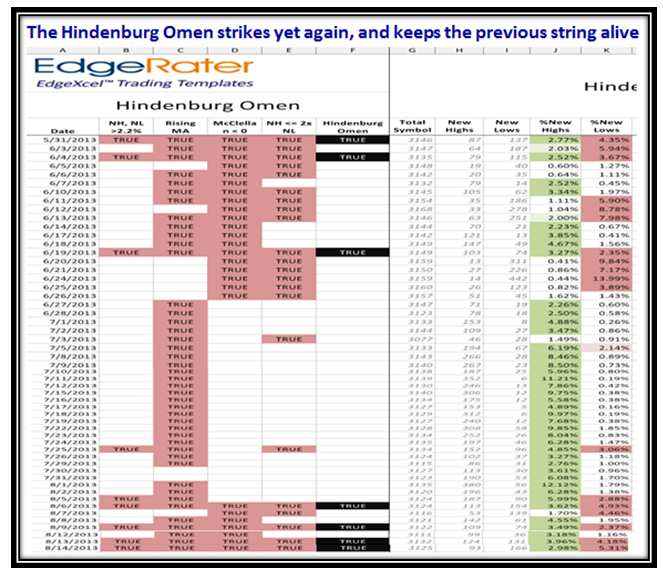

With Hindenburg Omens flying right, left and center with four of them within the last week or so, one way to tell when the Institutions are vacating is to do the “Canary in the Coalmine” test. Watch 8 to 20 Large Cap Stocks which are recent flyers with >50% Institutional Holdings and see whether their chart patterns are staying up above the 17-dma or drooping:

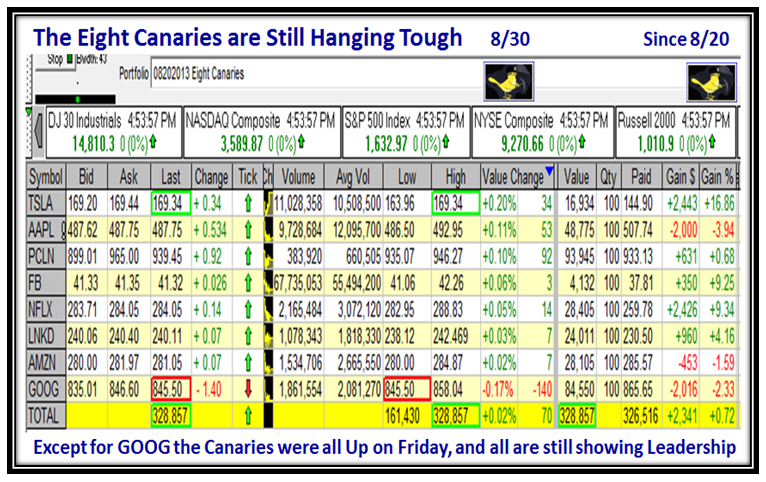

Here is a Test list of eight stocks which are in vogue at present and we see that we have 25% (GOOG and AMZN) drooping. If we find that two more start to give up the ghost, it’s a sure sign that you need to protect your nest egg and gradually move your money to cash or short the market:

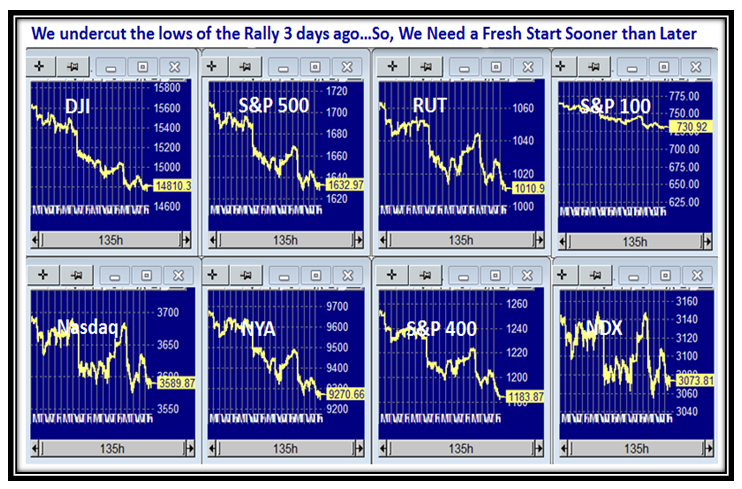

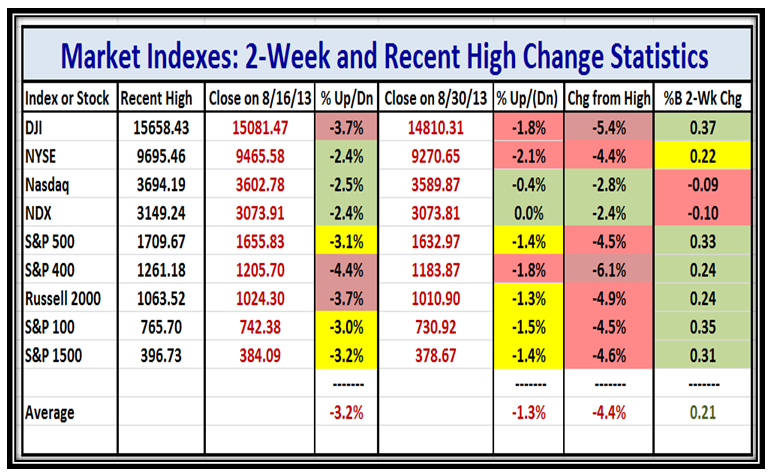

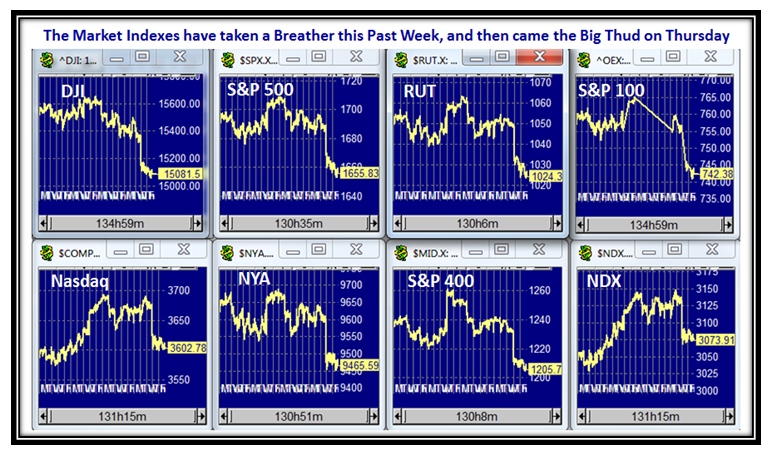

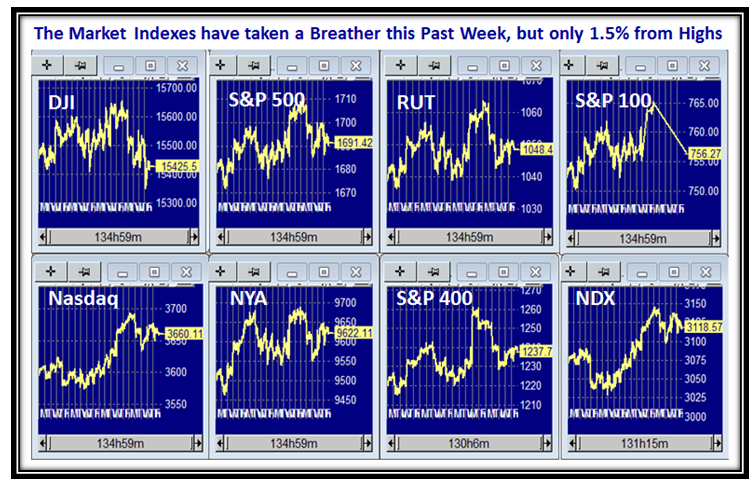

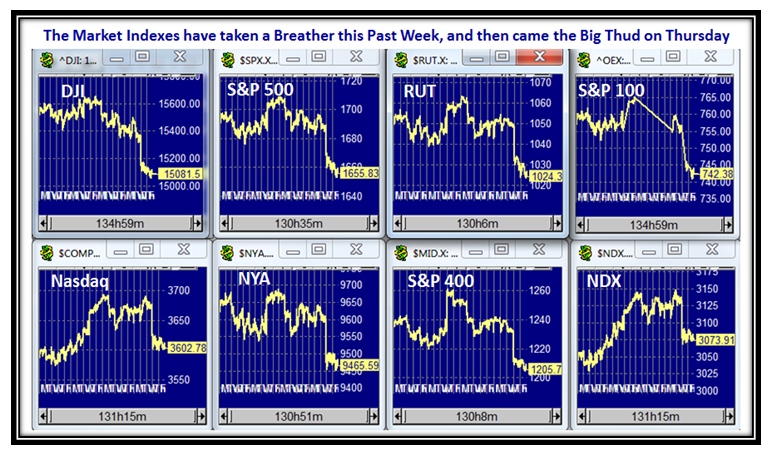

And as you would expect, after the clobbering the Market Indexes took on Thursday, the droop is on and the Bears are in Control:

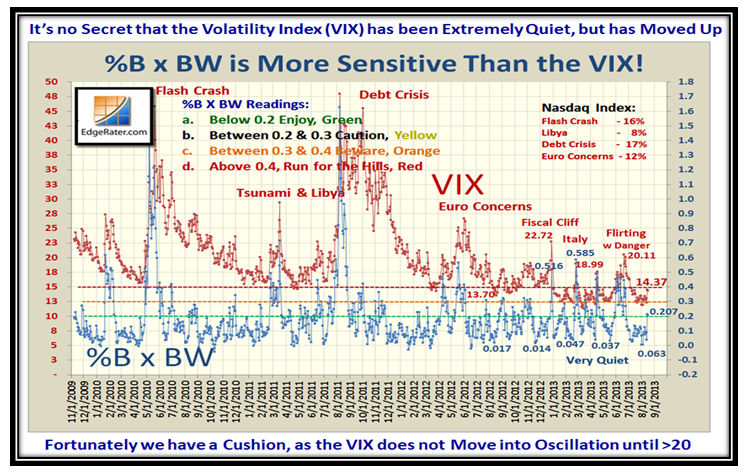

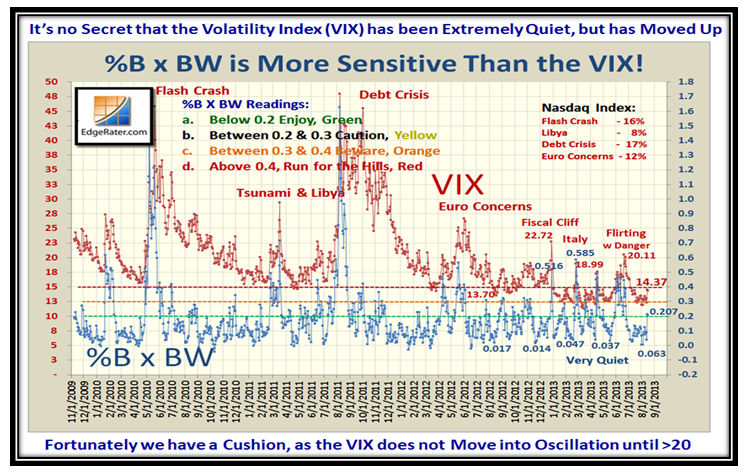

As we well know the Volatility Index (VIX) has been unusually dormant, but perked its head up this week. It is currently at 14.37 so there is plenty of cushion at this stage before it gets to 20ish, when it can then quickly go into oscillation as the Market takes a real dive and we rush for the exits. Make sure you are not trampled on:

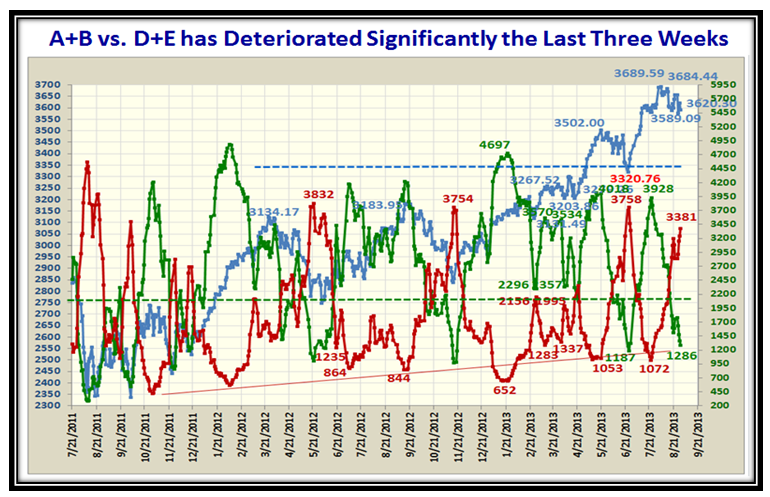

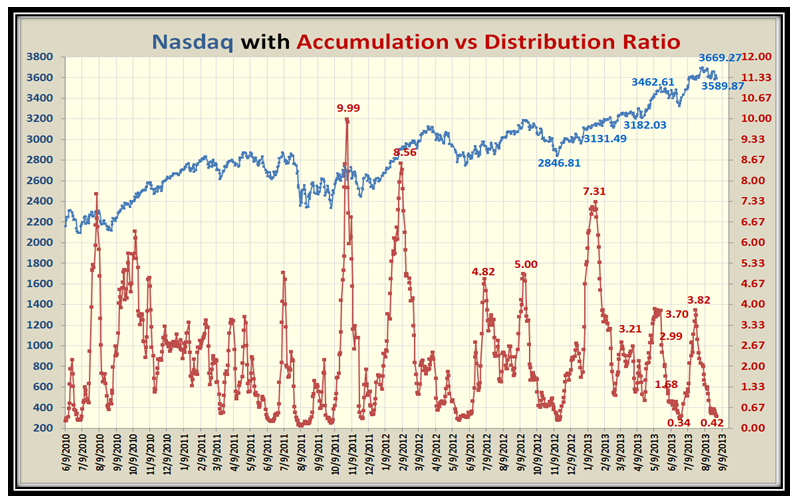

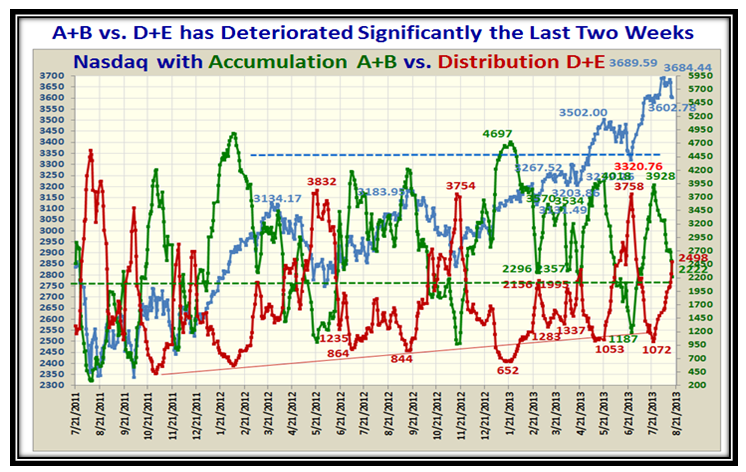

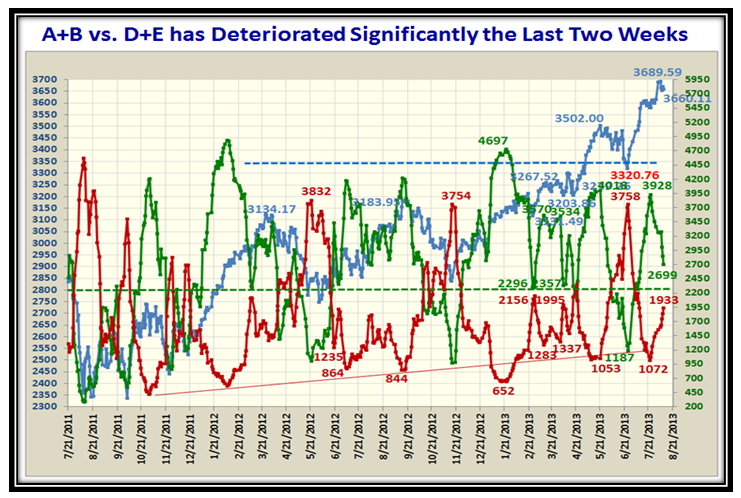

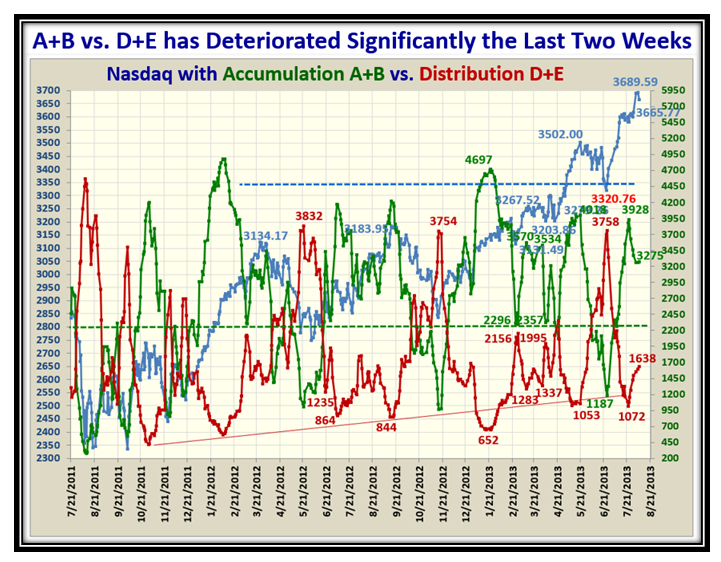

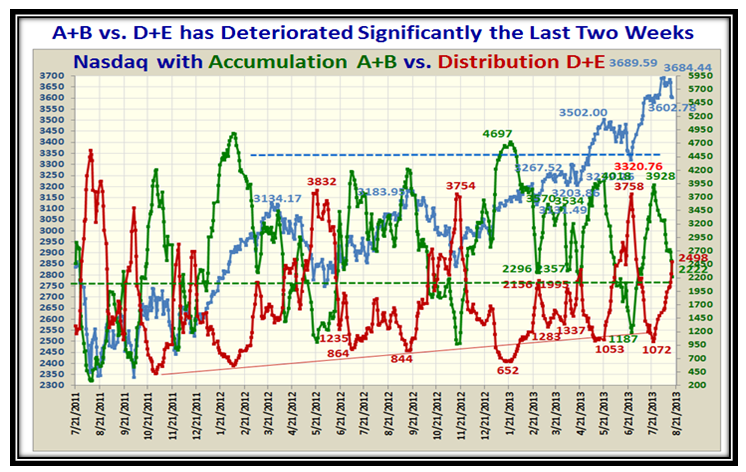

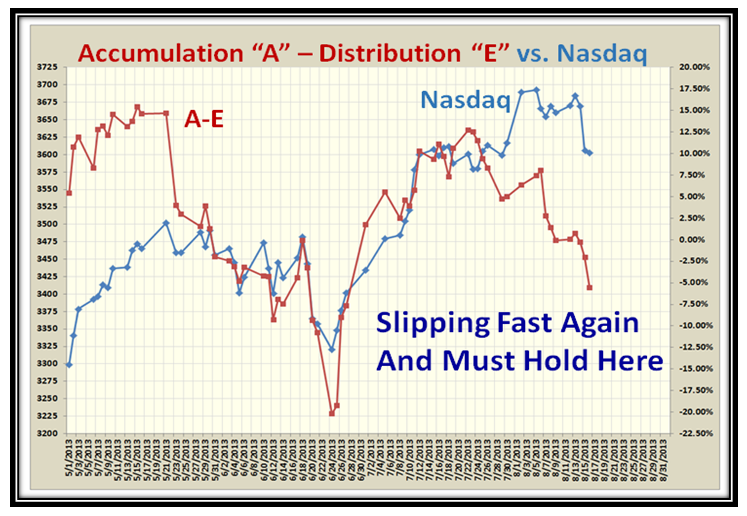

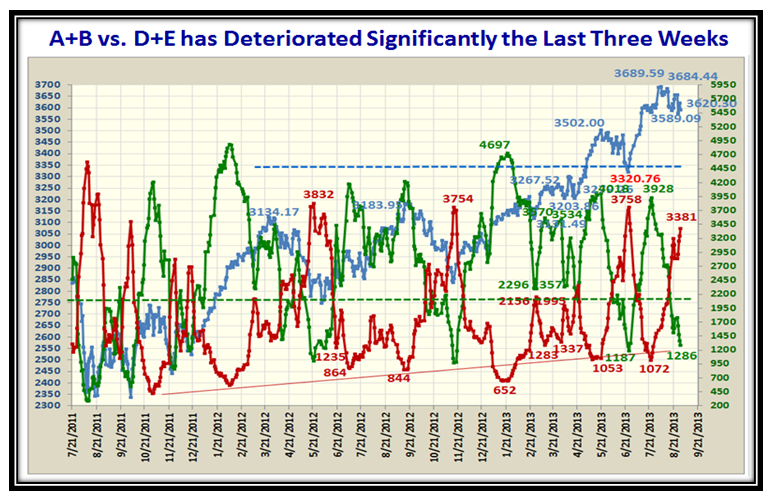

It is only natural to expect that the Accumulation vs. Distribution has deteriorated appreciably these last two weeks:

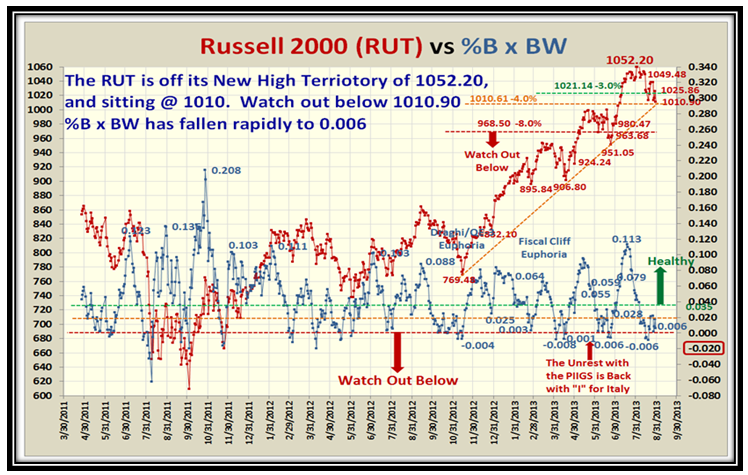

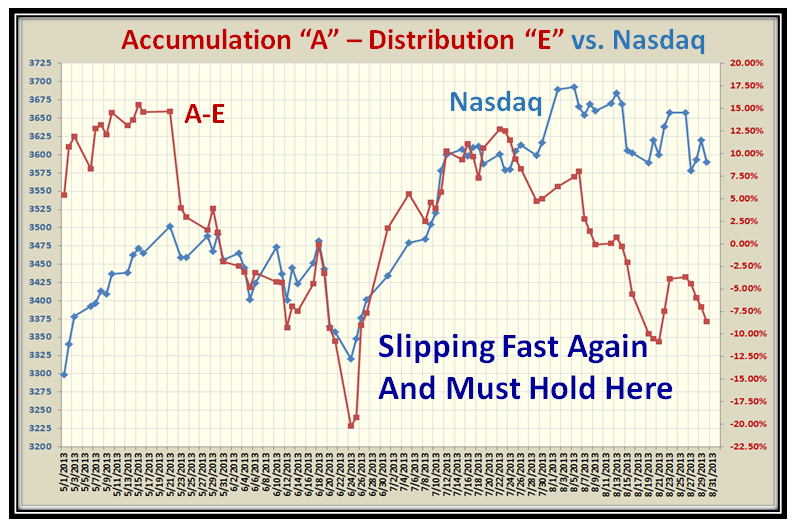

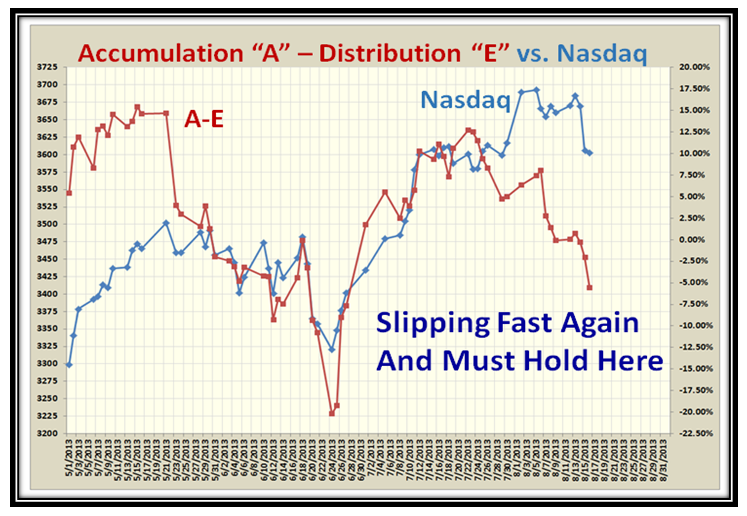

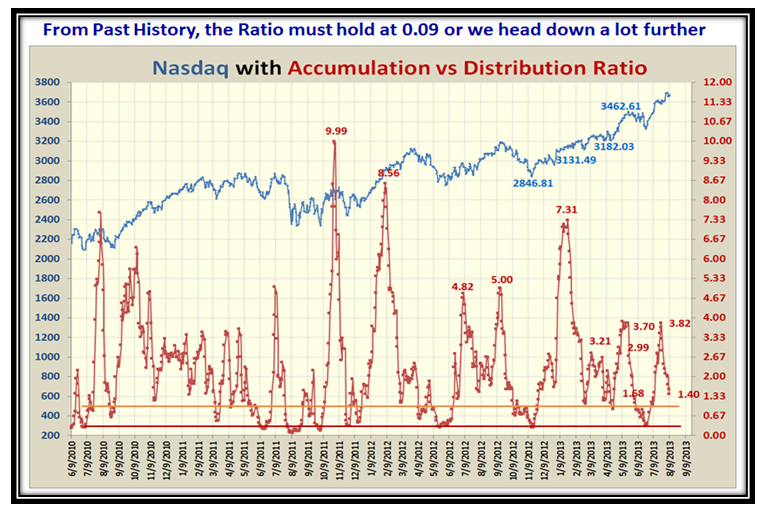

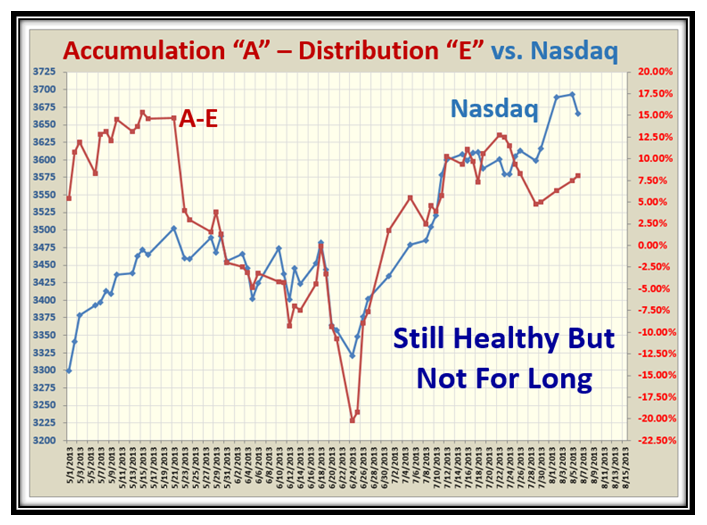

…And if we dig deeper we find that %A-%E stocks are slipping fast again and it is critical it holds here or down she goes:

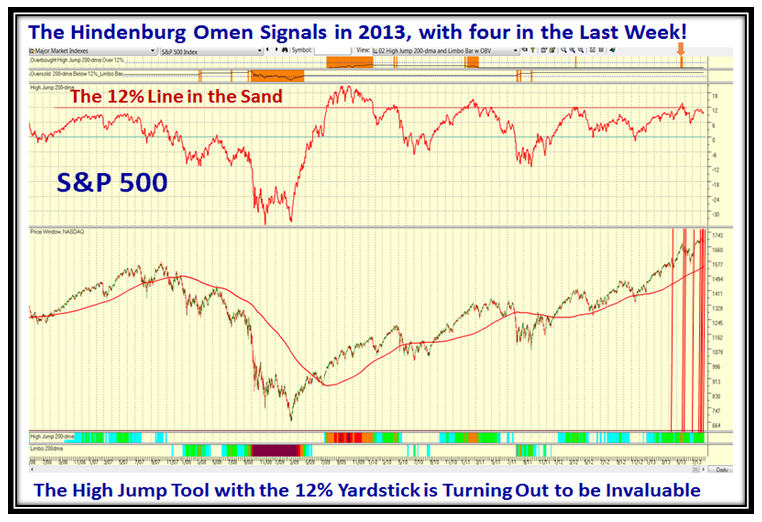

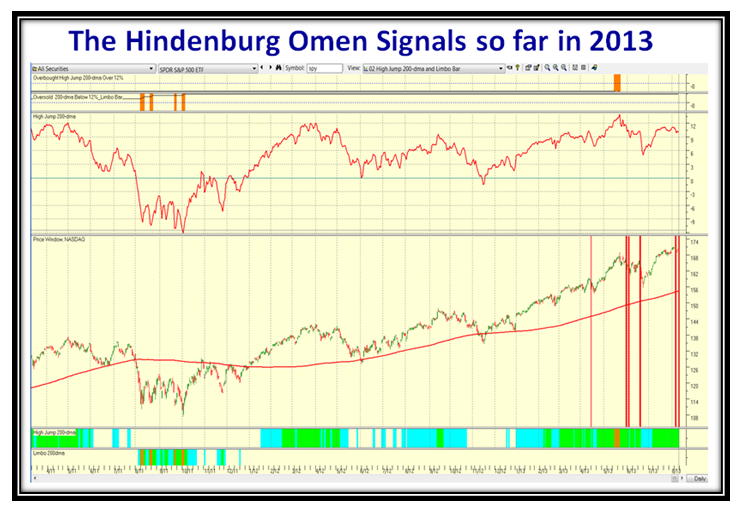

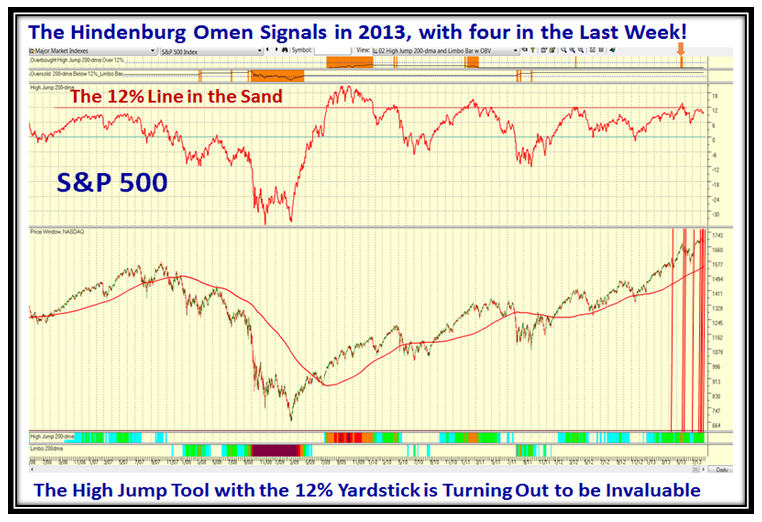

Here is a picture you have seen many moons ago when Wikipedia first plucked a similar picture showing 2005 to 2007, and is still popular today where many supporters have tagged it to get to my site. Incidentally, Germany, Israel and Saudi Arabia have been having a recent feast on these past notes on the Hindenburg Omen…tell your friends:

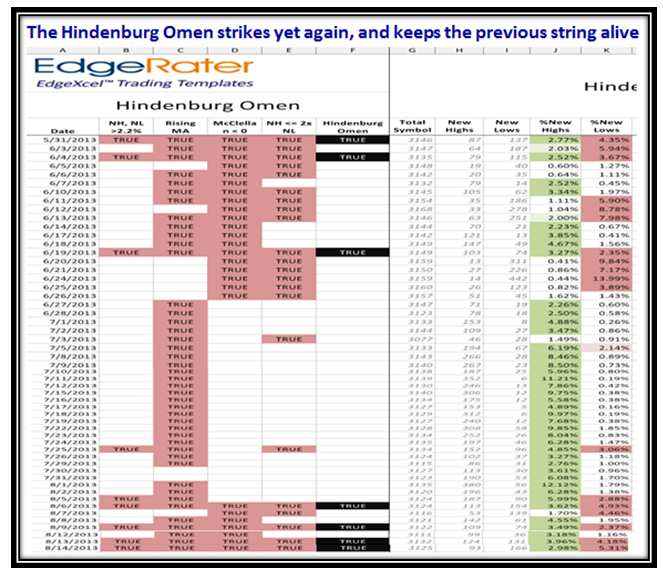

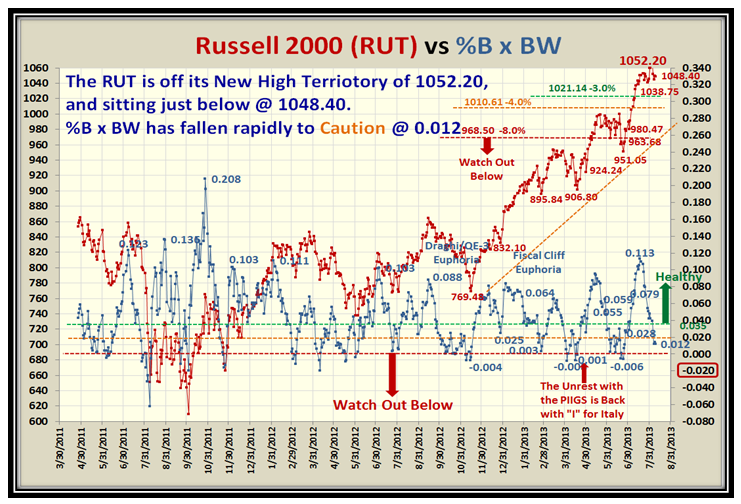

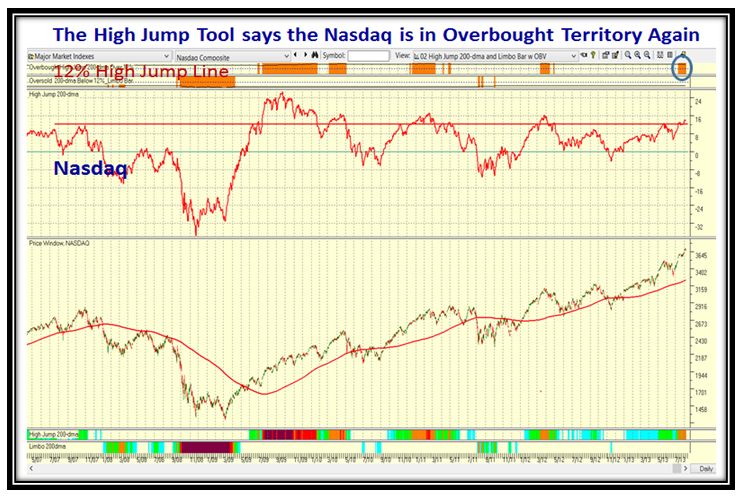

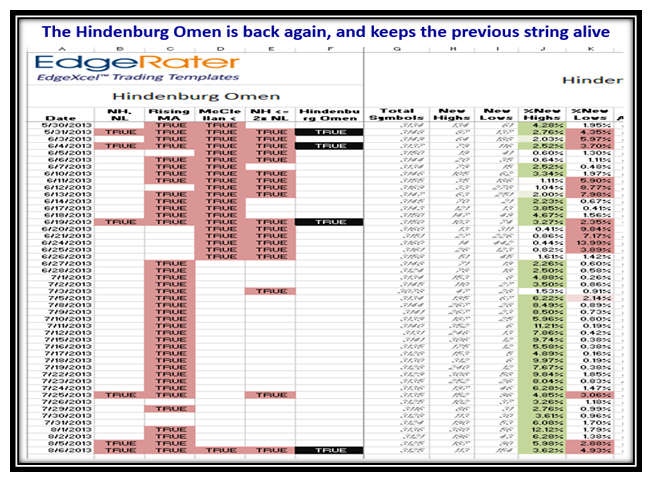

Note how the High Jump 12% Line in the Sand being breached a few weeks ago signaled a potential correction and here we are. This next chart updates the picture of when the Hindenburg Omen Signals fired, and we now have a decent CLUSTER, which is key to observe as it invariably suggests the more the merrier for potentially a deeper fall. Of course we don’t have to belabor the point that the original dataset has changed so we shall see what this new lot of using the ALL NYSE produces in the fullness of time.

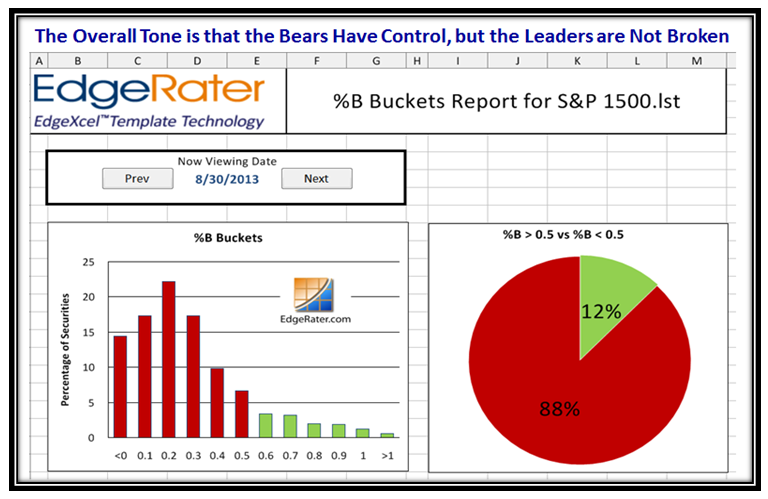

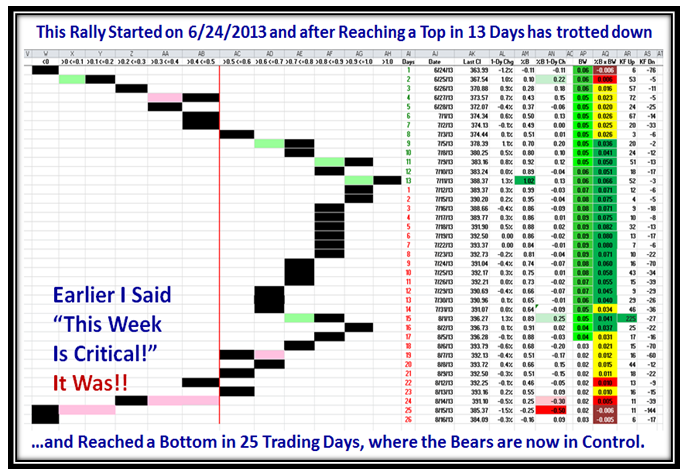

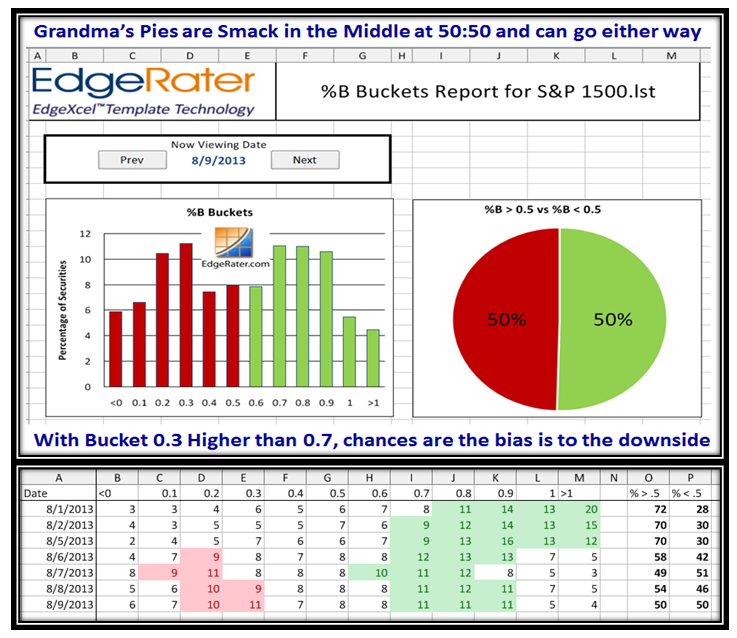

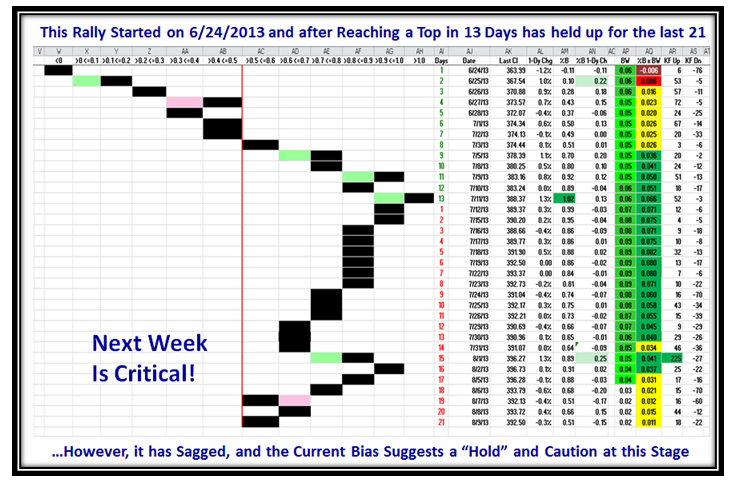

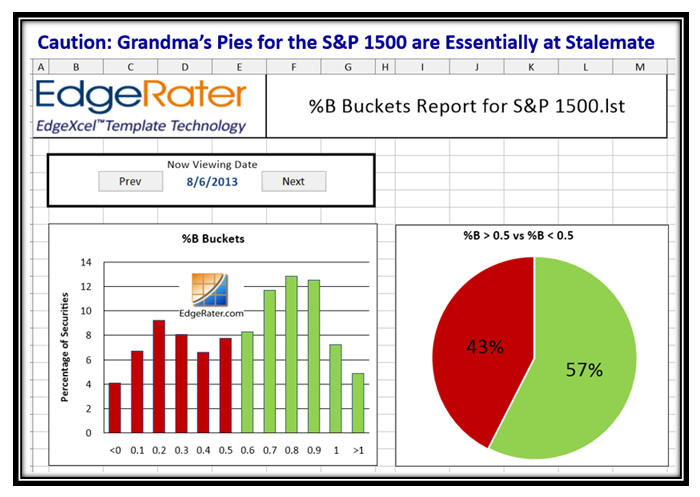

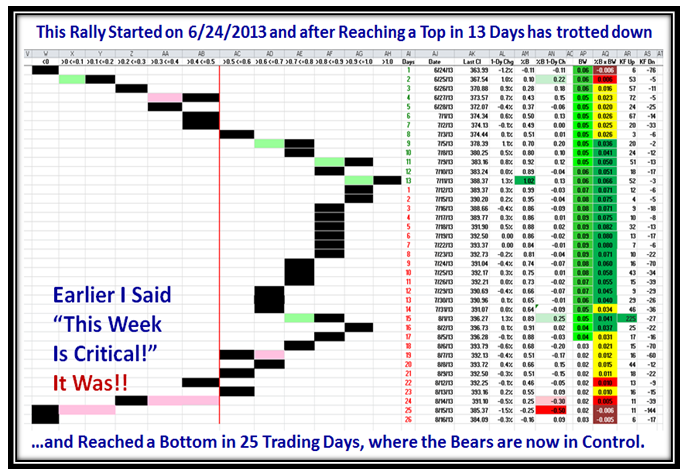

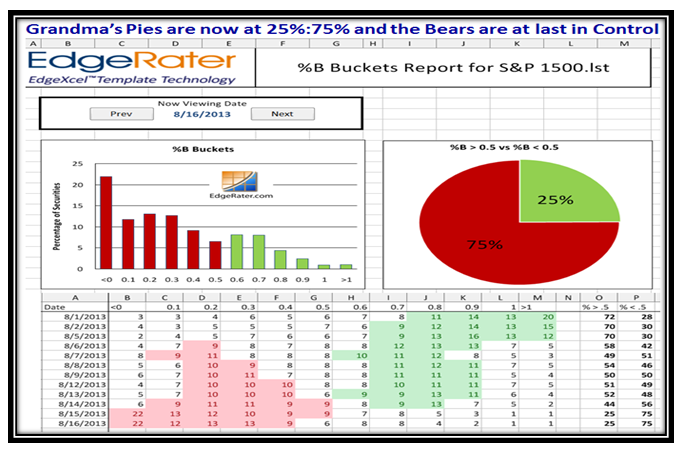

Here is a favorite chart of mine as all who follow my work using Bollinger Bands and “Buckets with %B for the S&P 1500” understand, I suggested in an earlier blog note that we had a critical week ahead of us and that is precisely what happened.

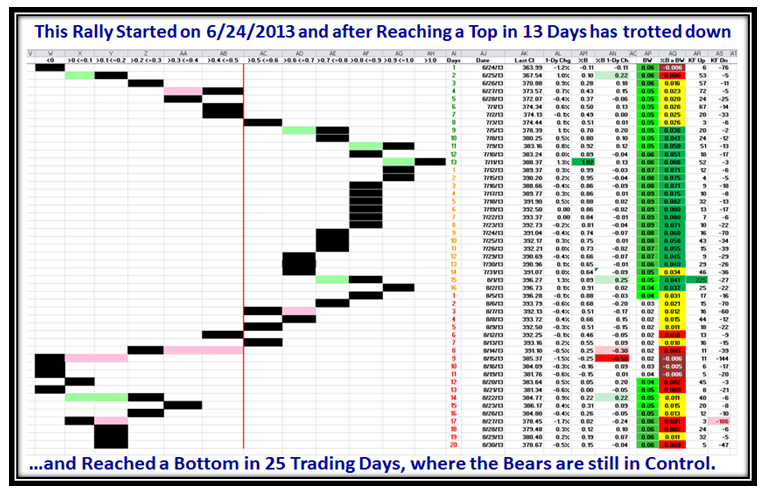

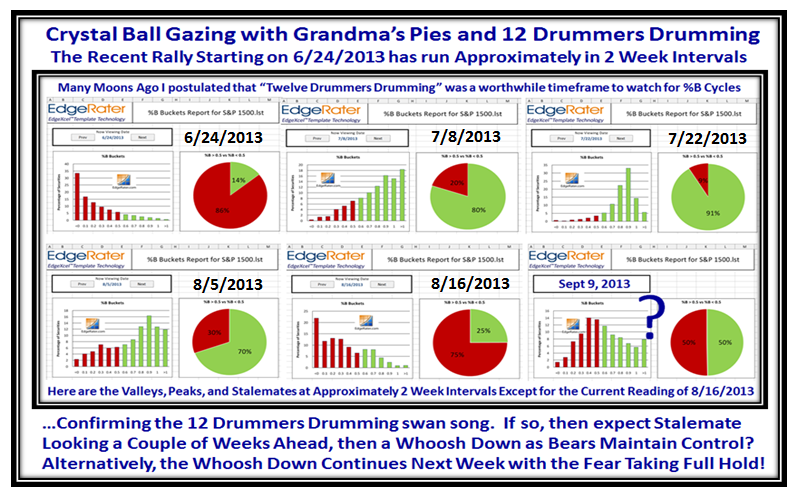

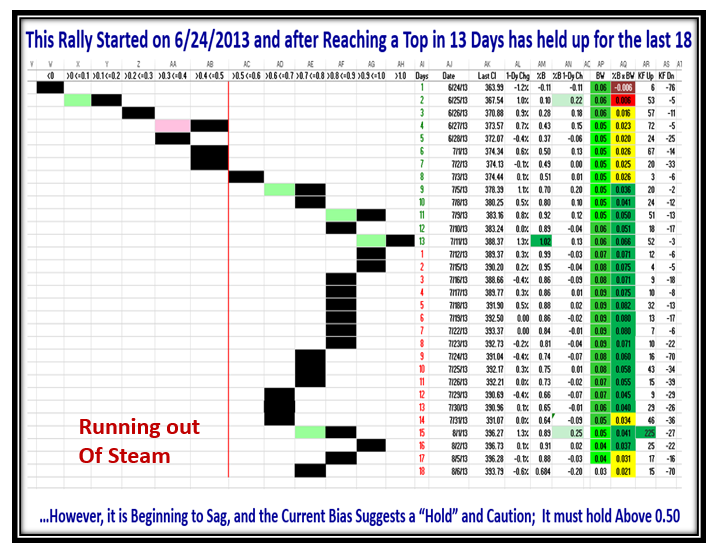

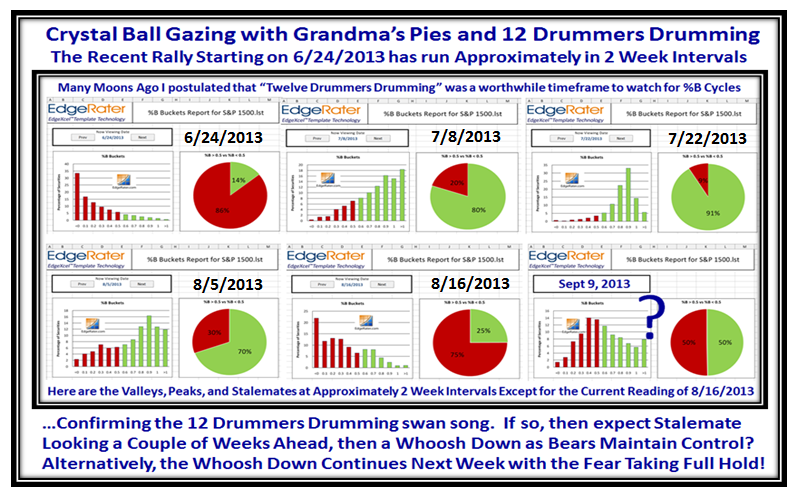

Those supporters who have been with me for sometime will recall that several years ago I hit on the concept of “Twelve Drummers Drumming” from the Carol “And a Partridge in a Pear Tree”, inferring that once a market starts a New Rally or has reached a Top %B will usually move in segments of 12 to 15 trading days up, down or sideways. If you look down the center column in green and red of the above Columns you will see that is what has precisely happened this time around. 13 Trading Days up, followed by 16 Days down to sideways, and then 10 days down so far. Keep this concept in mind as I take you through the next two slides where we couple this with Grandma’s Pies of the Ratio of %B above and below 0.5:

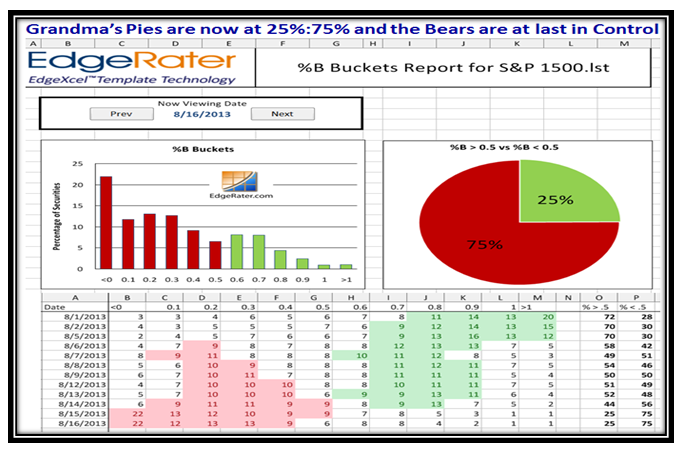

Grandma’s Pies are very soggy at 25%:75% above and below the middle Bollinger Band for %B. Now for the Concept of coupling began, and then within 13 Trading Days on 7/8/2013 it had trotted up to a bullish ratio of 80%:20%. Two weeks later %B was still holding, and then the next two pictures show the down cycle.

It’s anyone’s guess as to what will happen in the next two weeks, but there are two scenarios to watch for:

1. The Market continues to trot on down or

2. The Bulls come back from a beaten down market to push it up to where %B above and below 0.5 would be at Stalemate (say), i.e. 50:50 where usually one should expect a “Fakey” and the Bears take charge again.

It will be interesting to see how all of this unfolds. We will be holding our usual Monthly Roundtable on Tuesday, August 20th where we will as usual cover the details of the newsletter and include some of the new concepts in this Blog Note.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog