I am reminded by Tim, a friend and supporter of the HGSI Software who gave me good and encouraging advice in his feedback to my previous blog note of terms Ron and I use from time to time that new readers may come across which are unfamiliar to the casual reader. This Blog Note is to help such readers with a brief description of some of the terms I use from time to time. I encourage you to go to the Highgrowthstock.com website for additional articles on many of the concepts we have developed to keep us on the right side of the market.

Our approach recognizes that there is no silver bullet of an Indicator, but find that two are better than none and sometimes four are better than two. You will find that our emphasis is on Managing Fear and Greed through “Impulse Indicators” which are triggered at Oversold and Overbought times in the Market, where most of one’s nest egg is either made or lost.

Glossary of Investing Terms

High Growth Stock Investor has some very unique features that are characterized by names that are unique to those features. This glossary provides a brief explanation.

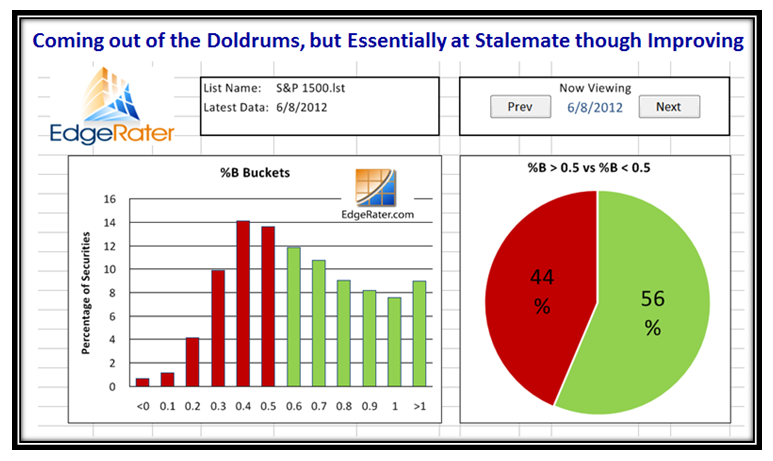

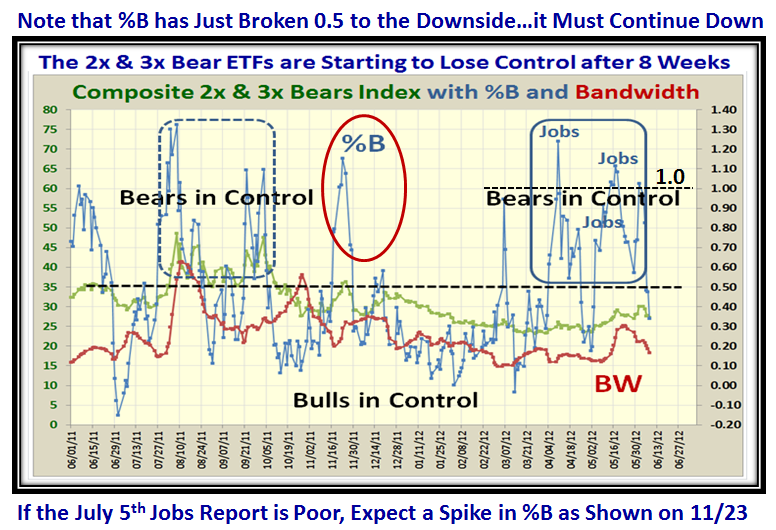

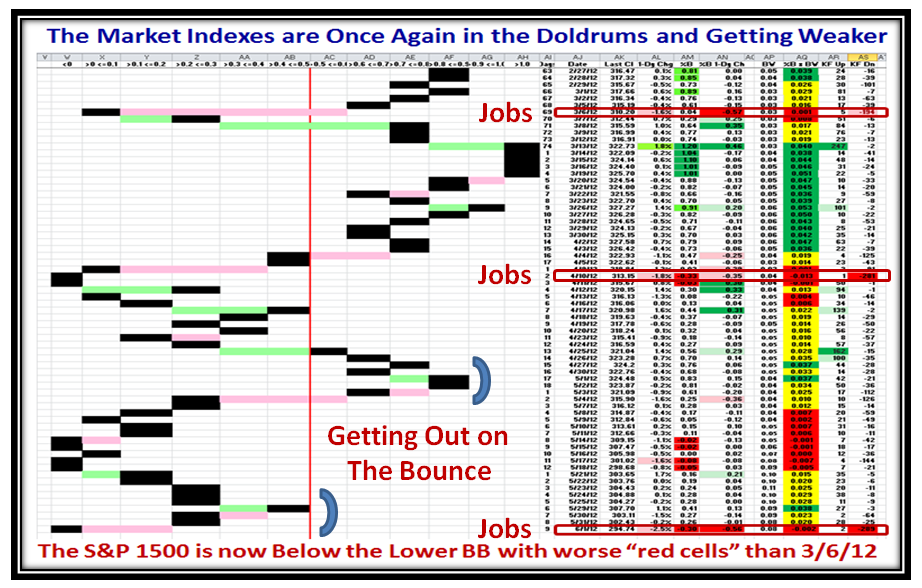

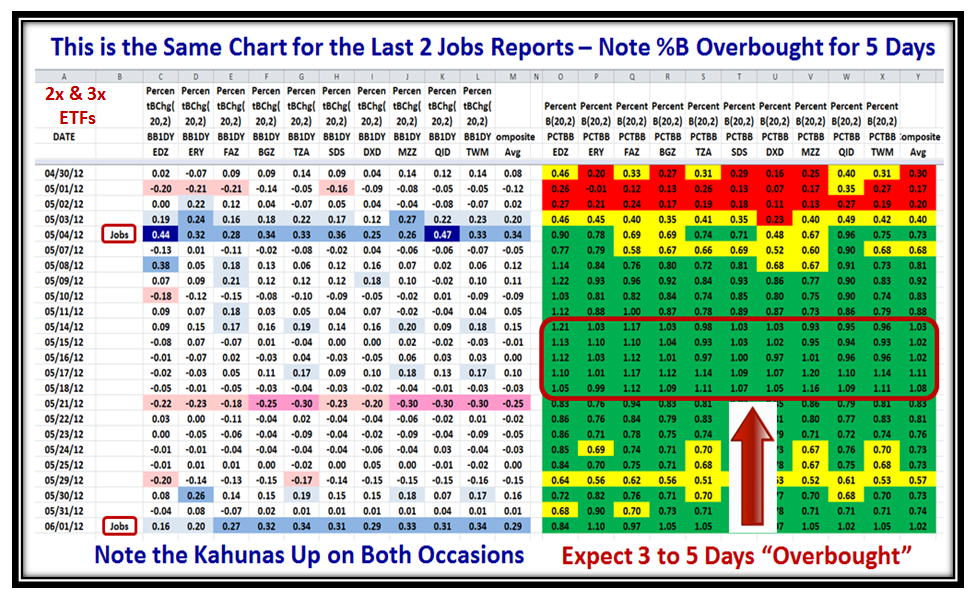

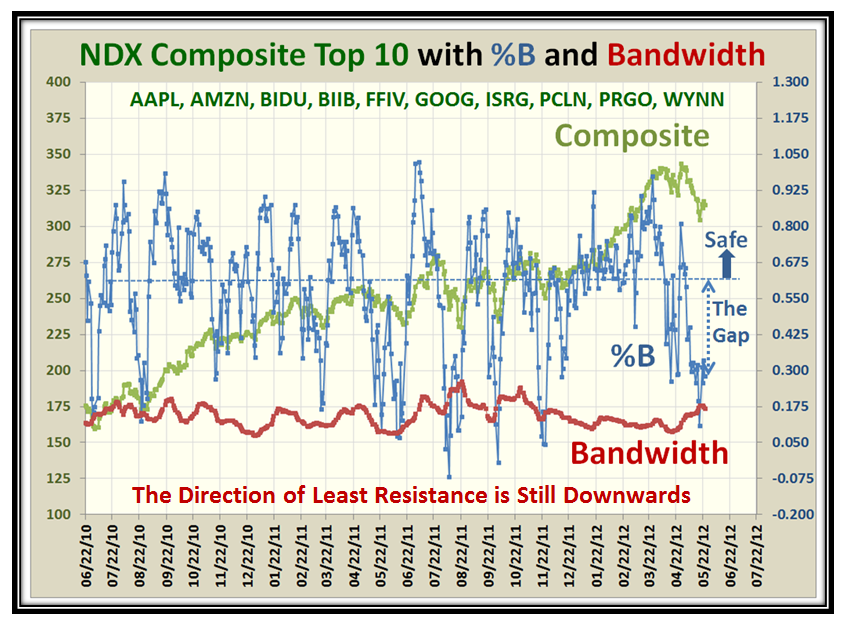

%B

%B is derived from the formula for Stochastics and tells you where you are in relation to an upper Bollinger Band and a lower Bollinger Band.

%B = (Last Close – Lower Bollinger Band) / (Upper Bollinger Band – Lower Bollinger Band)

Base Low

The Base Low is the lowest price a stock has based at in the last six to 12 months. It can be determined on both individual stocks as well as market indexes and can be used to measure stage breakouts as well as extension, i.e. risk. For more information, read the Base Low Concept discussion.

Bingo

A Bingo signal indicates an oversold condition in a minor or intermediate correction and many more lead to capitulation in a Bear Market. A Eureka signal will usually follow a Bingo signal within 15 days. With a minor or intermediate correction, there will usually only be one or two Bingo signals before a Eureka signal. With a Bear Market, expect several Bingo signals, with the last Bingo being capitulation.

Bollinger Bands

Bollinger Bands can be used to measure the highness or lowness of the price relative to previous trades. The purpose of Bollinger Bands is to provide a relative definition of high and low. By definition, prices are high at the upper band and low at the lower band. Prices moving closer to the upper band indicate a more overbought market, whereas the closer the prices move to the lower band, the more undersold the market is.

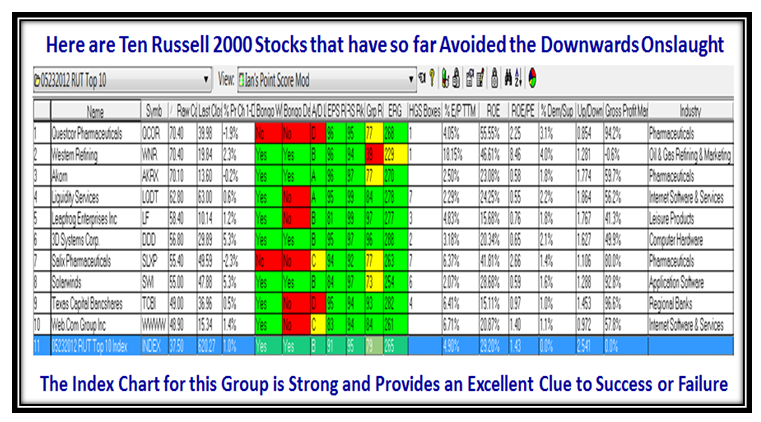

Bongo (Bongo Yes and Bongo No)

The Bongo indicators are a signal for markets, industry groups and stocks for entry and exit.

The Bongo Yes criteria (daily and weekly) are as follows:

1. Close > 9 SMA

2. RSI 8>14>19

The Bongo No criteria (daily and weekly) are as follows:

1. Close < 9 SMA

2. RSI 8<14<19

Cha-Cha-Cha Stocks

These types of stocks have strong fundamental and technical credentials and usually small- to mid-range capitalization from $100 million to $1 billion. They often make large moves up very quickly and can make just as dramatic reversals – hence the phrase “buy rockets, sell rocks.”

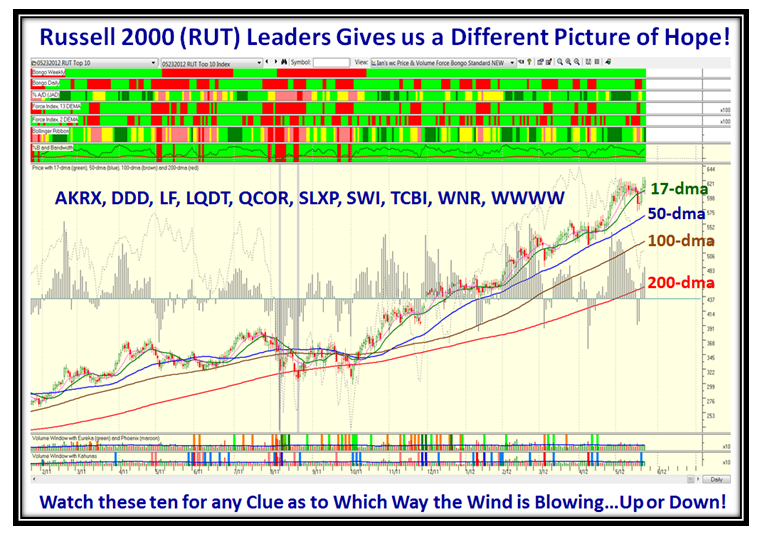

Eureka Signal

A Eureka signal identifies early up turns in the NYSE Index. It compliments 1-Day changes in %B of Bollinger Bands to signify the volatility – both up and down. This is a major indication to either a turn-around day after a market bottom or a follow through day(s) soon thereafter. It also gives an occasional warning to signify irrational exuberance near the end of a strong rally.

Eureka signals use the ARMS or TRIN Index Components for the NYSE. Eureka signals are infrequent – there have been 38 Eurekas in 7 years (usually 5 to 7 a year, depending on market conditions). Some components of the Eureka signal are as follows:

• It signals a very strong Bullish Up Day in the NYSE Market

• Advancing Issues to Declining Issues Ratio is greater than or equal to 3-to-1

• Advancing Issues to Declining Issues Volume Ratio is greater than or equal to 5.4-to-1

• ARMS Index is less than or equal to 0.9

Follow Through Day (FTD)

The concept of a Follow Through Day can be used to signal a rally. It is an indication of a potential change of trend in place. After the market has made a new low and a rally has been attempted, a follow through day is identified when a major index (Nasdaq, S&P 500 or DOW) closes up 1.7% or more for the day with an increase in volume from the day before. Look for follow through days to occur between four and seven days from a potential bottom.

Gas in the Tank

The concept of Gas in the Tank is a simple approach for judging how far a stock might advance when it has paused to refresh for a quarter or more after a recent positive move up in price. “Gas” refers to increasing earnings coming into a stock while it is basing (moving sideways), i.e. the P-E is coming down with increasing earnings to create value. A projected target price can be established by using the difference in the current and next quarters earnings from that of a year ago, multiplied by a P-E range. This difference is the amount of “new gas,” while the P-E is analogous to the miles per gallon. For more information, read the Gas in the Tank article.

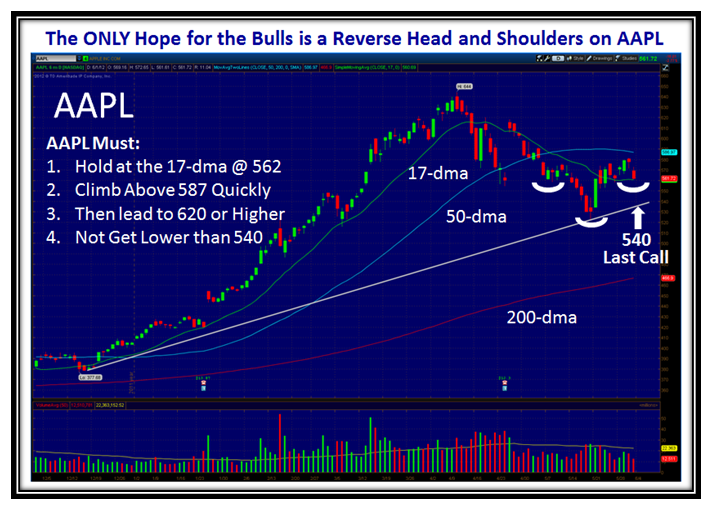

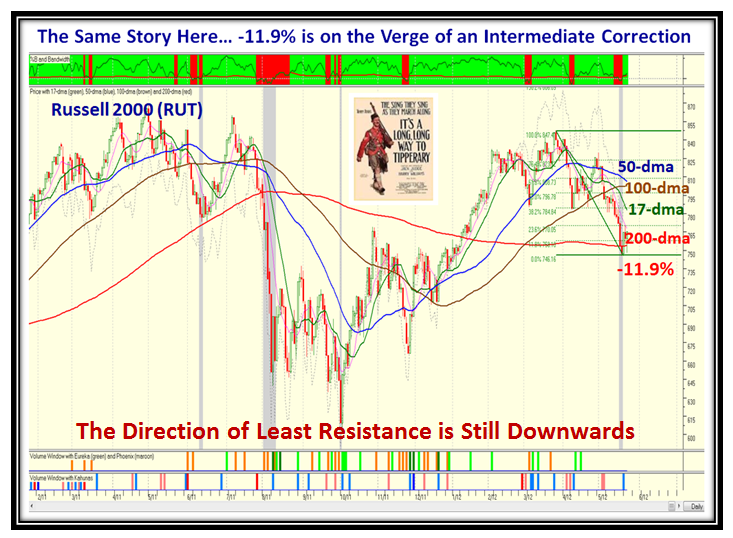

High Jump Indicator

A technique used to establish when a stock is extended and due for a correction. There are three elements used to determine when a stock is fully valued:

1. The current price from the 17-day moving average (MA)

2. The current price from the 50-day MA

3. The current price from the 200-day MA

Hindenburg Omen

The Hindenburg Omen is a strong warning signal for a market top. Named after the crash of the German zeppelin in 1937, it is a technical analysis that attempts to predict a forthcoming stock market crash. The traditional definition of a Hindenburg Omen has five criteria:

1. That the daily number of NYSE new 52 Week Highs and the daily number of new 52

Week Lows must both be greater than 2.2 percent of total NYSE issues traded that day.

2. That the smaller of these numbers is greater than 79.

3. That the NYSE 10 Week Moving Average is rising.

4. That the McClellan Oscillator is negative on that same day.

5. That new 52 Week Highs cannot be more than twice the new 52 Week Lows (however it

is fine for new 52 Week Lows to be more than double new 52 Week Highs). This condition

is absolutely mandatory.

A confirmed Hindenburg Omen occurs if a second (or more) Hindenburg Omen signals during a 36-day period from the first signal.

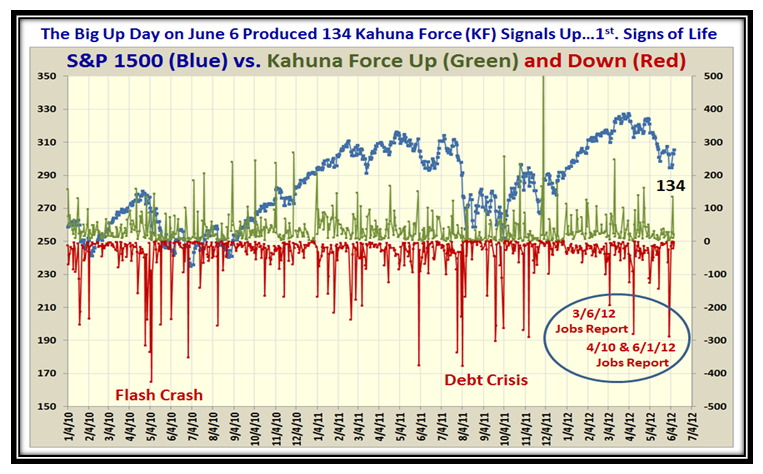

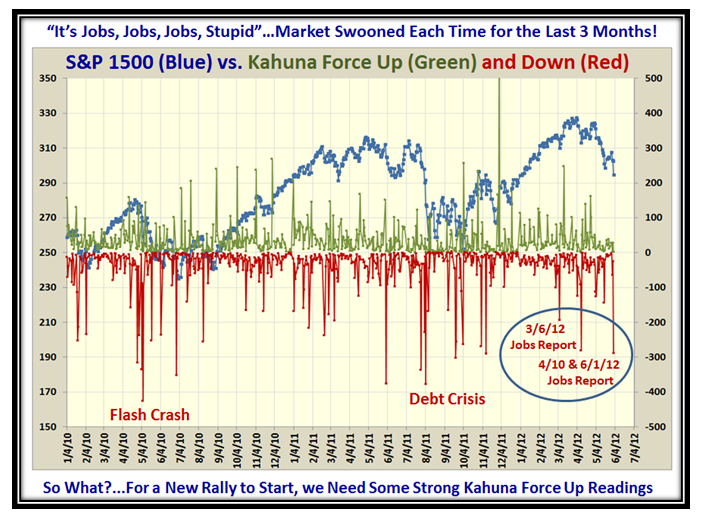

Kahuna (Little and Big)

The Kahuna indicator measures volatility and momentum by looking at the one-day change in %B. The Big Kahuna is a 1-day change in %B of plus/minus 0.40. A Little Kahuna is a 1-day change in %B of plus/minus 0.24. Big Kahunas are signs of strong momentum (either up or down) and work well with the Eureka signal to identify tops and bottoms.

Limbo Bar

The Limbo Bar is the inverse of the High Jump Indicator. It is used to test stock valuation by looking at negative numbers below the 200 day moving average (DMA), the 50 DMA or the 17 DMA.

Mattress Stuffers

Mattress Stuffers are large cap stocks with solid earnings credentials. They have earnings stability – dependable earnings growth of 15% to 25% year after year. The stock’s chart pattern rises steadily, but not as fast as Cha-Cha-Cha Stocks. These slower growth stocks can be held much longer, thus earning their moniker.

Nine Box Matrix

The Nine Box Matrix is a simple chart used to identify stocks that have a better chance of growing faster in price. It uses Annual Earnings % growth rate over the past five years in combination with Current Earnings % growth rate for the last two quarters compared with the same quarter a year ago. For more information, read the Concept of the Nine Box Matrix article at the HGSI Website.

Phoenix

The Phoenix is the reverse of the Eureka and signals potential downturns in the NYSE. It is a Heads Up on a bad day in the Market. Two or more of this signal in a week coupled with a “Down” Kahuna or two says “Watch out below” and the Bears are now in Control.

Tsunami

Confirms the ebb and flow for the Kahuna and Eureka signals.

VIX

VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index. It is a popular measure of the implied volatility of the S&P 500. Sometimes referred to as the “investor fear gauge,” the VIX is a commonly used measure of market risk.

Wolf Pack

Wolf Pack refers to the idea that stocks move in groups, like a pack of wolves.

I hope this helps, and many thanks to you all for your continued support.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog