Stock Market: A Second Wind, but Watch for the Evil Eye!

As I write this Blog Note, I am reminded that we have just one month to the day for the Gathering of the Clans at our March 24 to 26 Seminar. Hurry, hurry, hurry if you want to learn how to Manage Fear and Greed and to stay on the right side of the Market using the Balanced Approach which Ron Brown and I have developed. Our objective is to show you winning ways in enhancing your Portfolio Gains, so let me once again ahead of time lay out the value of what we offer you at an intense but very friendly seminar which might help you grow and preserve your hard earned Nest Egg.

I note that my good friend Kevin from Qatar is wondering what is happening back here in the pulse of the market, so let me lay out the High Road and Low Road Scenarios and Targets so that he might be induced to come and visit us again! Ron and I are having withdrawal symptoms from all the folks whom we have not seen in a while but are still loyal followers. As usual, my opening picture gives you the gist of what to expect in the Blog Note below:

Those who are regulars to these notes now know what to look for in the following chart, but you will immediately notice we are now into “Nose Bleed” Territory with the light Blue lines I have added to the Major Market Indexes Chart. However, the higher the Market goes the harder it falls, but the Bigger the Cushion before you get creamed. The White Lines are your “Get Out of Jail Free” card:

It is painfully obvious that the Institutions do not want to let this Market die until we are well past the 13,000 mark on the DJIA. It gets the juices flowing for the “herd” (usuns) that may be sitting on the sidelines and something for the talking heads at CNBC to pump things up for those who wish they “coulda, shoulda and woulda” been in at the start of the year. Meanwhile the big boys are also reluctant to step up the bidding as witnessed by the turn down in the Money Flow, yet not enough to cause a stampede for the exits as yet. I’ll show you that picture later. The beat goes on albiet slowly to the High Jump Targets I laid out in the Newsletter:

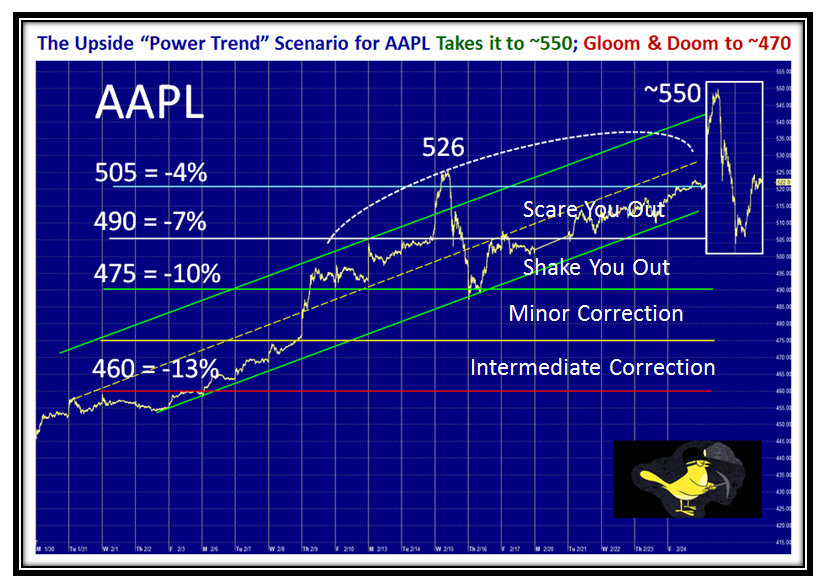

The Canary in the Coalmine, AAPL, survived a whiff of Carbon Monoxide and is now sitting close to its old high. It’s not difficult to estimate the two near term extremes on the high and low jump based on what transpired a week ago as it trotted into a climax run. Don’t be surprised if the big guys suck you in for another Upside Power Trend move and then kill you to the downside:

Having given you enough for Targets on the Upside, let’s now turn our attention to the Volatility Scenarios that help us determine ahead of time when the Party is truly over long before you and I get whalloped. The chitter-chatter on the HGS Investor Yahoo BB leaves me smiling as we look to “What If” Scenarios for some dramatic action to the Upside in the VIX and TVIX.

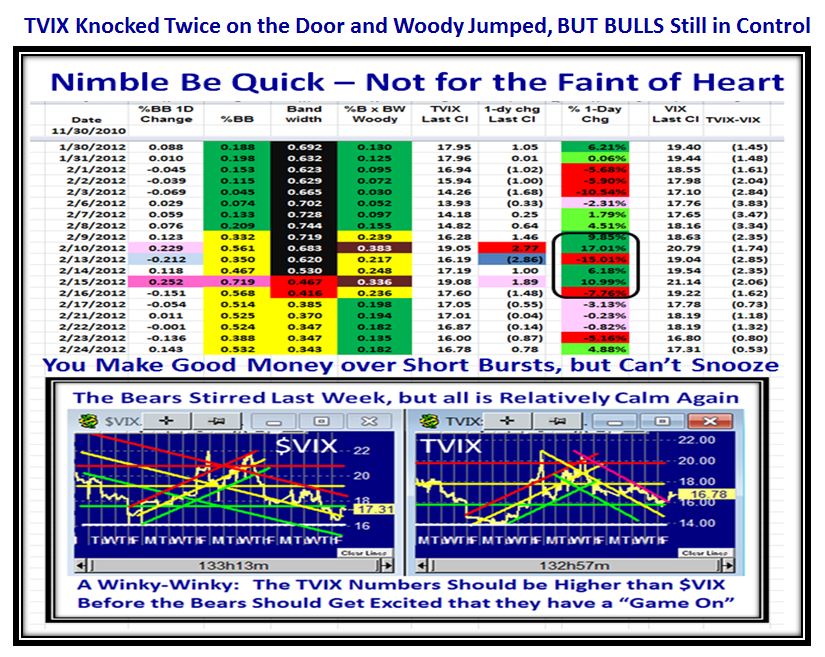

The Market has played right into our hands to develop the Up and Down Scenarios, especially as we now know for sure that 5 Buckets Up or Down in one day is a “Take it to the Bank” heads up to either enjoy the Power Trend or Run for the Hills with the Woody Indicator showing you the way. With the TVIX this quiet despite the two shots across the bow last week, the real challenge for it is to get above the VIX in price before there can be a real surge in the making. Otherwise it can again fizzle into a “Fakey”, as it did a week ago. Yet, let me not deter those who are lamplighters with cast iron stomachs as there is good money to be made in the very short term when it stirs for a day or two as I show in these next two charts:

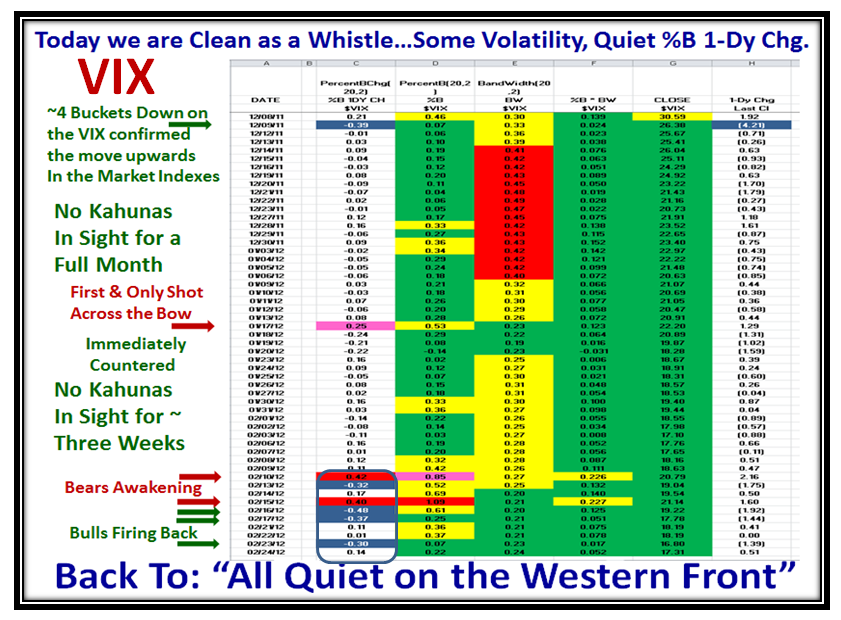

Here is the picture for the VIX and as you can see by the red and green arrows and comments on the bottom left hand side of the chart we had a couple of shots across the bow and despite the volume being light this week, the Bulls still have control:

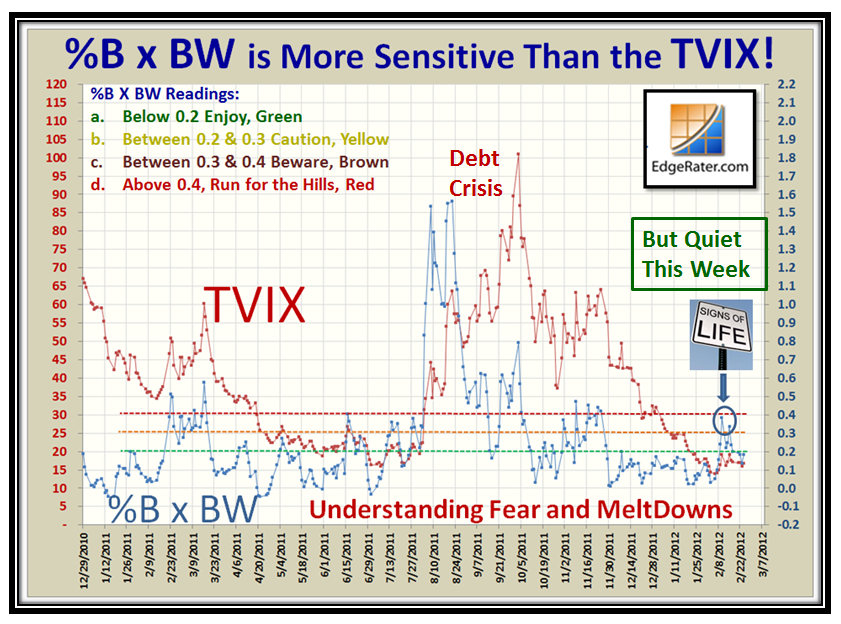

This next chart shows you the full value of the Woody Indicator which leads the TVIX, and is our Savior from a Catastrophic Failure in the Market when it goes into shock ala Black Swan 2008, Flash Crash in 2010 and Debt Crisis in 2011 as shown below. Let me add that those who come to the Seminar will have this chart in the HGSI Software so that you can follow this goodie in it:

This next chart is worth its weight in gold as there is much chatter on the HGSI Yahoo BB about “What If” Targets for next week so that you can be ahead of which way the wind is blowing. By now, I have drummed into you that five buckets up or down can either be Mana from Heaven or the Kiss of Death, so here are the targets to watch for should there be a sudden knee jerk one way or the other. I am not suggesting for one moment that we WILL see a Plus or Minus 5 Bucket Day, but in addition to whether we do or don’t, the chart shows you that the two numbers to watch for in the TVIX is either 13.31 for a strong move up in the Market or 20.05 for a Knee Jerk downwards:

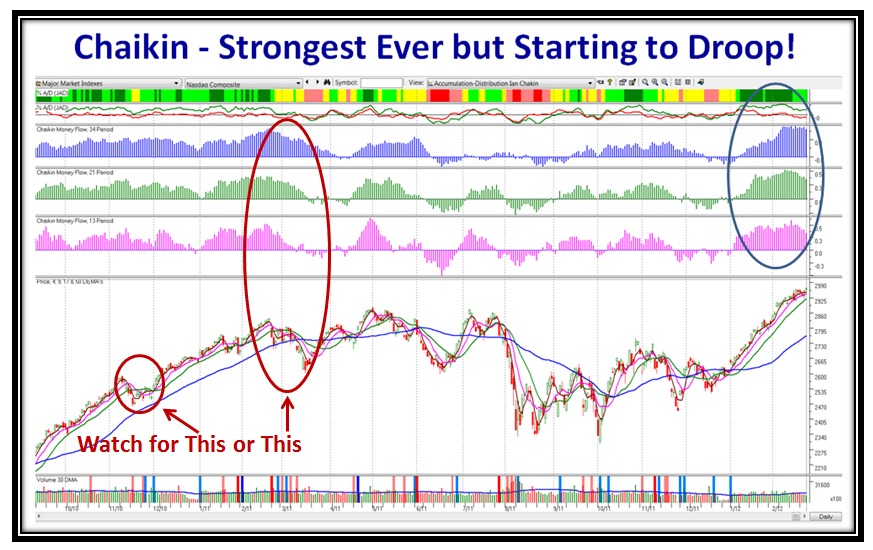

As you well know in times like these, I always hunt with Chaikin’s Money Flow to sense the direction of the Wind Sock. It is strong but starting to droop as big boys are gradually pulling money out while still buoying the Market up with talk of Golden Crosses and driving the Market above their old highs.

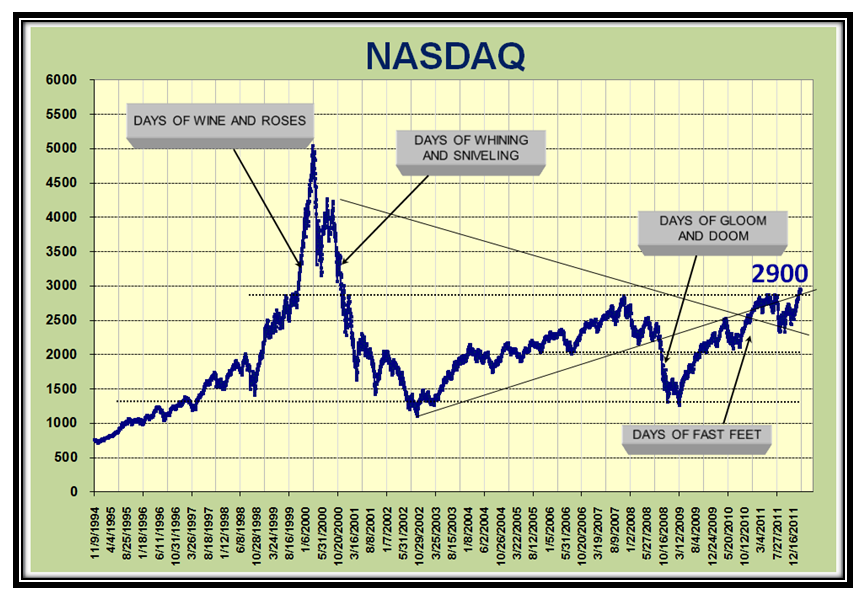

On the positive side, let us not forget that 2900 on the Nasdaq has been the buggaboo level since the Days of Wine and Roses and we are once again knocking on the door for a potential strong breakout! This is a chart my good friend Aloha Mike Scott generated many moons ago and I savor it with fond memories of 20 Years of giving back to the Community:

…And finally as I leave you with this thorough analysis of the pulse of the Market, never fall in love with one scenario. In this day and age we are too quick to look to gloom and doom as the go to scenario, but there is usually a silver lining especially in the 4th Year of a Presidential Cycle, which seldom sees a Bear Market in 72 Years of History:

If you got to this chart, the sentence in red at the bottom is all you need to remember going forward.

Should you be thinking of coming to the Seminar, it does help you and us if you will sign up quickly as time is running out and the curtain is coming down in two weeks time on the special rates at the Courtyard Marriott, so it is up to you.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog