Ian,

Not to beat a horse to death, but I would like a short response from you on the H.O. Brouhaha that seems to have taken the spotlight again. I always listen to your words instead of the masses … but what are your thoughts on words attributed to Miekka in his article?

Yours … Brother Steve

Brother Steve…As I Live and Breathe! I have been kept mighty busy on the H.O. Brouhaha, but I am glad you came to visit. You asked for a short response, but I have given you the whole nine yards. Having spent over an hour on this reply, I intend to use it and your question on the blog having got your permission.

1. Unfortunately, our HO is not registering the same as others as you have already suspected and known. A couple of things:

a. The Reuters feed on Highs and Lows are different than others like WSJ.

b. The way Matt originally set this beast up for us on the 10-Wk ma, suggests this last one also didn’t trigger

c. Not Matt’s fault, as he interprets our input requirements. Just de-select the MA item and you will see it triggers.

So, net-net we can blame it on our criteria not being the same and/or more stringent than others.

2. I am well past that point in the scheme of things:

a. There are several people who jump on this signal at the drop of a hat to make hay in selling Newsletters and Services

b. Miekka himself threw the whole community for a loop when in a recent interview he said he didn’t know where Wikipedia got the 2.2% number from. He used to use 2.8% and then when decimalization came along he adjusted it to 2.5%.

c. Likewise, we use 79 stocks instead of 69, according to Miekka’s rules.

So, net-net, it makes the whole mumbo jumbo a trifle dubious as far as the “triggering mechanism” is concerned. But at this stage of events, who cares RIGHT NOW about the purity of the numbers…it’s close enough for Government Work to make the point that one should sit up and take note.

3. As you know, I try hard to give both sides of the coin, and I appreciate folks like you who never waiver from their support of what I do, and look to me for the “straight skinees” when things look a trifle uncertain:

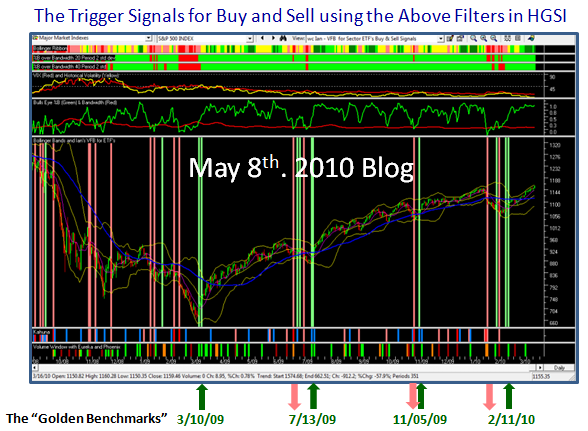

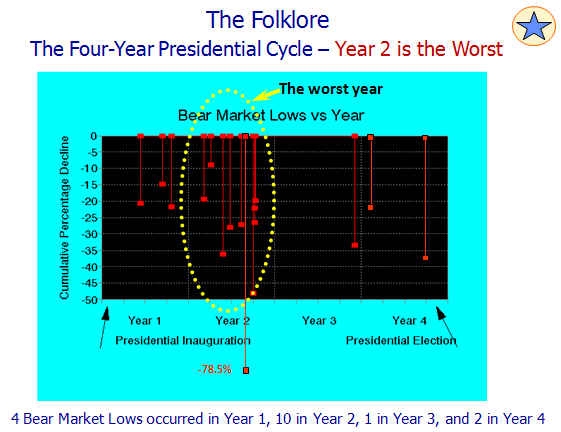

a. You could blame me for fanning the flames by my reminding us that this is the 2nd Year of the Presidential Cycle, where most Bear Markets tend to occur and more so in the second half of the year (see my recent blog of August 19). As you know, all my Impulse Signals are related to the Psychology of the Market, so it is only natural I would remind us of this every four years. I show that same slide at every Seminar. We are just 68 days from the mid-term Election.

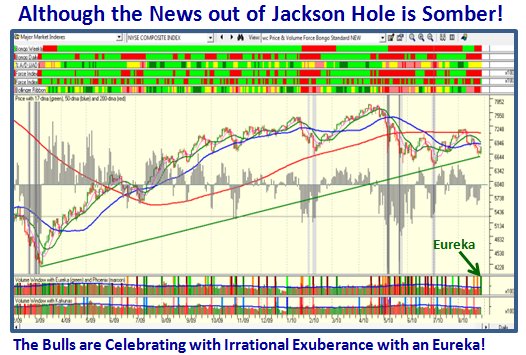

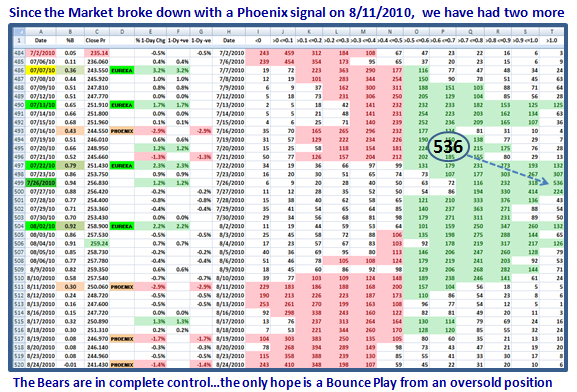

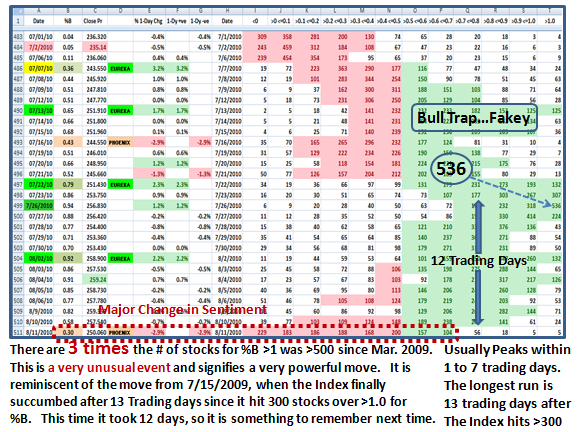

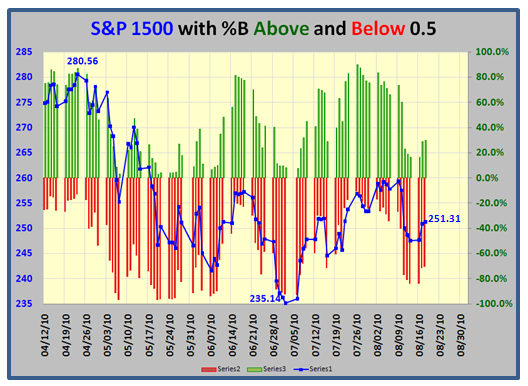

b. But, aside from that, notice the yin-yang of the Eureka and Phoenix Impulse signals for the last four months which I have repeatedly mentioned, which is EXTREMELY unusual. You and I know these are supposed to be, and are, Rare signals at the Fat Tails end of the Bollinger Bands, yet we see them two-a-penny these days, i.e., spells Volatility and Instability.

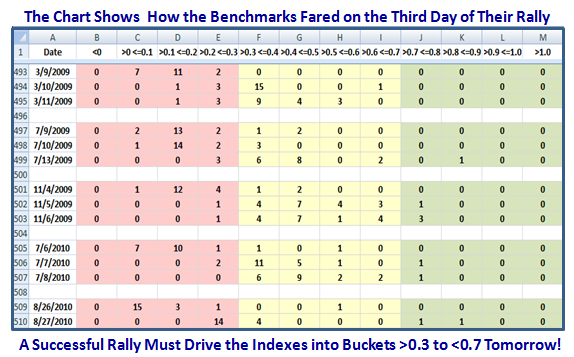

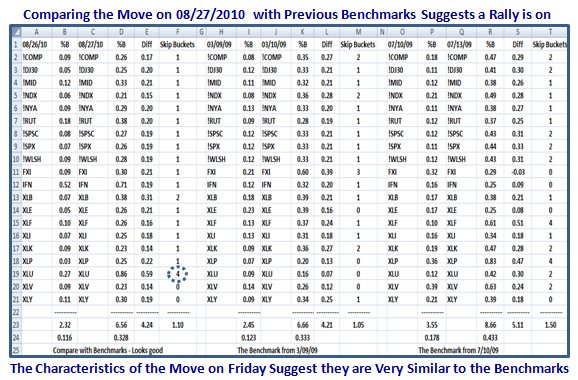

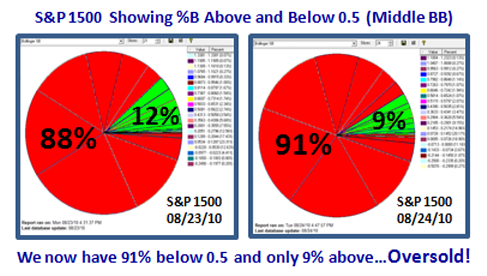

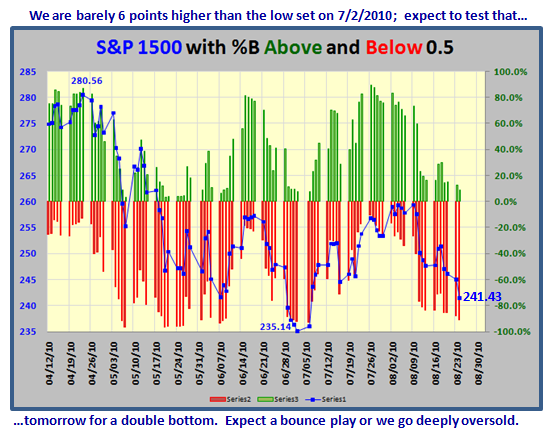

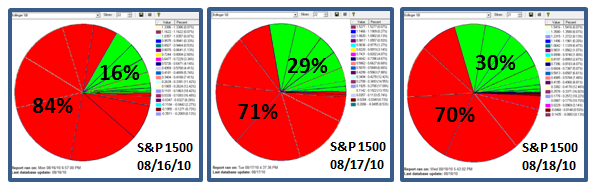

c. You also see the latest mumbo jumbo (good stuff!) I am into on the %B Buckets which gives us far better insight with regard to the internals of the market. Why do you think I keep circling that 536 on the spreadsheet I put up in the newsletter and the blog (see August 24 blog)? The move from over 300 to 536 in one day in the >1.0 bucket is startling, and tantamount to a blow off on that day. Come to look at it as Ron and I are always on our toes to do, it seems highly likely that it was triggered by a flight to Bonds, where now the chant is the Bond Bubble is coming.

So, net-net…it pays to be very cautious. None of us know what will happen in the future, or can forecast a crash based on these signals. All this business of “No Market Crash has happened without a Hindenburg Omen set up prior to it” is good hype and true, but what about the other 70% of the occasions when there has been no blow off. You know and I know that all one can do is wet your finger and stick it up in the air and see which way the wind is blowing. At the moment, the wind is gusting in your face, not at your back, so we take cover as I have taught you.

4. Be that as it may, who is right and who is wrong hardly matters; the Psychological damage has already been done:

a. Everyone, including the taxi drivers know we had Hindenburg Omens coming out of our ears. It is the talk of the Internet.

b. To boot, I now get 1000 hits a day on the blog, whereas I used to get 250 on a good day. People feel I have something to offer, and they are again paying attention to my musings, especially since I gave an appropriate early alert back in 2007.

c. This only adds to the fuel that we are probably due for a double dip recession, and that debate can go on and on.

So, net-net, it says be on your toes and be prepared for a sudden yank of the chain ala Black Swan Days or worse yet the recent Flash Crash we had due to a one minute error that sent everything into a tail spin. I am getting skeptical in my old age and wouldn’t put anything past anyone when it comes to the High Frequency Trading (HFT) that is going on under our very noses. Now everyone is waiting with bathed breath to see what comes out of Helicopter Ben who is holed up at Jackson Hole, Wyoming, for the Fed’s annual sojoun. Stay tuned.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog