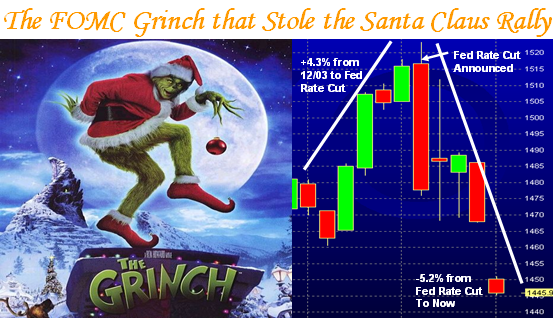

The FOMC Grinch that Stole the Santa Claus Rally

Monday, December 17th, 2007What goes around comes around. Several times in October and November the FOMC handed out pre-Thanksgiving gifts when the Bulls were on the ropes in their fight with the Bears, but it seems justice has been served to the Bears this time around. Helicopter Ben thought he would shave a little off the Fed Funds Rate, but the cut blew up in his face. The Stock Market felt that 25 basis points wasn’t big enough as they were already anticipating 50 basis points, and felt that the bigger problem is that there are a lot more shoes to drop on the sub-prime loans business to say nothing of the other problems of a weak dollar and Inflation/Recession raising their ugly heads.

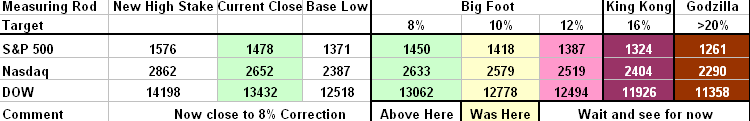

Today the Bears hammered all those darling Silverback Gorilla stocks fat with profits, and although the Indexes came down 1.3% to 2.48% for the DOW and Nasdaq 100, respectively, the Market seemed to go down in an orderly fashion with no panic selling evident. Realize that this is triple witching week for Options Expirations, so we should expect Volatility tomorrow which is usually the most volatile of the week on such occasions, and Wednesday to be quieter and the most positive day for the week based on the past two year’s history. Monday’s are typically the most negative so it behaved true to form.

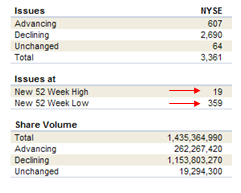

Turning our attention to the New Highs and New Lows the beat goes on to confirm that we are headed down as shown with a very low reading of 19 New Highs and a reasonably big reading of 359 New Lows. Not panic stations as yet when one expects several readings at this level with some as high as 600 to 1000…then we might expect a bottom to set in. Also Decliners and Declining Volume outpaced Advances by a ratio of about 4.5 to 1, also weak readings.

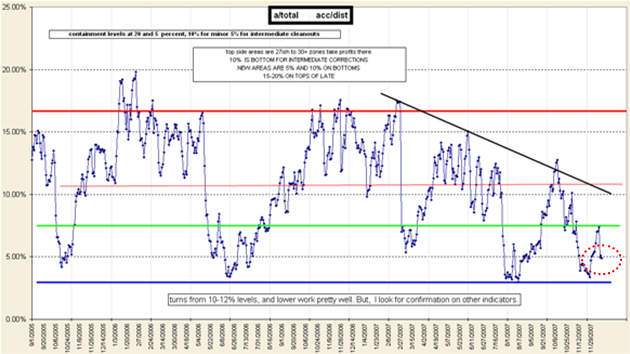

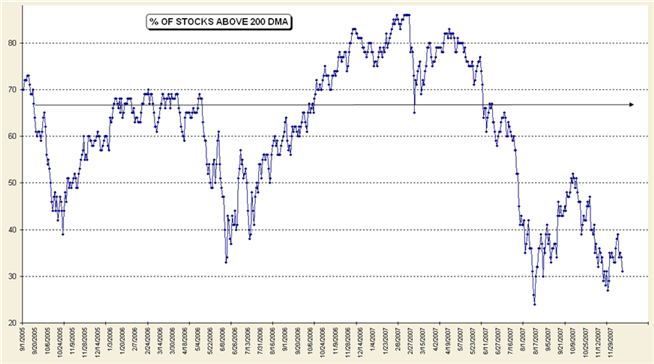

Sure, we can always have a bounce play off a very oversold situation, and certainly with the two pictures I showed in yesterday’s blog on the weakness of the leaders as measured by the “A” accumulation stocks being 5%, and the less than 35% of stocks above their 200-dma, we are due for a bounce. However, I would expect that except for the day-traders and moment-traders will be playing for very short-term gains, longer term holders will take the opportunity of selling into any reasonable rally, since they have been caught on the wrong side of the momentum of the market. Lastly, the place to make quick and big money is in the Ultra Short ETF’s with the biggest winner being the FXP…Ultra Short on the Chinese Silverbacks!

Be careful in this market and settle back with an EGG NOG or two to enjoy the holiday spirit. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog