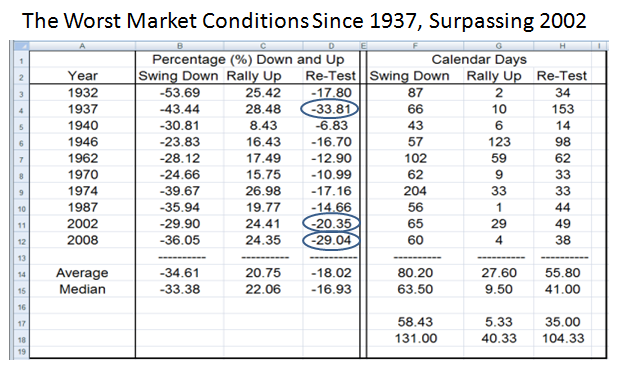

The Worst Market Conditions Since 1937, Surpassing 2002

Sunday, November 23rd, 2008At this time of the year, let me start with Season’s Greetings to wish you and yours a Happy Thanksgiving. Consider this particular Blog Note as my Thanksgiving Gift to all of you. It is a trifle long, but it lays out the entire assessment and a new game plan of what to expect against which we can measure where the market takes us.

As the Woodward Family sits down to enjoy a get together of 17 people, there will be sobering discussions about what is ahead, especially as my two elder grandsons are just two or three years away from heading off to college. The nest eggs have shrunk all around us and now the Auto Industry is the latest to be with tin cups in hand while flying in to Washington in private jets to ask for a $25 Billion handout. Where will it end?

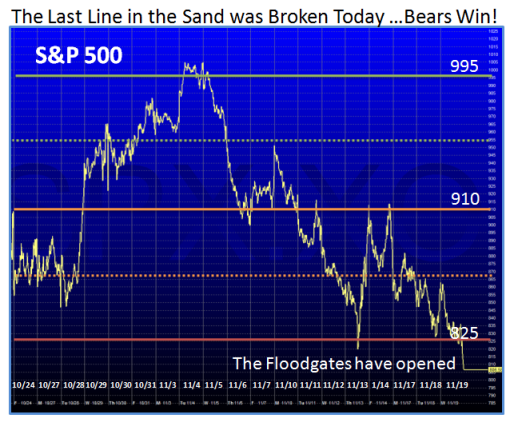

At least the announcement of Tim Geithner late on Friday afternoon as Treasury Secretary for President Elect Barack Obama buoyed the Stock Market by a whopping 1-Day Change of 6.3% for the S&P 500. Earlier we were headed down once more and did indeed set a New Low of 741 on the S&P 500, but drove up nearly 60 points at the close to finish at 800.03. If you have followed this blog over time, you will know that I am a firm believer in watching the Stock Market’s reaction to FOMC and Treasury actions, and now as we have a changing of the guard at the White House, the new appointments in key positions of the Administration. So far, so good…let’s hope that reaction continues as these unfold and more importantly that the decisions are pragmatic to restore consumer confidence and stability for the ordinary person in the street…usuns:

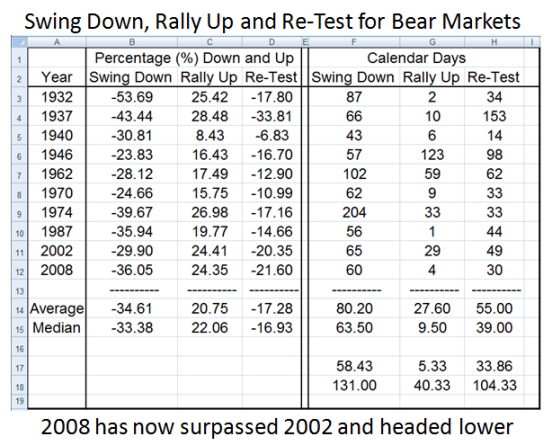

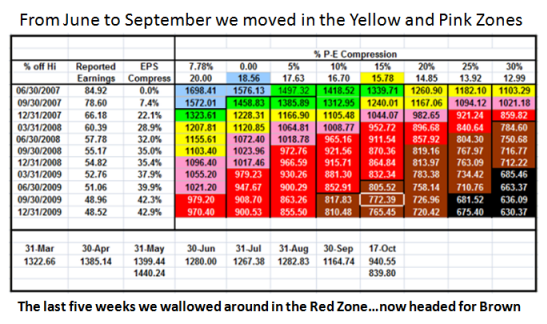

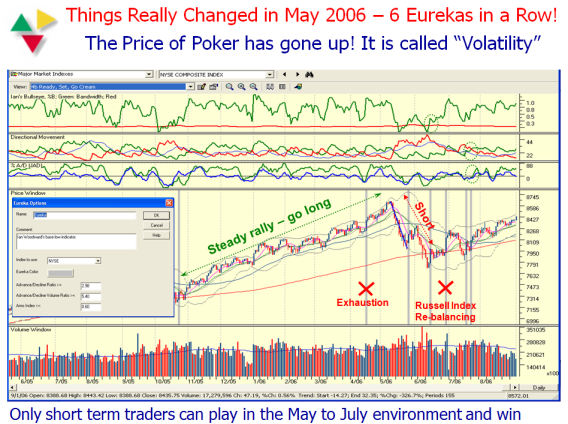

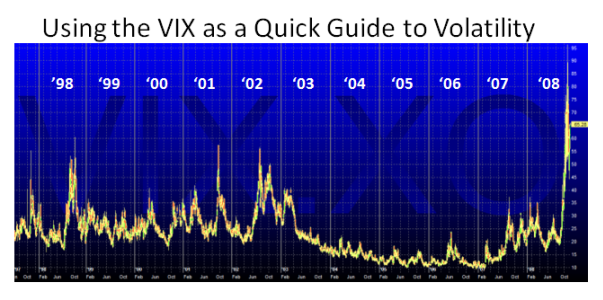

This latest free fall has produced the worst market conditions since 1937, surpassing 2002 as shown by our latest barometer which we have watched these past six weeks:

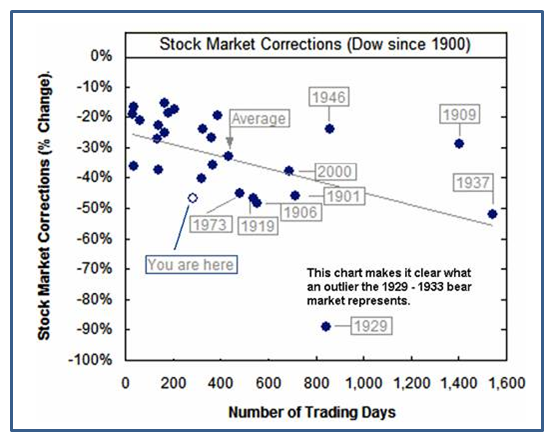

One of my staunch supporters put up an interesting chart showing the Stock Market Corrections on the DOW since 1900, and it gives a good perspective of how serious a fall we have had, especially since the Bail Out Plan was passed:

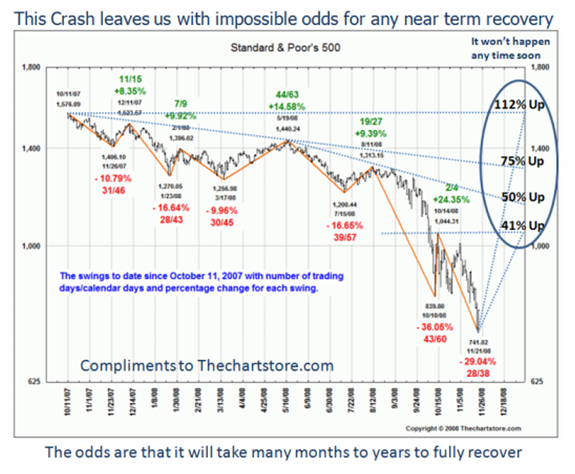

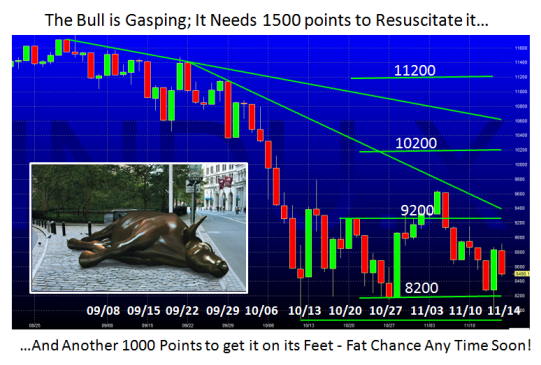

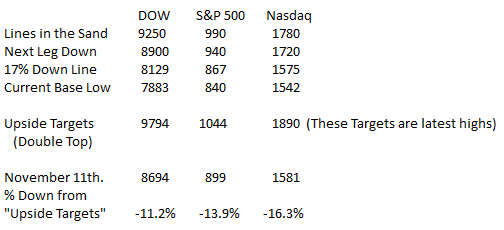

This Crash now leaves us with impossible odds for any near term recovery, since the return paths all require huge Market Rallies to get anywhere near the down-trend-lines which I call the 405 Freeway. Just to get back to a double top of the recent Bounce Play we had to 1014 requires a 41% Rally. The numbers are on the chart:

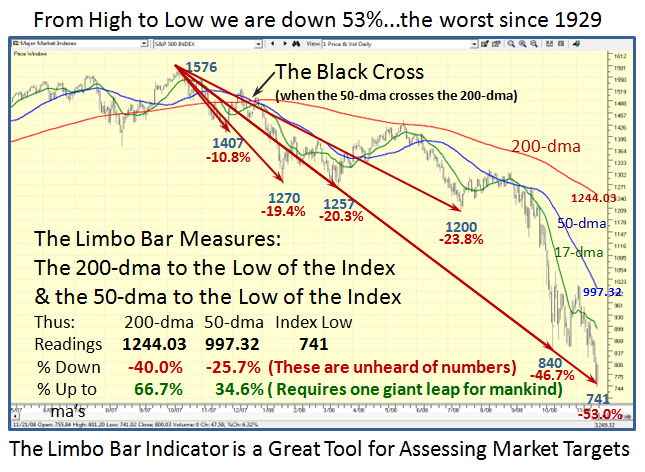

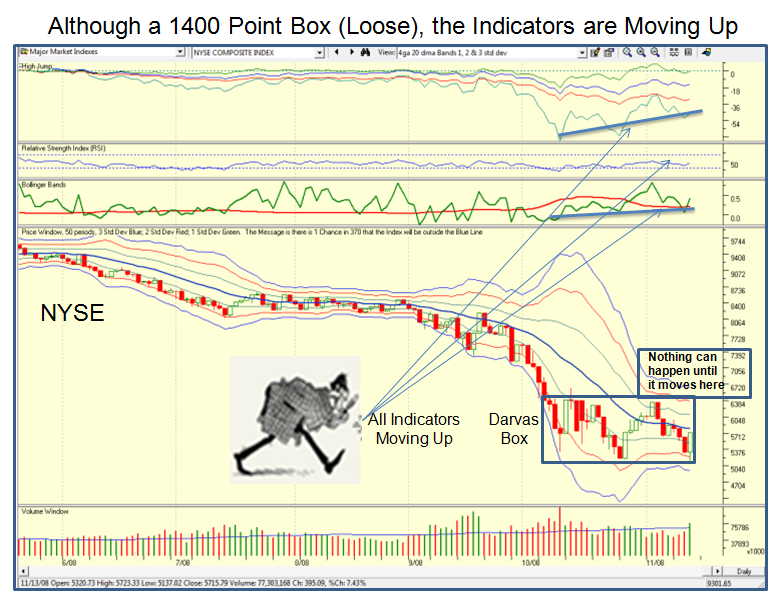

Let me give you one more chart of the hurdles we must surmount on the way back to set the stage for what it will take to recover from the free fall. I have spoken often about using the High Jump and Limbo Bar Indicators as valuable tools I developed over 15 years ago at Market Peaks and Market Bottoms, respectively. The High Jump measures the % difference of the 200-dma and 50-dma from the Index High, while the Limbo Bar reverses the process and measures the % difference of the 200-dma and 50-dma from the Low of the Index. When done this way, it gives a feel for the magnitude of the problem we face as we try to retrace our steps up to what we would consider normalcy. That can only be attained by rapid Bounce Plays, Bear Market Rallies and then Bull Market Rallies in quick succession. As the chart below shows the challenge is huge:

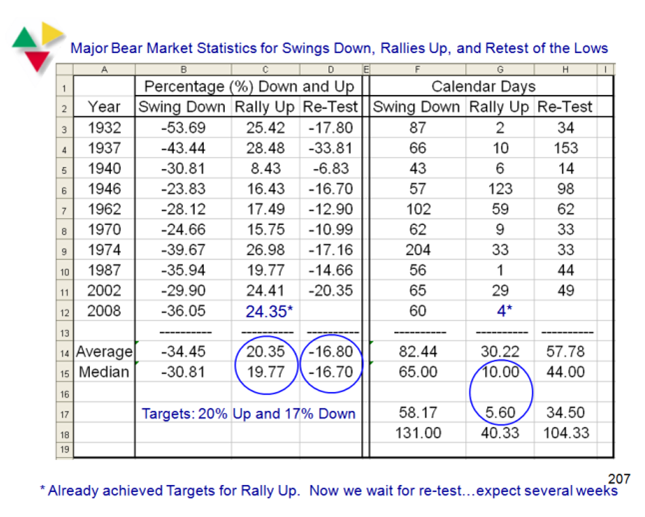

All right, you have heard all of that gloom and doom enough now to last us until the New Year. I had to lay out the perspective of the size of the problem to begin to give you a feel for what it could take for the Market to restore itself out of this insane hole that we have dug for ourselves. You will have to bear with me as when problems get this tough, I resort to Stakes in the Ground and Measuring Rods. Understand that now that we have undercut all previous numbers, we have to innovate and start afresh with what history has given us but then address tests-of-reasonableness to see whether the scenarios I offer you are achievable or beyond the probabilities of achievement.

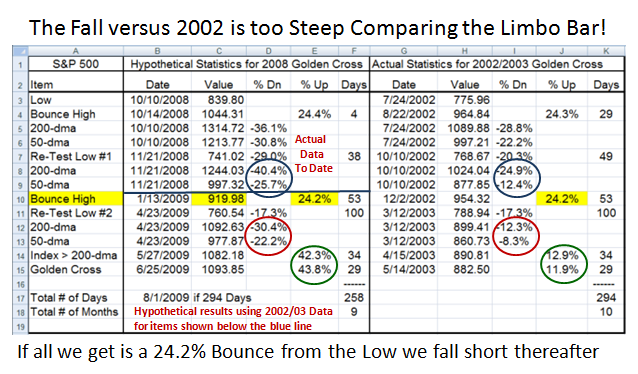

Since I introduced you once again to the value of the Limbo Bar and the fact that the most recent set of deep hole statistics was back in 2000 to 2003 and within our comprehension, what better way than to start with the Low back on 10/10/08 and 7/24/02 as the initial starting points, come forward from these since then to the current date of 11/21/2008 and assess the Actual situation of the Limbo Bar readings (200-dma and 50-dma to the Lows). Then superimpose the 2002 and beyond statistics on the current situation and see what it gives us for things to come as shown by the data below the blue line:

The conclusion is at the top of the chart…this recent free fall is too steep compared to 2002 when we focus on the difference in the numbers for the 200-dma and 50-dma, i.e., the Limbo Bar numbers for the two cases. We are almost 2:1 lower for the 200-dma and over 2:1 for the 50-dma (blue circles). If we now experience a Bounce Play from this low of 741 comparable to the 24.2% jump we had back in 2002, this leaves us with big shortfalls thereafter as shown when you compare the numbers shown by the Red and Green circles, respectively.

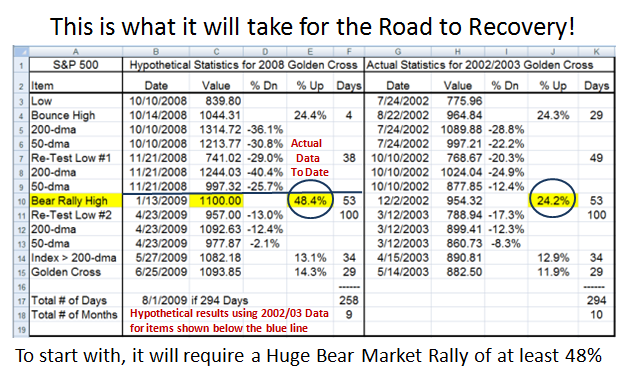

So the next step is to see what it would take to make the numbers more reasonable by increasing the Rally from what I term a “Bounce” to a full blooded Bear Market Rally. It’s sad to say that it will require a move of twice the 2002 move of 24.2% to produce the desired results. The net Target is a 48.4% rise from the low of 741 to 1100 on the S&P 500, virtually an impossible task, though such rebounds were achieved back in the 2001 timeframe.

Of course, one can do anything with numbers…that is not the point of this exercise. It is to show you the magnitude of the challenge. Others would say it doesn’t have to be achieved in one step and that is correct. In that case the Retest Low #2 would have to be less than shown…I’m sure you get the point.

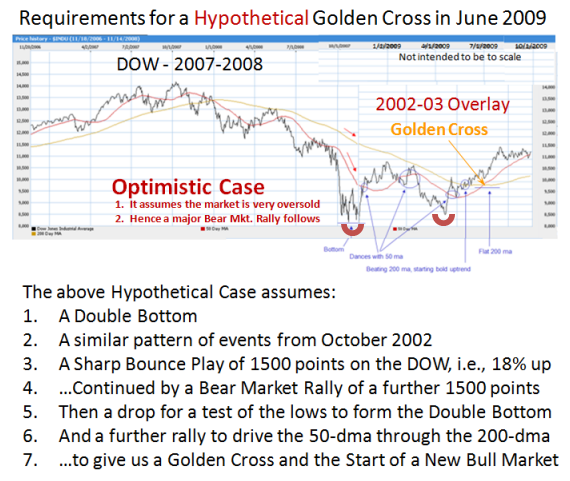

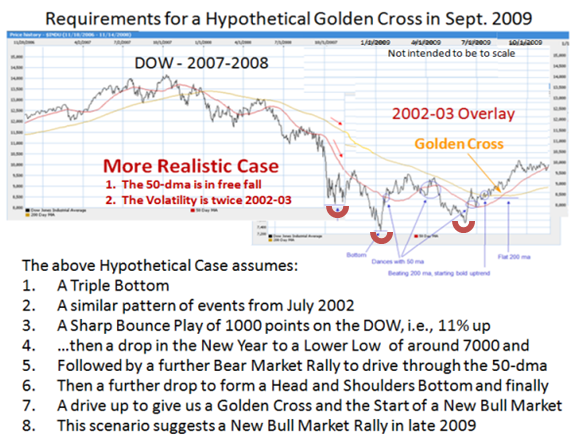

Many people are not left brain types and prefer a picture to a bunch of numbers. So let me turn the tables around and immediately give the right brain types their wish with two obvious pictures. I turn to superimposing the history from October 2002 implying we expect a Double Bottom scenario to play out, and then try the obvious Triple Bottom, or Head and Shoulders Bottom as I have shown starting with History from July 2002. The next two charts show those two conditions.

This chart shows the best of conditions with regard to a strong rally, but will still not show a Golden Cross of the 50-dma coming up through the 200-dma before mid year 2009. Note it would take the best part of a 3000 point rally for the DOW to pull it up by the boot straps in the next couple of months to give any assurance of withstanding a re-test of the lows that form the Double Bottom.

The Triple Bottom Case sets the overlay back a stage to July 2002 and does not have as ambitious a rise in this next Rally. Note that the expectation is that we will have a re-test of the lows undercutting the current level to a lower low of around 7000 or let’s say 700 on the S&P 500, and then drives up sharply. The final leg would produce the Right Shoulder as shown and with all the to and fro, the Golden Cross would occur later by around September of 2009 and at a lower level of around 8000.

All of the above is Modeling and Game Playing, but is based on logic surrounding the depth of the Limbo Bar numbers, and more especially demonstrates the havoc that has befallen the internals of the market with the steep drop of the 50-dma well below the 200-dma. The bottom line message is “The recovery will not happen any time soon and we are in for a long winter in the Stock Market”. At least we now have a Game Plan and Targets to measure against. We will amend these as the Market tells us where it is headed. It goes without saying that if we head down again immediately below Friday’s Lows, all bets are off and we will have to re-adjust the Game Plan.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog