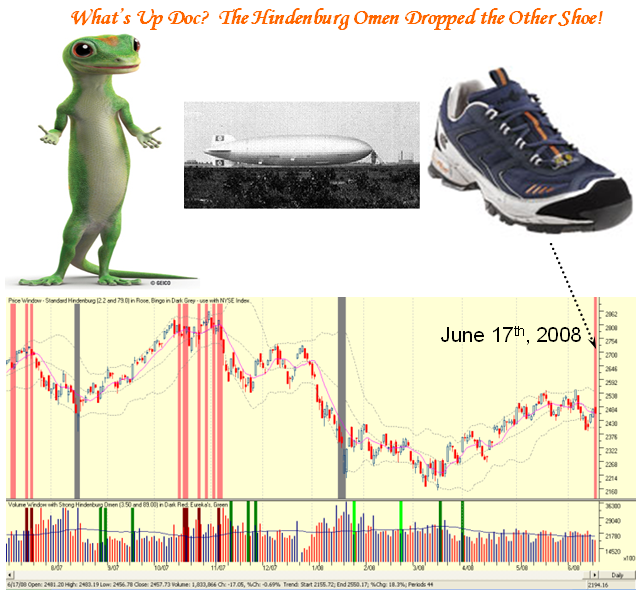

The Hindenburgh Omen is back again – June 17th, 2008

After a potential False Alarm a week ago last Friday which I covered by citing a Phantom Lone Ranger Hindenburg Omen, the “beast” is back again. Yes, we got a firm signal this time as shown in the picture below, thanks to our proprietary indicators from the HGS Investor Software!

-

Whether the previous one was true or false remains a mystery. I did follow up as promised with a note to our Data Supplier, but as luck would have it the storms and floods in the mid-west took out the Servers, Electricity and all, so my note went into the ether. Anyway, we certainly have a signal this time and as I can see by the flurry of people visiting my blog including my friends from overseas in Greece and Finland, the Europeans are certainly on their toes and concerned that the famous Hindenburg Omen (HO) has struck again and they know where to come for the Heads-Up! Even Google seems to have my blog on their radar as I am in the Images Section if you take the trouble to type Hindenburg Omen and make sure you click on their Images Tab.

-

This on top of the news from some of my friends in e-mails to me this morning that the:

-

>>>The Royal Bank of Scotland has advised clients to brace for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks. “A very nasty period is soon to be upon us – be prepared,” said Bob Janjuah, the bank’s credit strategist. A report by the bank’s research team warns that the S&P 500 index of Wall Street equities is likely to fall by more than 300 points to around 1050 by September as “all the chickens come home to roost” from the excesses of the global boom, with contagion spreading across Europe and emerging markets.<<<

- The traditional definition of a Hindenburg Omen has five criteria:

- That the daily number of NYSE new 52 Week Highs and the daily number of new 52 Week Lows must both be greater than 2.2 percent of total NYSE issues traded that day.

- That the smaller of these numbers is greater than 79.

- That the NYSE 10 Week moving average is rising.

- That the McClellan Oscillator is negative on that same day.

- That new 52 Week Highs cannot be more than twice the new 52 Week Lows (however it is fine for new 52 Week Lows to be more than double new 52 Week Highs). This condition is absolutely mandatory.

A confirmed Hindenburg Omen occurs if a second (or more) Hindenburg Omen signals occur during a 36-day period from the first signal.Now don’t panic, but forewarned is fore-armed. Keep your powder dry and don’t be too complacent is the watchword. Please understand that it takes a lot of factors to trigger the HO, but it seems the real sign is that the market is jittery right now and we may need a few more of these to really get us to take major defensive action. In any event all HGS Investors are already playing this market close to the vest and the only ones sitting out are what I have called the Type 4, Long Term Buy and Hold Types, who continue to wait for the Short and Long Term Targets I have spelled out for you are traversed. By the looks of things it seems that will be a while longer.

Types 1, 2 and maybe 3 are having all sorts of fun on both sides of this market, but as usual “nimble” is the keyword to success. Ron’s excellent Movie for the High Growth Stock Newsletter this past weekend showed you how to fish in the best Industry Groups, both on the upside and beaten down “downside”. It goes without saying that the Energy Stocks are making hay for all of us, with the caution that one of these bright days that bubble will burst. The Coals are moving fast as are the Fertilizers, and don’t forget the Steels which have been a trifle sluggish but warming up to go again. Add the beaten down Solars to the list with CSIQ, SOL and ESLR the hot stocks of the moment, all are tricky to play but who said it was easy in this market?

I am no bottom fisher but I say watch out as you have to be one with extreme patience and further more have your wits about you that you may end up having to dredge rather than bottom fish. Just look at the example I covered on the Limbo Bar the other day with TKC, it would give me nightmares trying to catch the bottom on a stock like that unless you are extremely patient and wait and wait and wait. Otherwise you will be caught knee deep in the mud. It is trying to put in a bottom here with five days of sideways move, but Chaikin’s Money Flow says they are still selling. It’s not difficult, and even “bottom fisher’s must be good timers and know how to play that game or else they become dredgers.” I like the ring to that line and will keep it for our next seminar in October!

Best Regards, Ian.

Editor’s Note! I recommend that you read the notes in the Comments section where I explain what it takes to trigger a Hinenburg Omen signal and that the recent near misses are a CAUTION that the reason for all of this is speculation on Oil coupled with the “herd is buying while the pros are selling”.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog