I have always maintained that the Stock Market’s Moods relate heavily to the events that dictate major policy decisions by the White House, the Congress and the Fed. The Moods of Fear, Hope and Greed as the herd decides to be more buyers than sellers or vice versa often stems from these events and influences the short and intermediate term direction of the market.

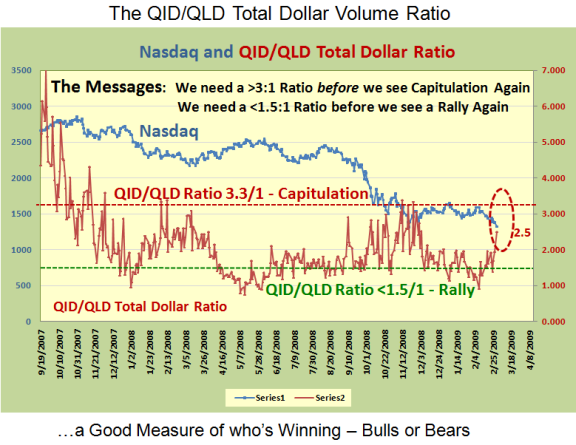

I have captured enough evidence on this very blog of the Market behavior countless times that this is not fiction I have made up; rather it is reliable fact backed by example after example. Of course “Buy the rumor, sell the news” is a convenient way of expressing that mood, but make no bones about it the DEPTH of that sell off is what describes the true Mood and whether there is a preponderance of buyers or sellers…bulls or bears.

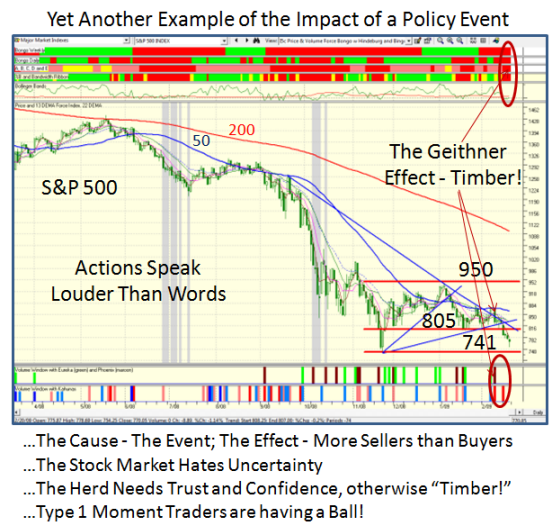

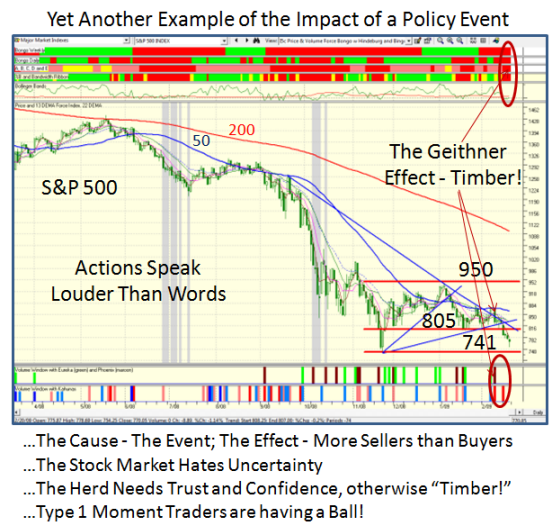

The latest example of this was when the Treasury Secretary was in the limelight and got his first stern warning that waffling on platitudes is not enough when the country is in this dire situation which he in fact mentioned time and time again. He shrugged off the market’s mood and reaction, but he now knows full well that he is on notice.

Unfortunately, most of Main Street have lost their way, have had their butt kicked often through no fault of theirs, and don’t know which way to turn when it comes to their life savings.

It really doesn’t matter what one’s political persuasion is, Wall Street Investors hate uncertainty which quickly turns to fear and can take the Market Indexes down into a spiral. It was appropriate to have straight talk to portray the difficult situation the Nation is in and to put a firm stake in the ground that this was handed to the current administration by the previous one. But now comes the true test of “Where’s the Beef?” or dare I ask “Where’s the Pork?” It will not be enough to say “I told you so”.

Confidence and Trust are what the Nation needs at this juncture, and in my opinion it will have to start this coming week to restore it with a one-two punch from two important events due soon:

1. The President’s State of the Union Address to Congress on Tuesday. I for one agree with President Clinton’s advice who suggested in an interview with ABC News this week that rather than taking every opportunity he can to talk down the economy, the President should begin to show “that he’s confident that we are gonna get out of this and he feels good about the long run.” We shall see whether he heeds that sage advice and becomes a Statesman or he delivers another campaign stump rhetoric.

2. After the Raspberry the Market gave Tim Geithner 12 days ago with 381 points down on the Dow that eradicated the two Eureka signals and supplanted it with a Heavy Red Phoenix signal, the Treasury Secretary seems to have gone into hiding when the entire banking sector is on the verge of collapse (once again). If he fumbles once more when he appears with his plan, heaven help us all as the market’s reaction will undoubtedly signal the first signs that we are headed for a Depression, and that will now be on his watch.

It has become very apparent since the Geithner fumble that the enthusiasm for any form of rally has been drummed out of the bulls and although there are plenty of places to make short term gains, it is difficult to stay the course for the long term. Add S&P 500 projected earnings to the list of under $50 (and I am being generous) and the Fundamental types can’t see supporting 600, leave alone 800!

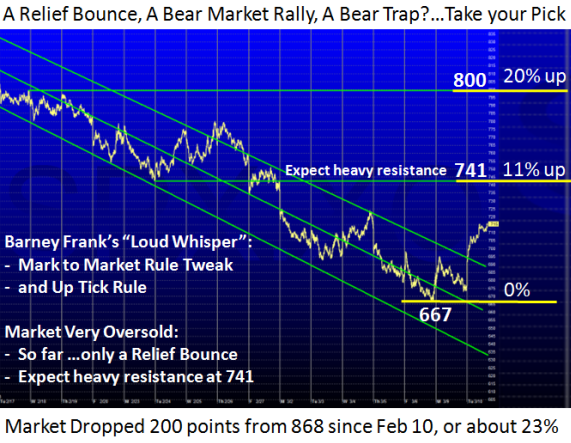

Since we are now on a Phoenix red as the last “Impulse Signal” together with two dark red Kahunas, the direction is not only down but “Timber Below” is the watch word. 741 on the S&P 500 is within easy reach for the floodgates to open to the downside. I don’t have to remind you that with the market as fickle as it is and already oversold for now, that any form of good news can turn this upwards…but it is the THRUST of the move which will determine whether it is a one or two day wonder or new hope or despair.

HGS Investors will be able to apply this Indicator to their views hopefully this coming week. I am sure you have seen the other important upgrade with the “Days Since” feature for the Force Index parameters that Ron described in his Movie on Saturday, which will make for easy pickings of the low hanging fruit, both up and down.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog