Stock Market: How High the Moon? Game Plan

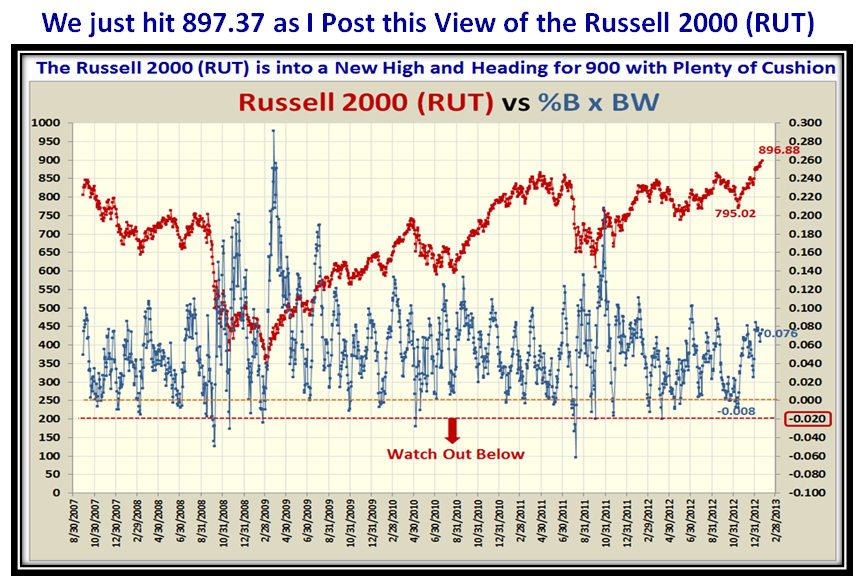

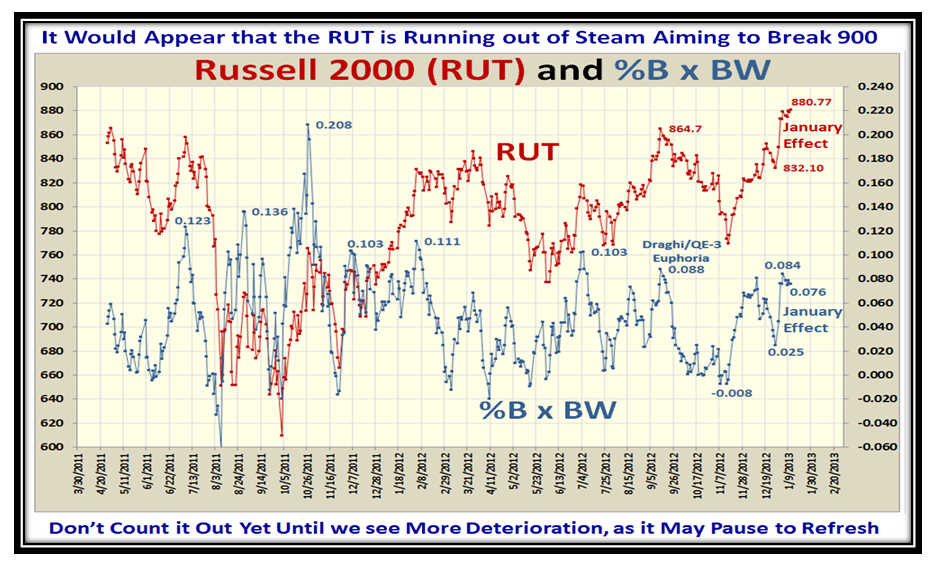

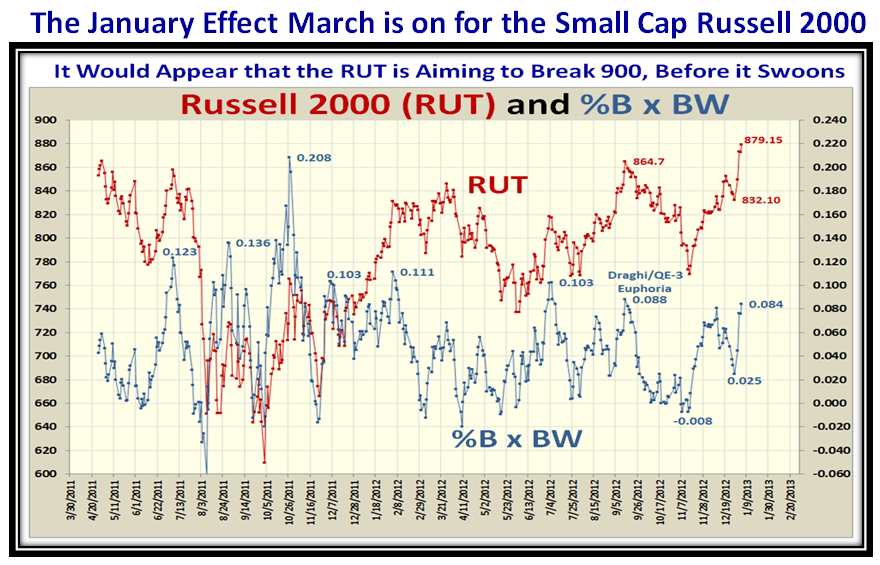

Saturday, January 26th, 2013Having achieved the recent Targets of 1500 on the S&P 500 and 900 on the Russell 2000 (RUT), the question on all our minds is “Now What?” I hope the picture below hits a chord with you as we try to make sense of where the Stock Market is headed:

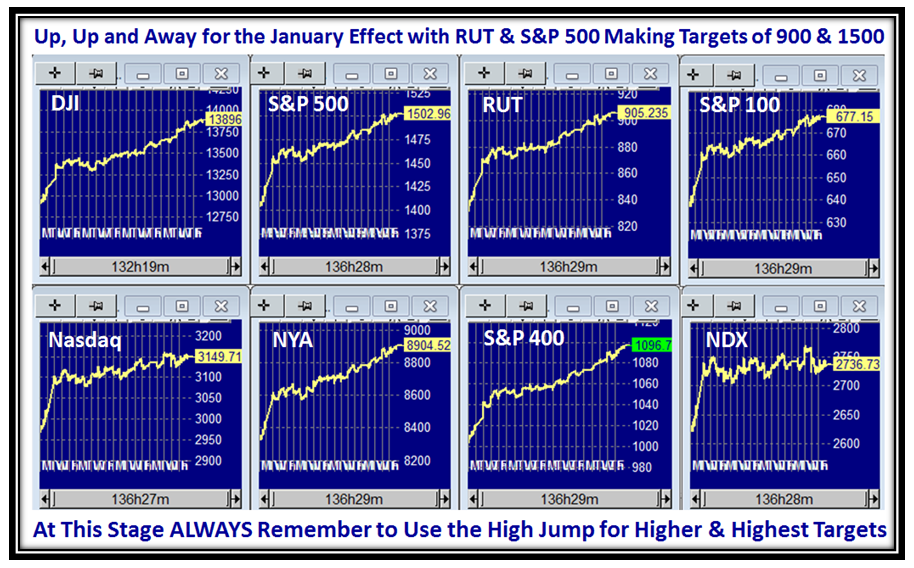

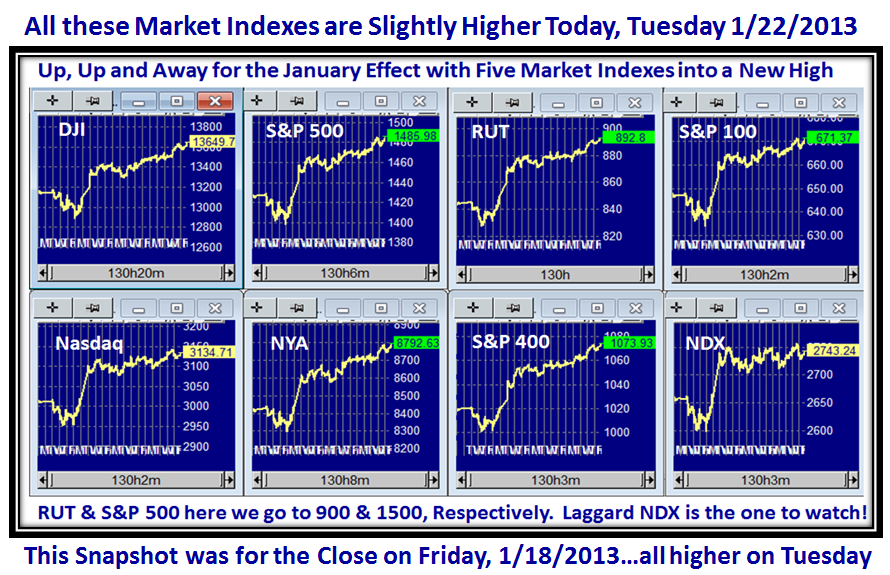

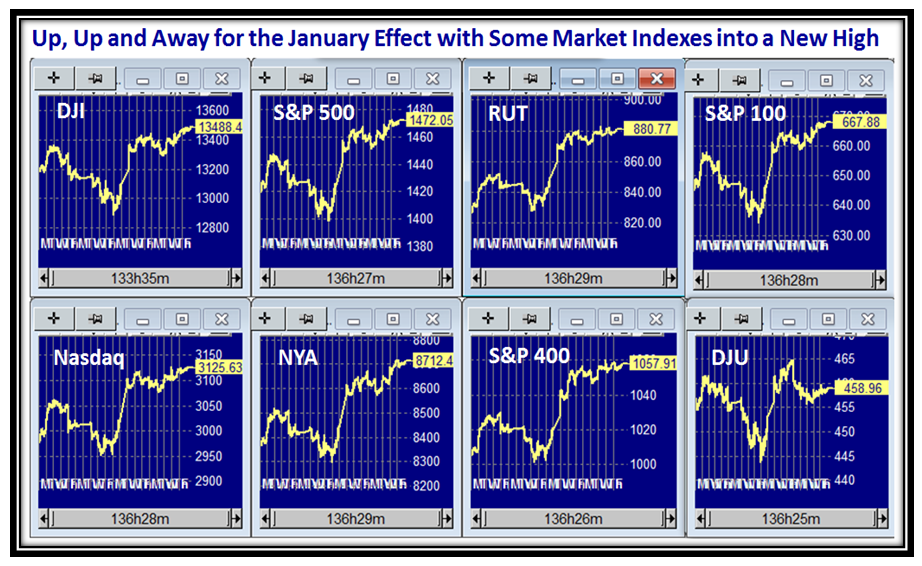

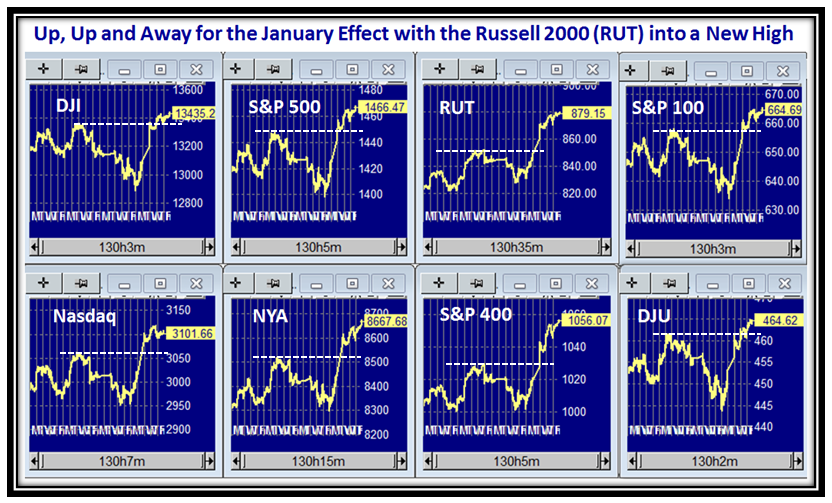

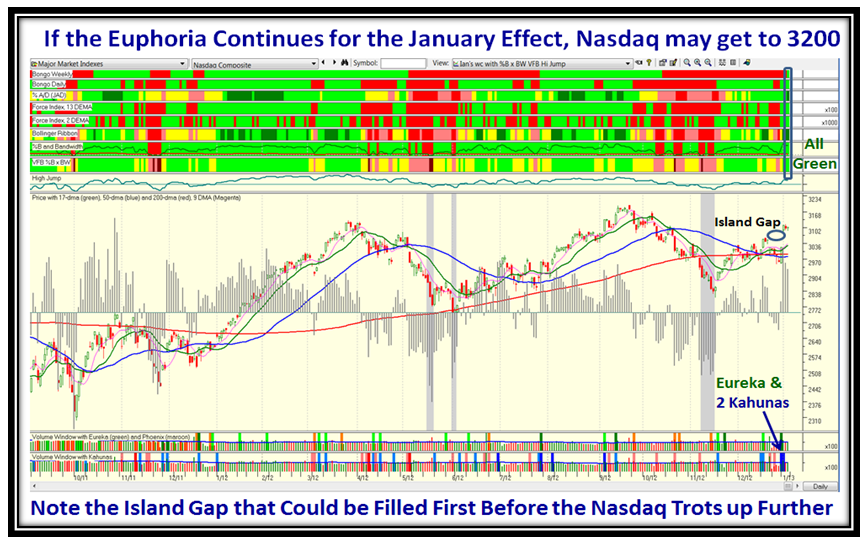

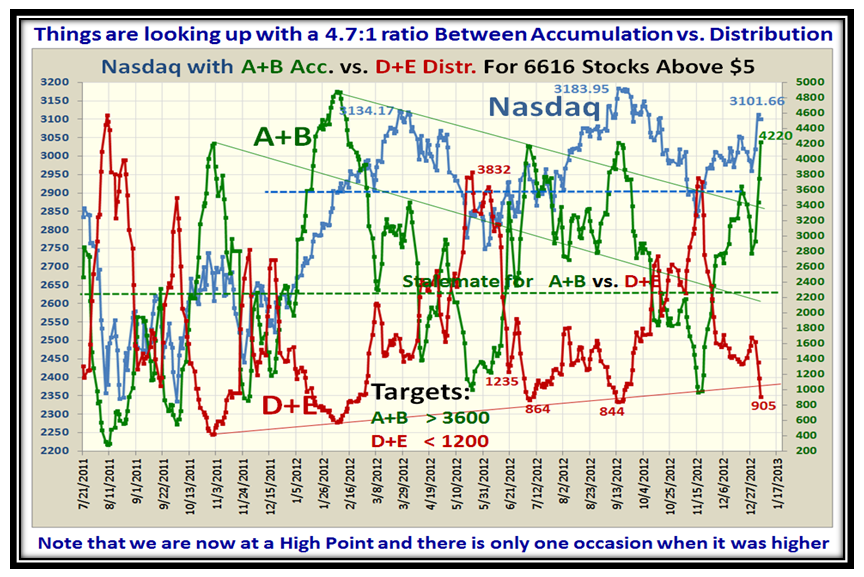

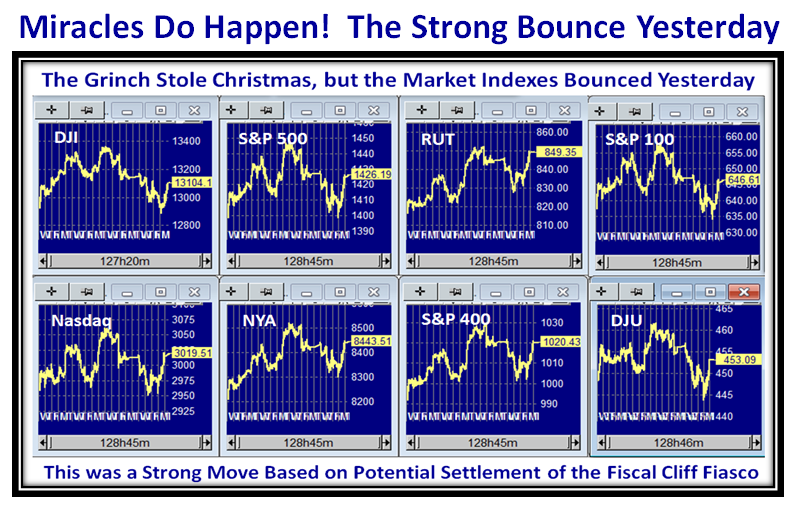

Here is the latest picture of how the Market Indexes keep heading up into new highs, week after week, slowly but surely:

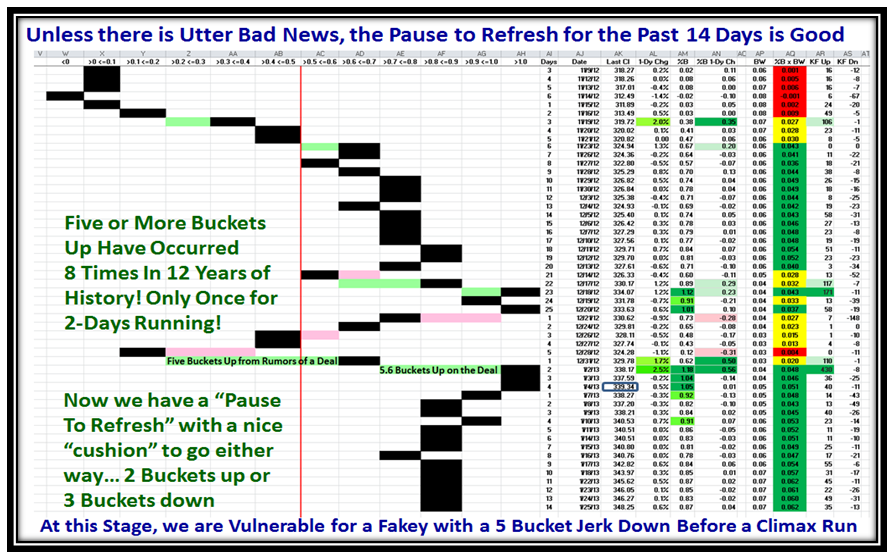

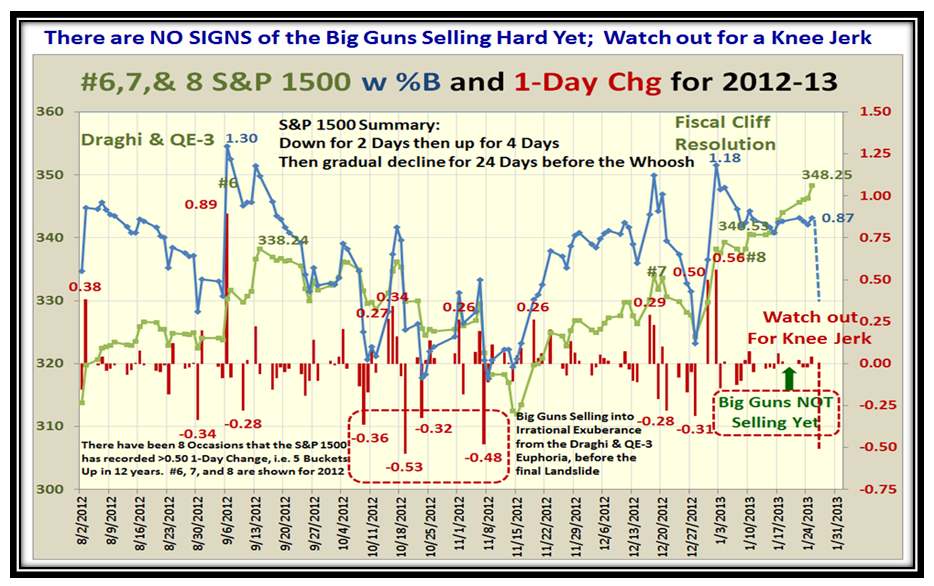

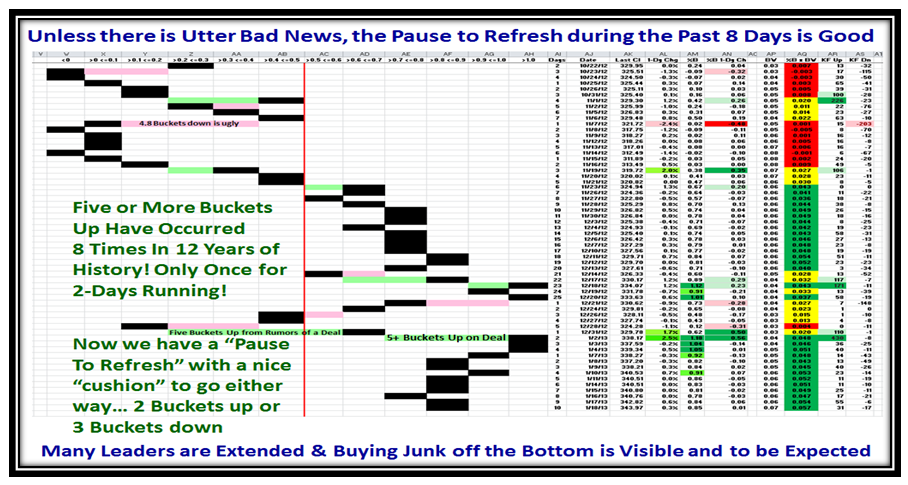

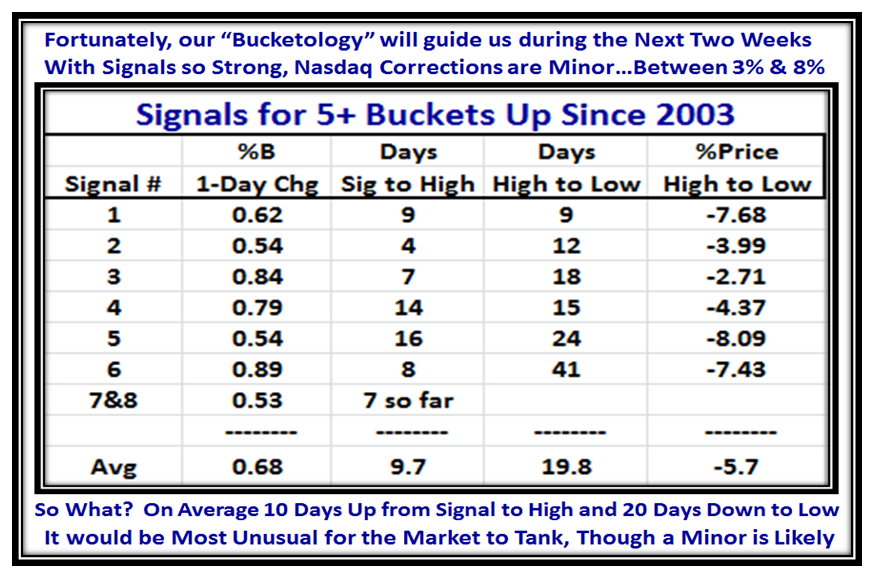

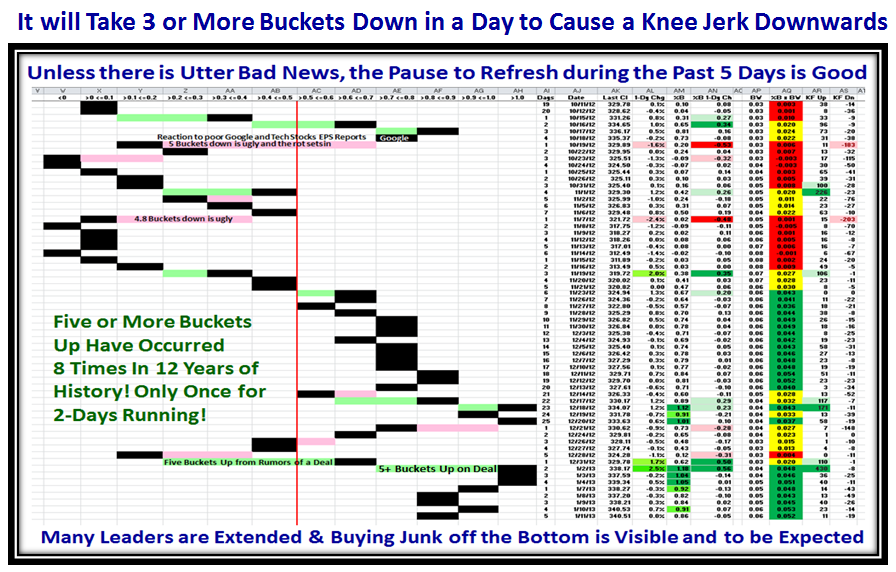

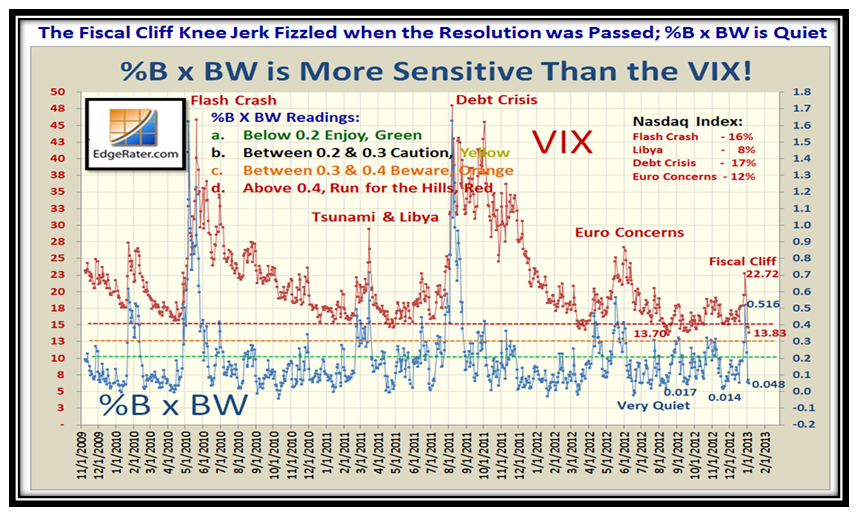

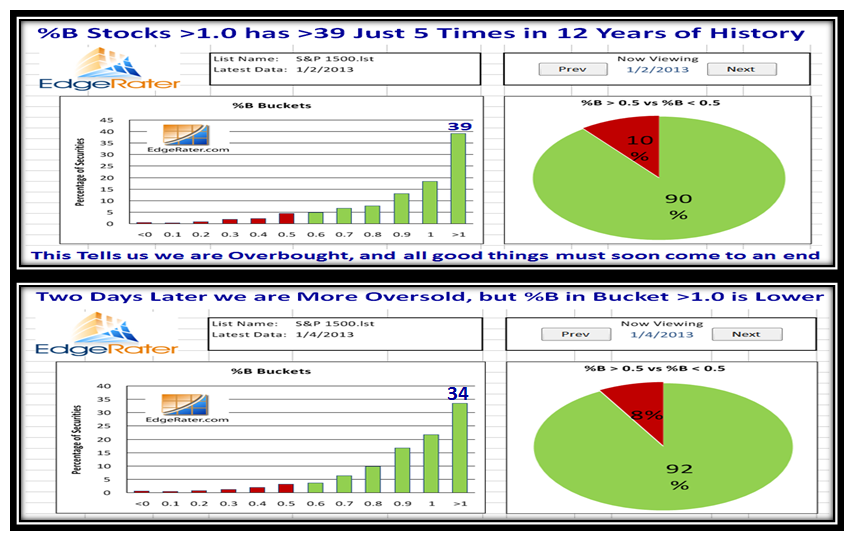

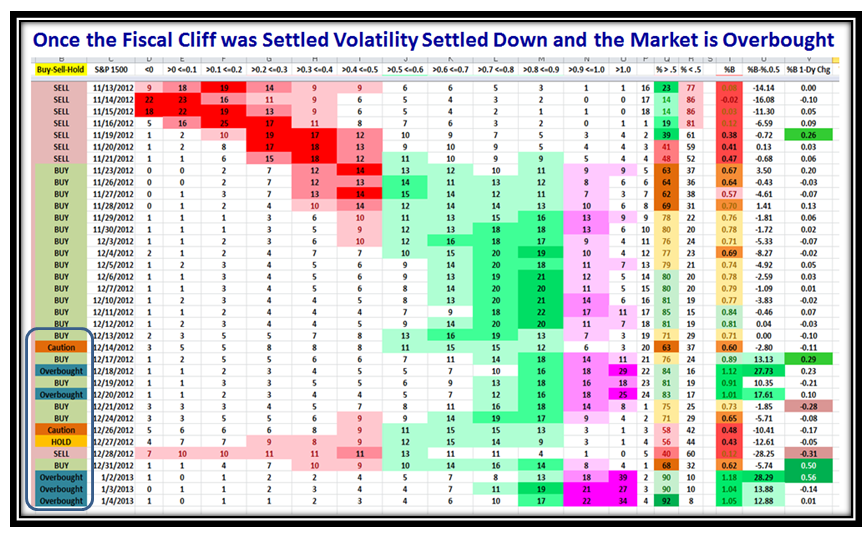

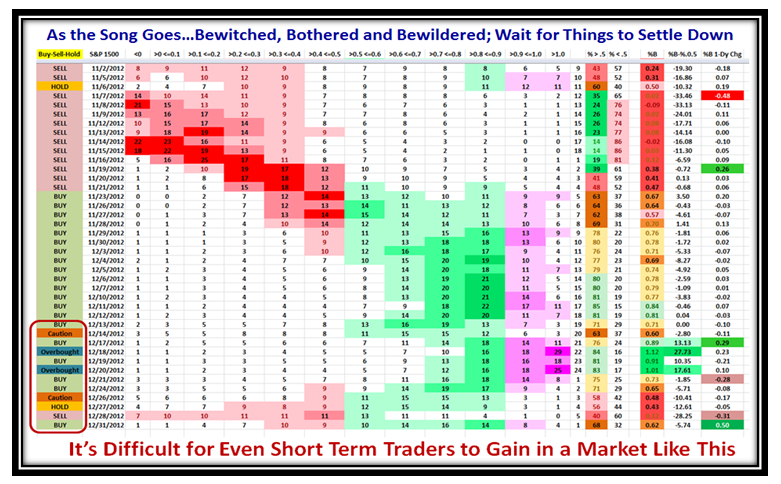

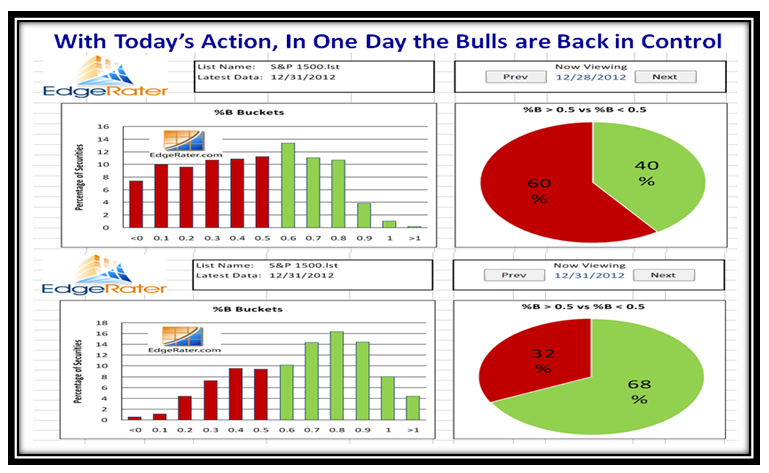

It is interesting that while the Indexes have inched up the %B is stuck in 2nd gear but healthy at between 0.8 to 0.9 for all of two weeks. That gives us some comfort in that we have a cushion for even a five bucket knee jerk but still have room to trot up:

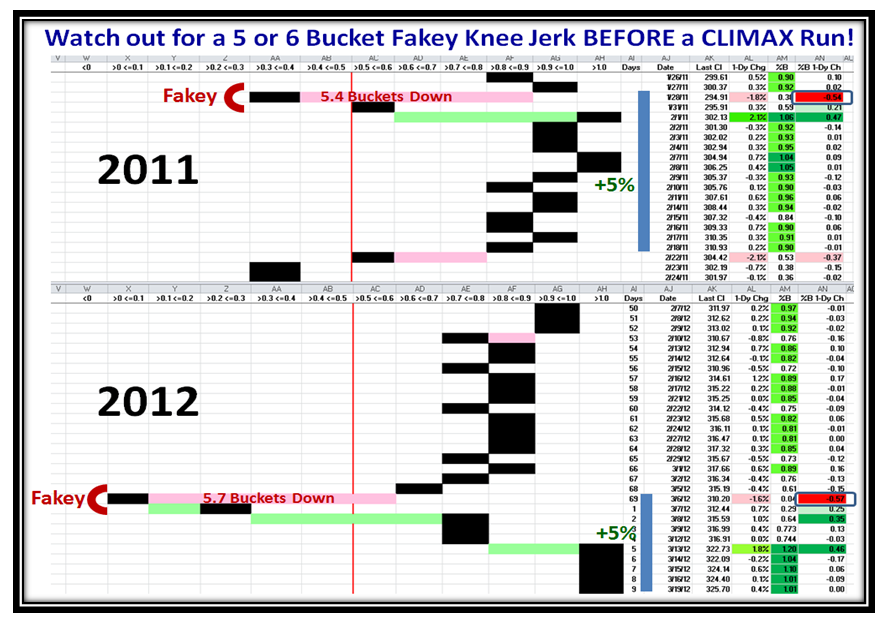

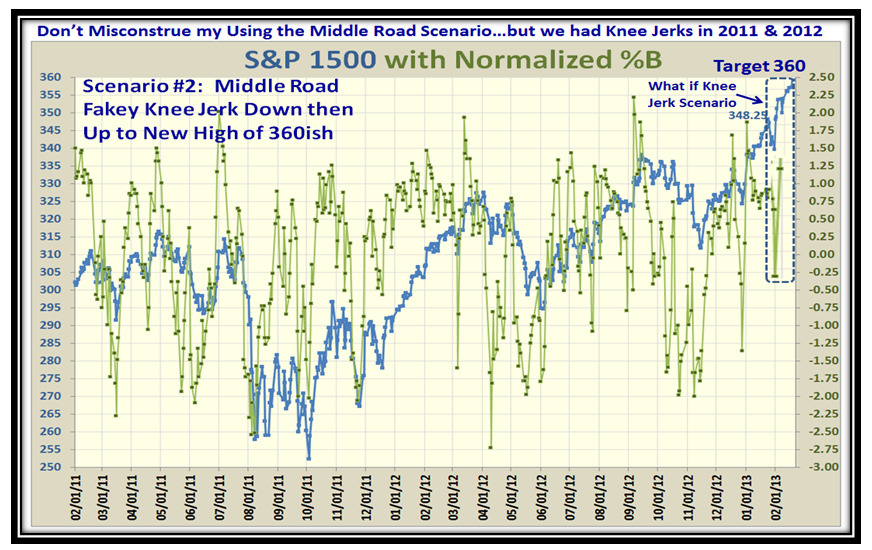

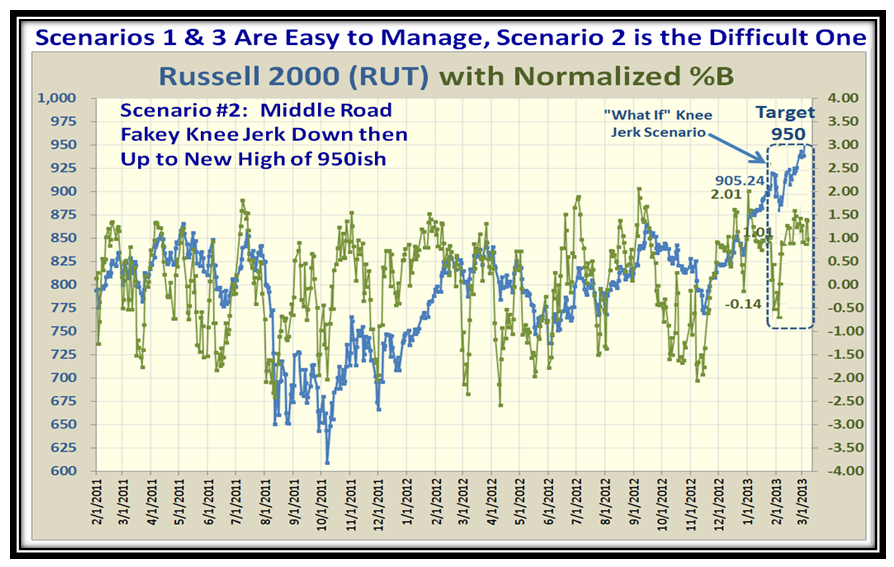

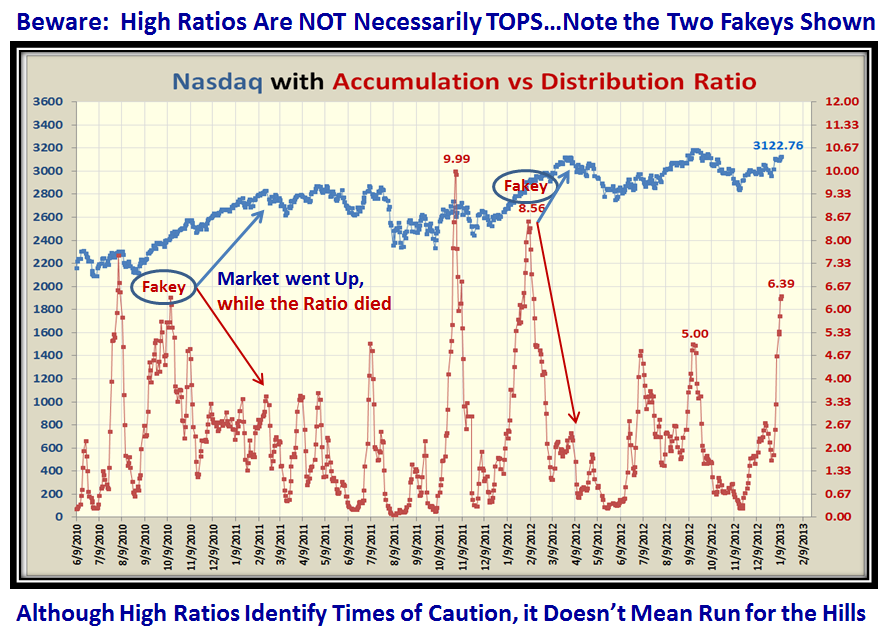

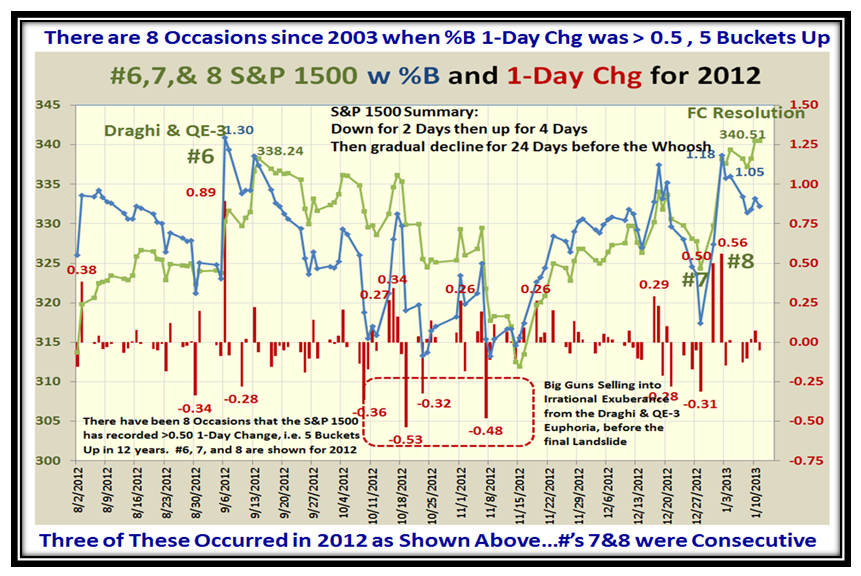

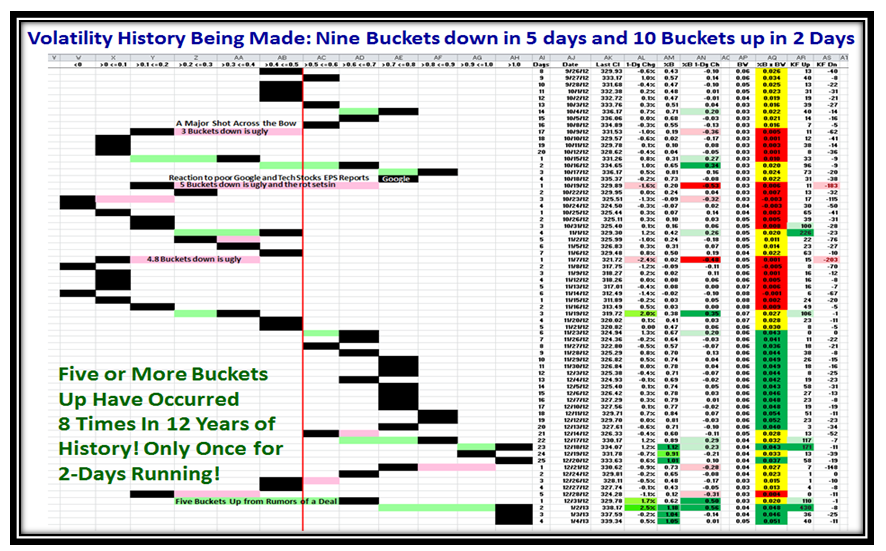

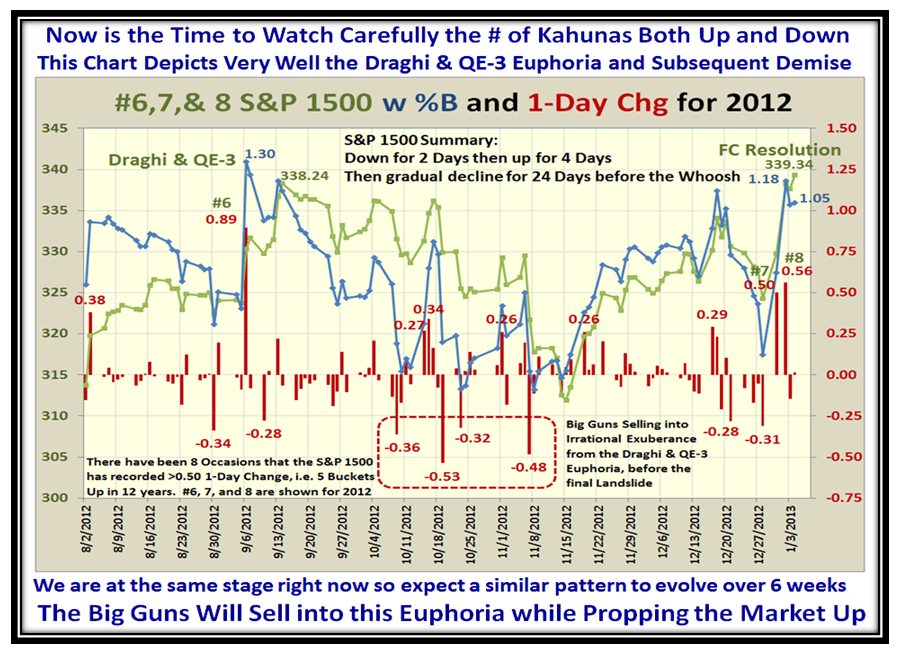

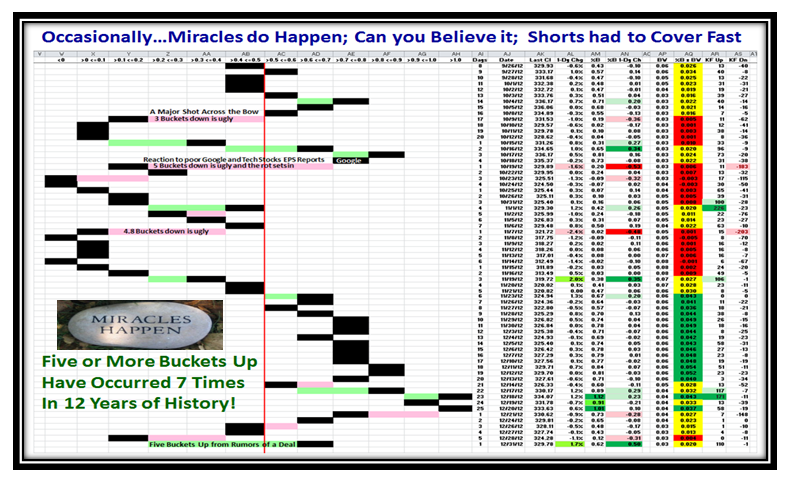

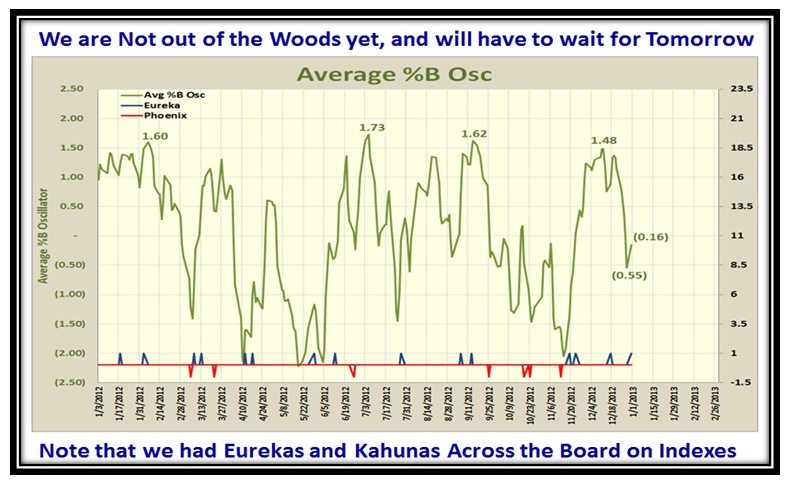

The unusual pattern these last two weeks led me to look back to 2011 and 2012 at around this time of the year, and I may have struck oil. Not only did I find a similar pattern, but also noticed that on both occasions we had a Five Bucket Knee Jerk down that turned out to be a Fakey of just a day or two before the Market shot back up to go on to new highs! I know the old swan song that History seldom repeats itself, but at least it has become one of the Three Road Scenarios I will leave you with and in my usual manner I borrow “snippets from the past” to put on the present to show you what might happen should this phenomenon occur for the 3rd year in a row. I am not suggesting it is the expected scenario, but my point is to not be too quick to count your chickens that the market is headed down.

Please also note the similarity of heading back up to the tune of a 5% Gain in the Index Price after the Fakey, which happens to be approximately what one would look for to reach the next level of targets which my work on the High Jump will show you.

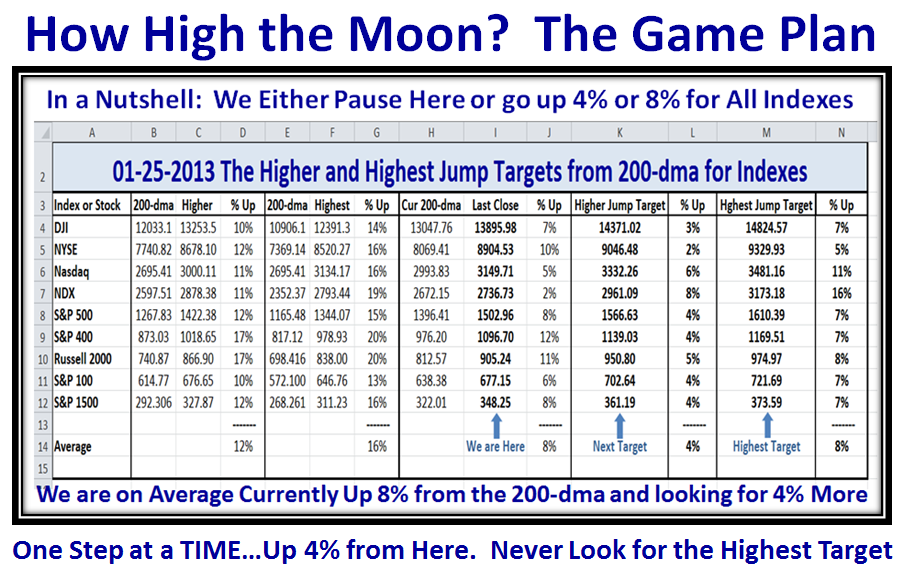

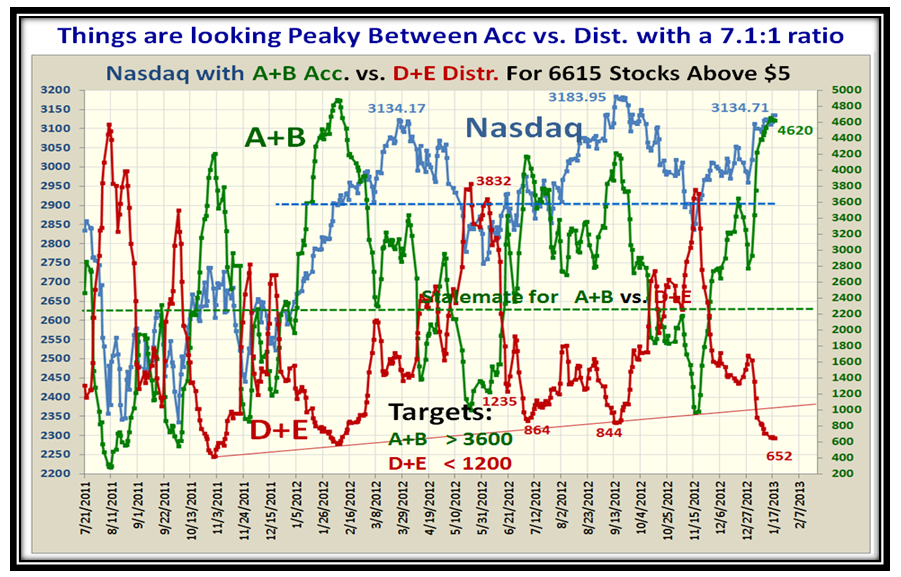

When things reach such peakiness, I ALWAYS turn to my trusty High Jump Tool to guide me of what are REASONABLE Targets, particularly for the Market Indexes. In the following chart I have developed Past Higher and Highest results for the 200-dma to the price of the Indexes, and then applied these to the Current Last close as shown in the Middle Column to get the Higher and Highest Targets going forward. Whether this unfolds this way is in the lap of the gods, but at least it sets reasonable goals of when enough is enough for you to think about running for the hills or shorting the Market:

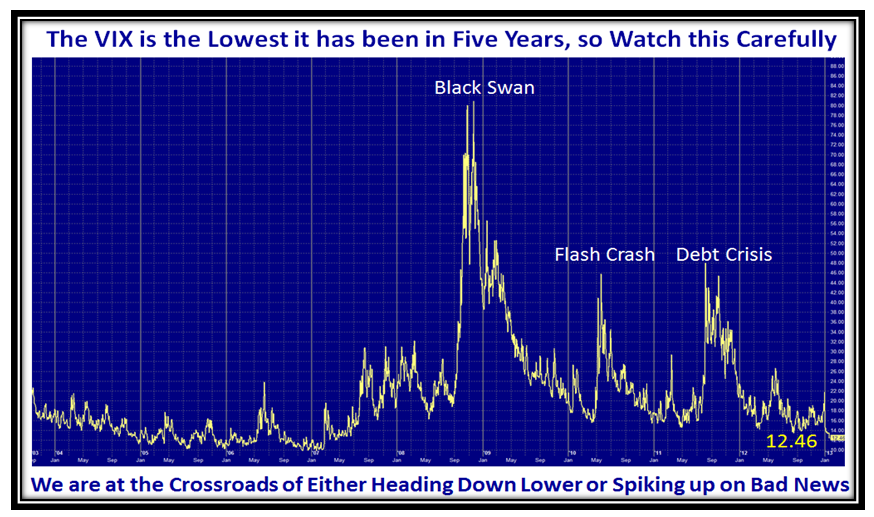

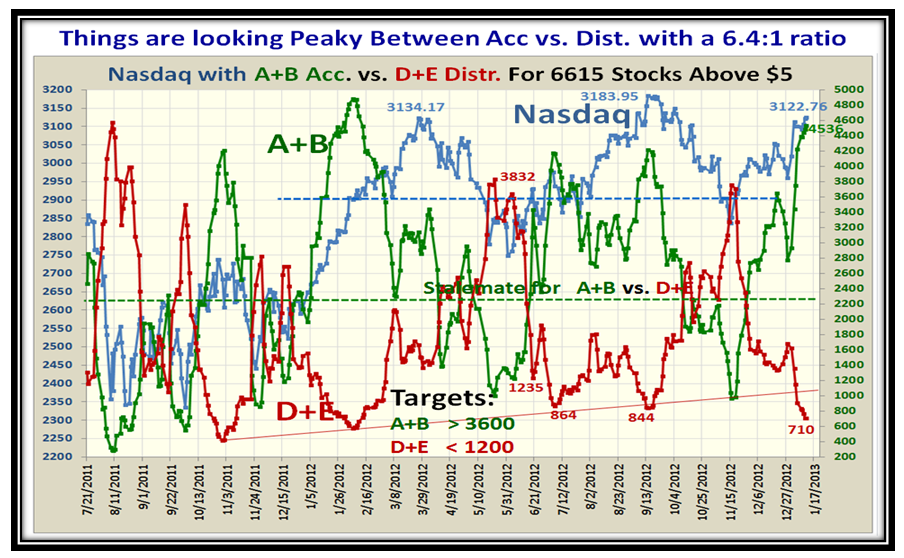

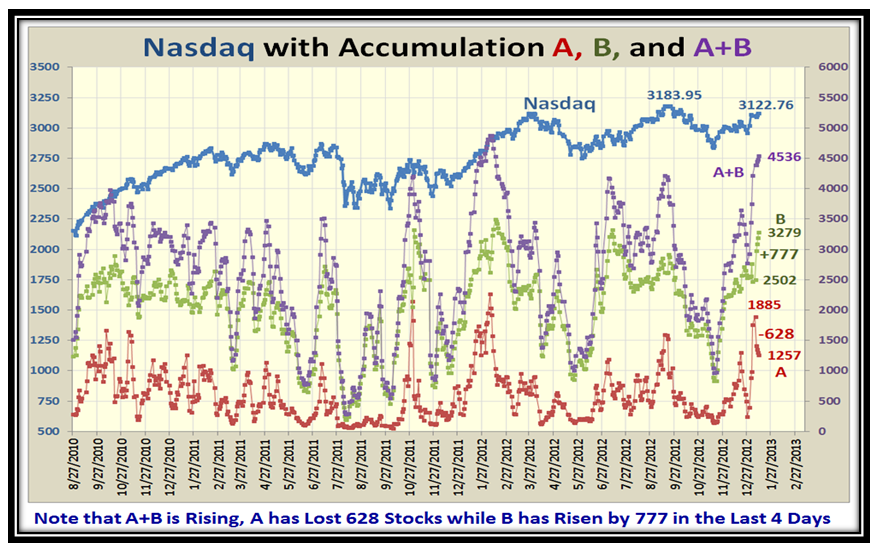

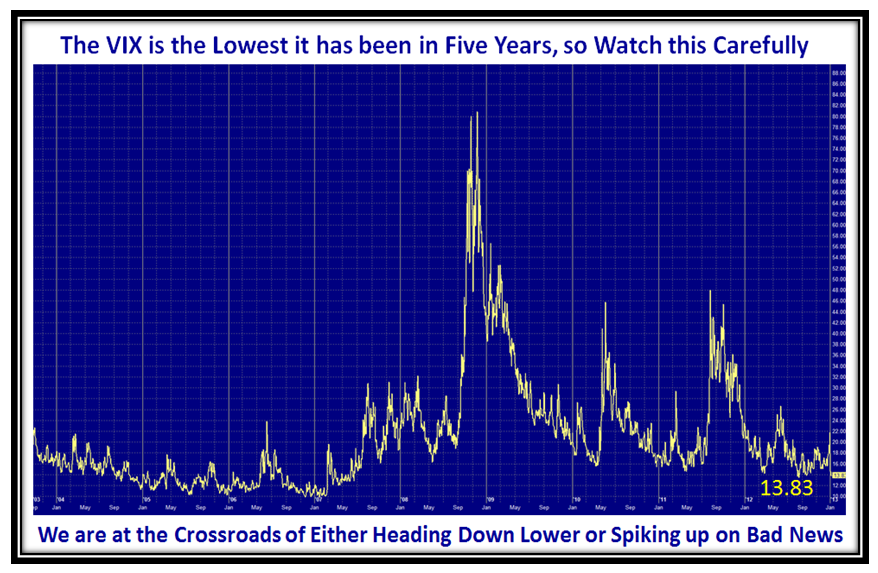

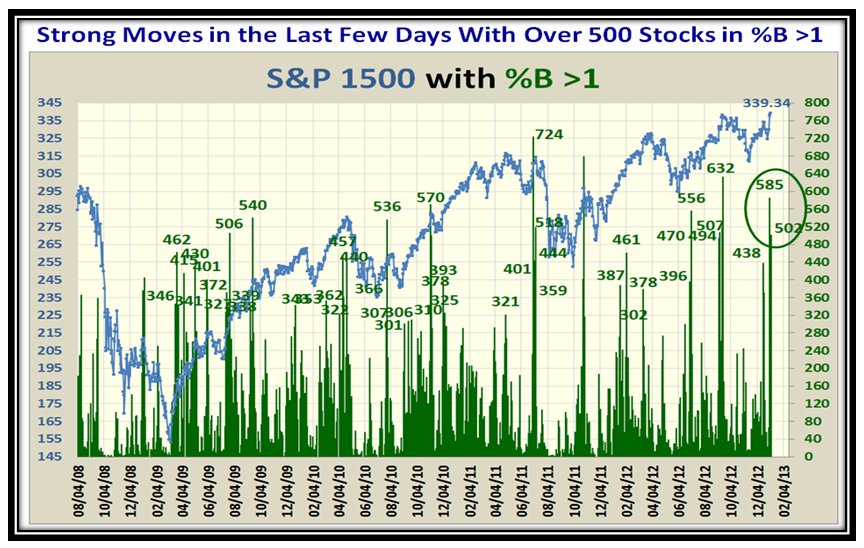

I hope by now with all the signals you have come to understand and enjoy about %B and 1-Day Change that you feel we have a warning system when unusual activity leads to big bucket skips. Likewise, when things are calm that is a MAJOR clue that the Big Guns are not selling into this overbought rally with any fervour as yet. Now that I have indicated the possibilty of a Knee Jerk look over to the right hand side of the next chart for what one should expect to see. More importantly as I have hammered home previously, we need to see several Kahunas in quick succession before we know that the Wall Street Gurus have done their propping up while quietly selling into it and are now ready to bring down the hammer and open up the floodgates as the herd gets panicked into selling en masse.

I wind up this blog with the three Road Scenarios, but before I do, I have chosen to kill several birds with one stone by choosing what I have called the Middle Road Scenario to show what the results might look like with a Knee Jerk Fakey before either the S&P 1500 or Russell 2000 (RUT) recover to seek the higher range of targets I set forth earlier. Enjoy:

In my scheme of things, I always develop three scenarios so that I am not caught off guard. I know many of you who have attended our HGSI seminars have incorporated that concept into their daily business in addition to their investing habits. They have also learned to never fall in love with one scenario too far in advance, but to let the Market tell you which one it is on, so as a wind up to this review, here is that chart:

Thank you to those who took the time to give me some feedback and comments; it makes it all worthwhile to hear from you. By the way, if you haven’t learnt the trick of clicking on any of these charts to make them bigger, shame on you. Then you can use snagit to capture a copy for your files to review at your leisure. I strongly suggest you do so with the High Jump Chart showing the targets and keep it by your elbow at your desk!

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog