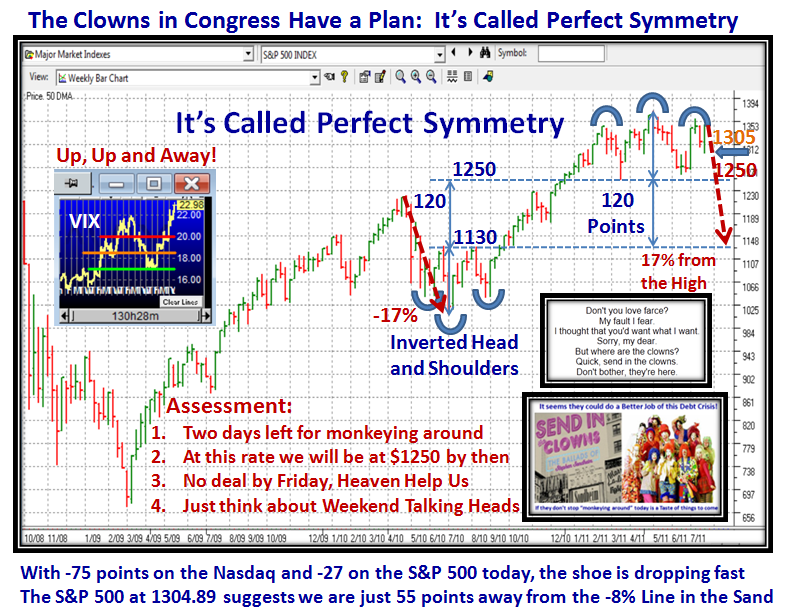

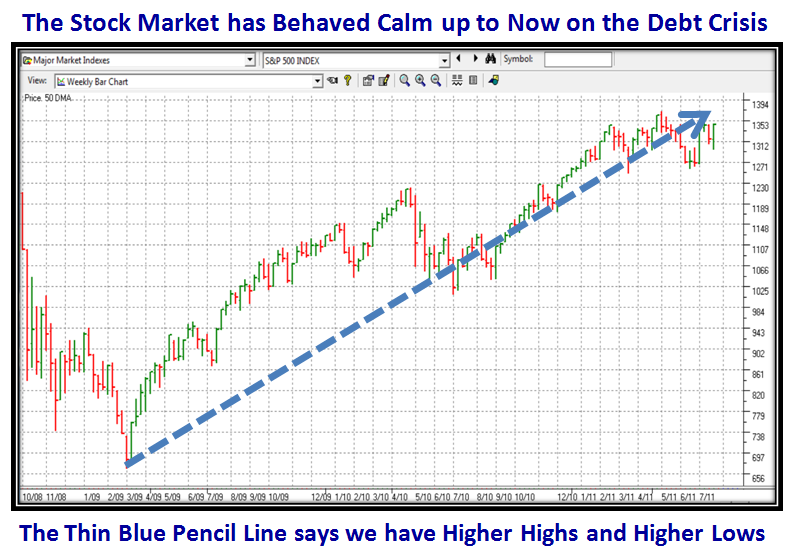

It seems we had our first shot across the bow with the Market getting a trifle spooked by the stonewalling on the Debt Ceiling Debate. However, although the Indexes took a -1% hit today, the Volume did not show panic buttons were pushed as yet, so it might just be a pullback. On the other hand it may be a taste of things to come if the “monkeying around” doesn’t come to an end within the next ten days:

My good friend and associate Ron picked a good time to have a bit of R&R as the Market yin-yangs back and forth between 2700 and 2800 of late:

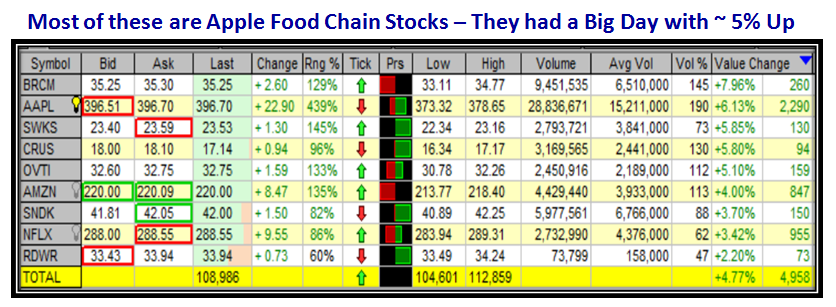

So let’s turn to our “Go To Clues” for where things stand with the Canaries and the VIX relative to the Nasdaq in the next few charts. Overall the Canaries have held up reasonably well except for today when both NFLX and AMZN took hits, along with the new-comer LNKD. AAPL was by far the strongest of the bunch and headed for New High Territory despite the Market sell off:

It is really not surprising that these Leaders are pausing to refresh as we all know a general rule of thumb is that a Stage breakout will usually last for about 22% to 25% Gain in 4 to 6 weeks when it is reasonable to expect a “Pause to Refresh” which is exactly what BIDU and NFLX have done. Although AMZN has not dropped significantly, both it and NFLX have broken their short term trend-line to the upside, with NFLX dropping an alarming 14%…presumably in reaction to the recent price hikes they have announced which has caused some form of an uproar. As you would expect these stocks have risen and fallen in concert with the Nasdaq, so there is nothing unusual yet other than profit taking and cooling off from an explosive rise.

So let’s turn our attention to the VIX, and I give you a new view which my good friend Bob Meagher produced for us to track the Kahuna Force and %B change in Real Time using the Think or Swim (TOS) software…good stuff!

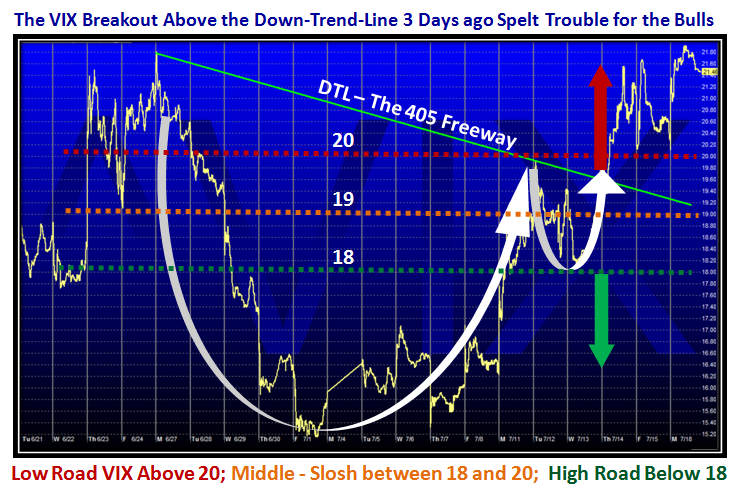

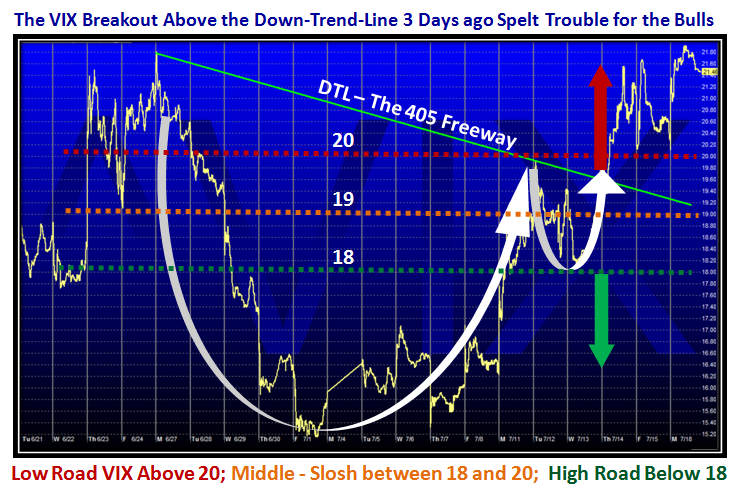

Let’s look at the 20-day view of the Cup and handle and breakout of the VIX above the Down-trend-line, otherwise known as the 405 Freeway, with the strategy to watch for where the three Road Scenario is unfolds very easily. Any push up from here will soon put the Bears in complete control:

…And finally, let’s compare the VIX with the Nasdaq on the same view, where I suggest that the Nasdaq has to get above 2825 to turn the corner. Sixty points up in a hurry is not very likely unless there is some blockbuster news to the upside:

Net-net: No alarm bells yet, but waiting for the other shoe to drop in the midst of the Earnings Reports, so its not surprising the movement is more news driven at this stage. The next ten days will tell us whether we survive another debacle or head down into the mire. Best to sit tight and wait it out.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog