Absence Makes the Heart Grow Fonder!

Wednesday, October 27th, 2010I can tell from the “hits” I get on the blog that there is a faithful following that enjoy my blog, and I hope the picture below assures you that I had not forgotten you, but I was extremely busy doing the October Seminar:

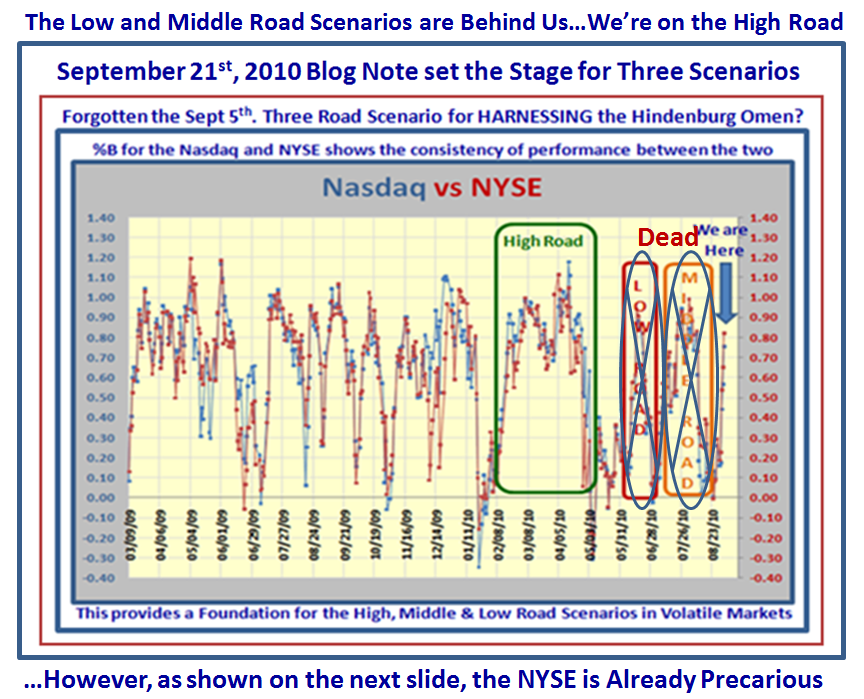

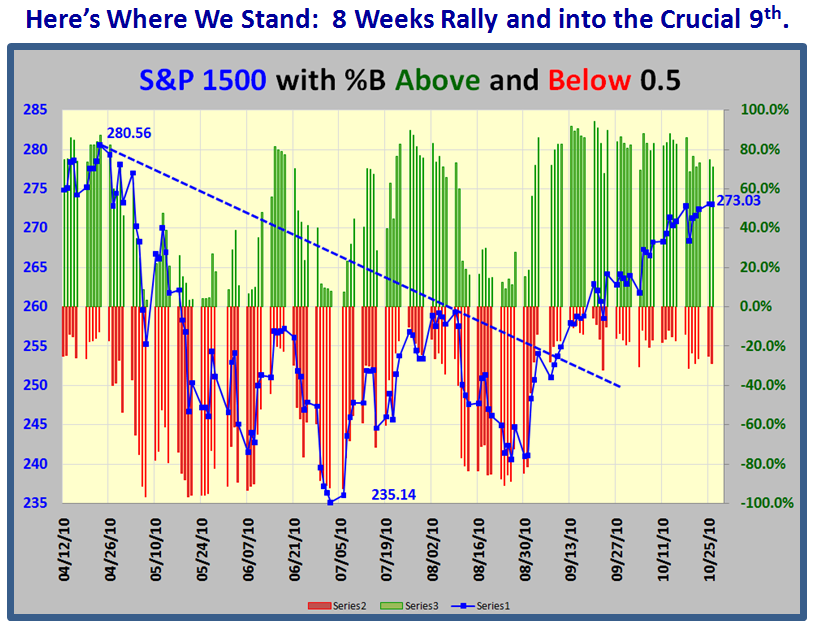

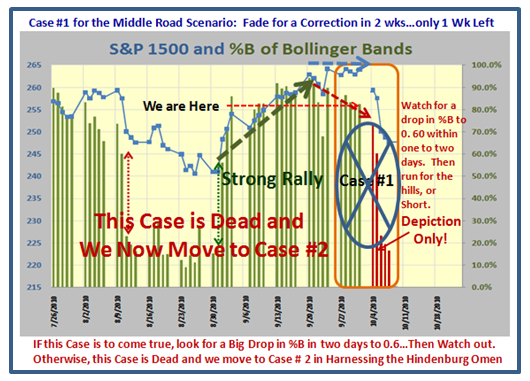

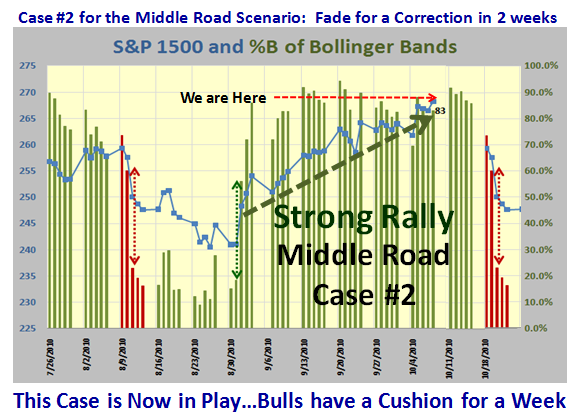

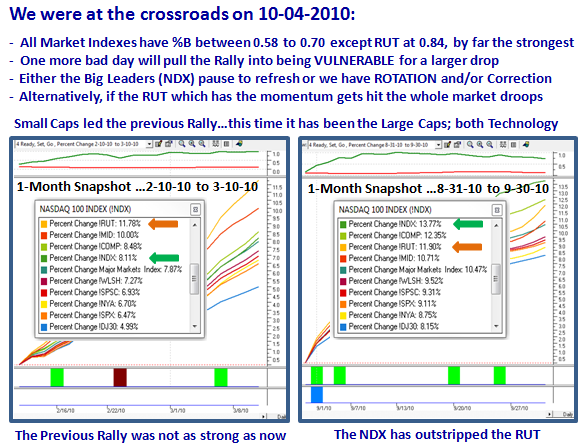

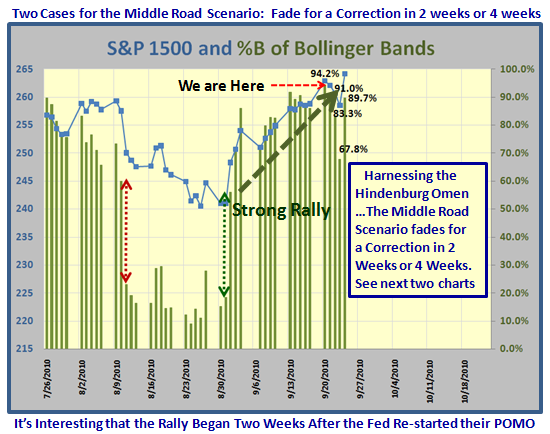

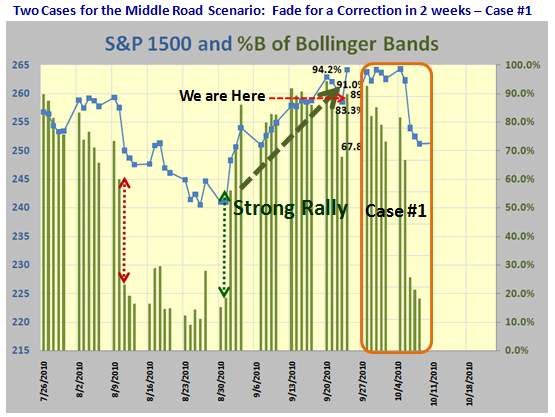

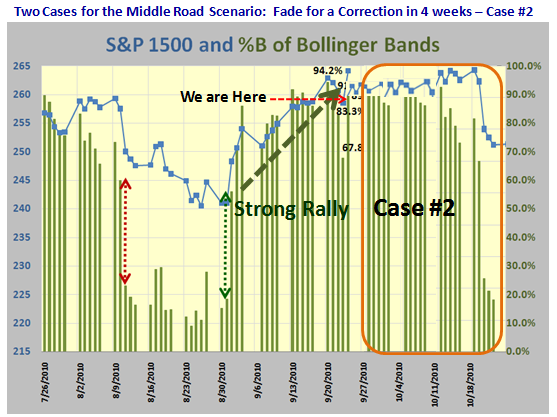

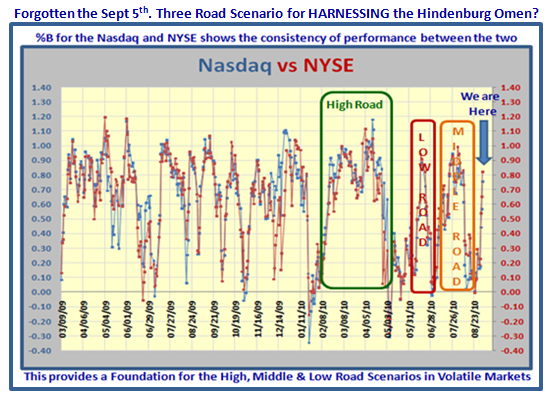

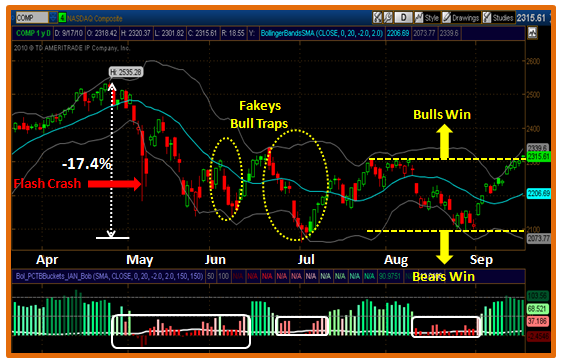

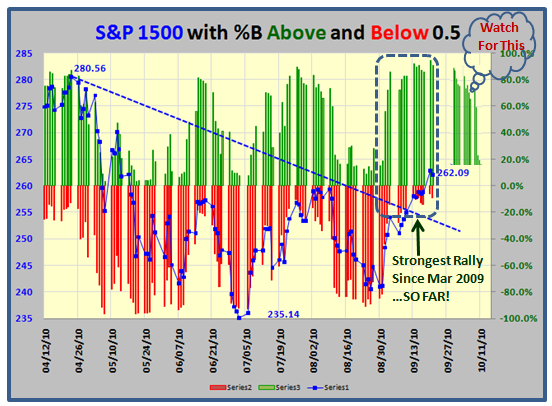

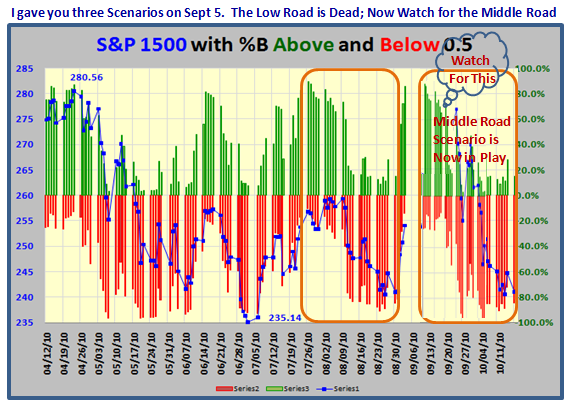

We are now less than a week away from the mid-term Election and regular visitors to this blog know that I set the stage to watch three scenarios over eight weeks ago. We have seen both the Low and Middle Road strategies end and we are now on the last leg for the High Road Scenario:

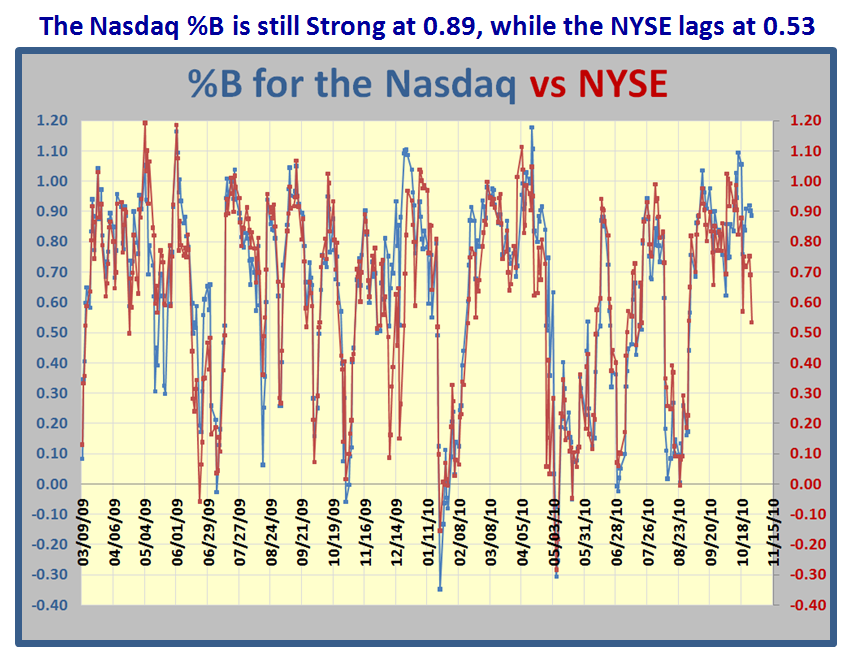

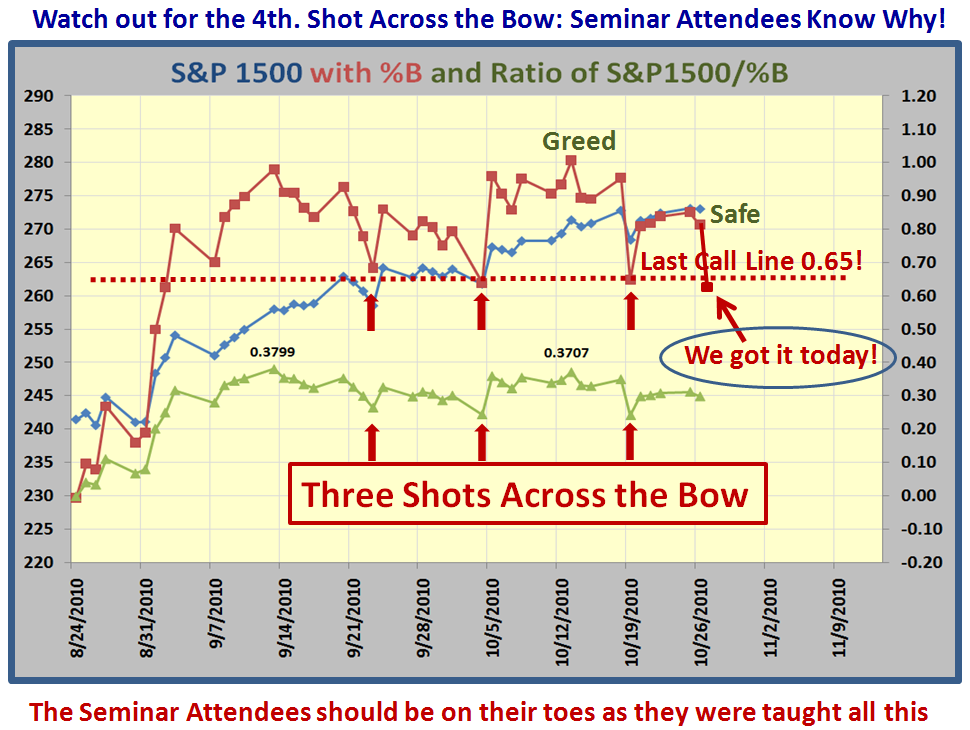

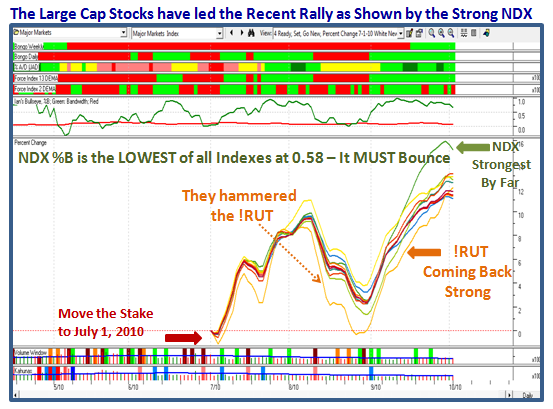

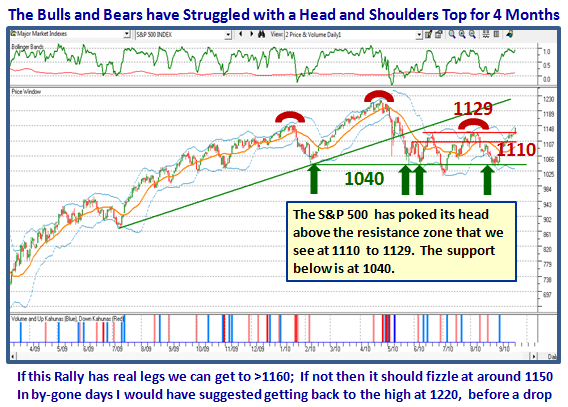

…And here is where we sit right now. You can see that just today the NYSE is now precariously close to the Lower Middle Bollinger Band at a %B of 0.53:

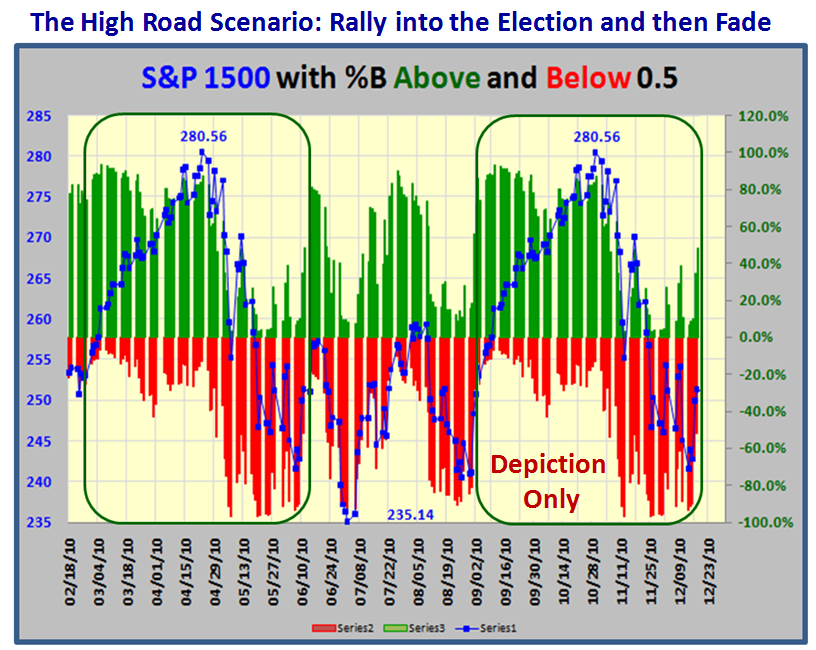

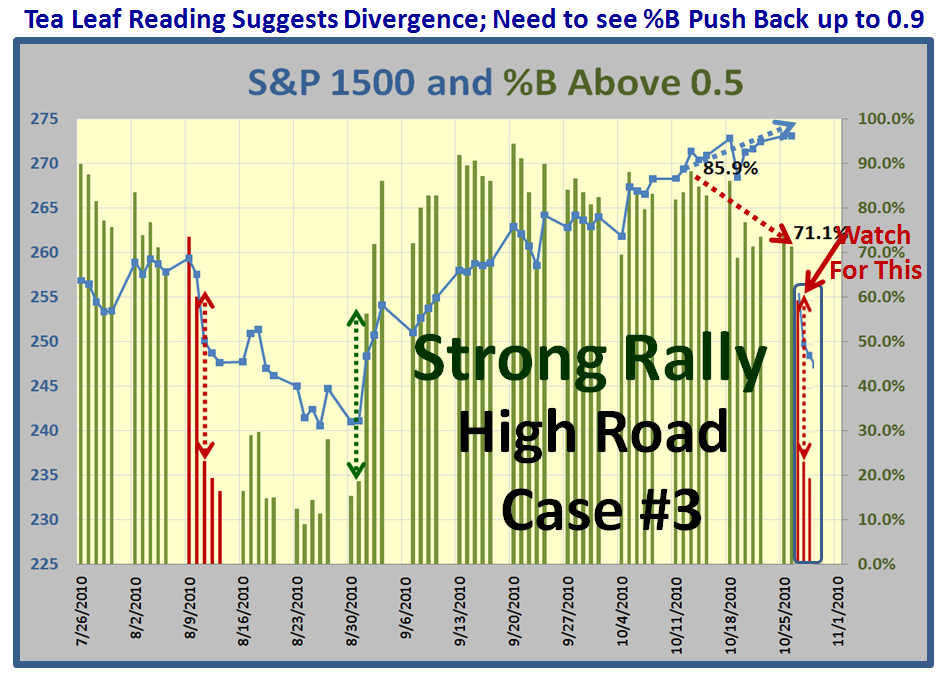

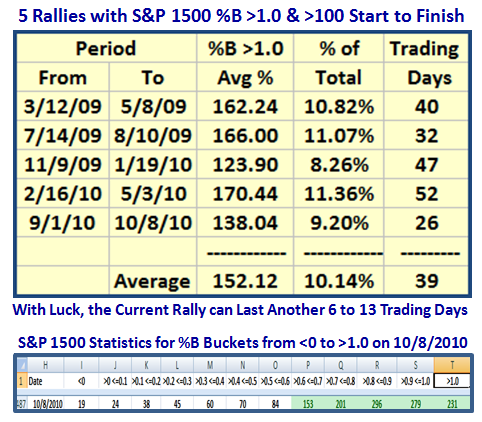

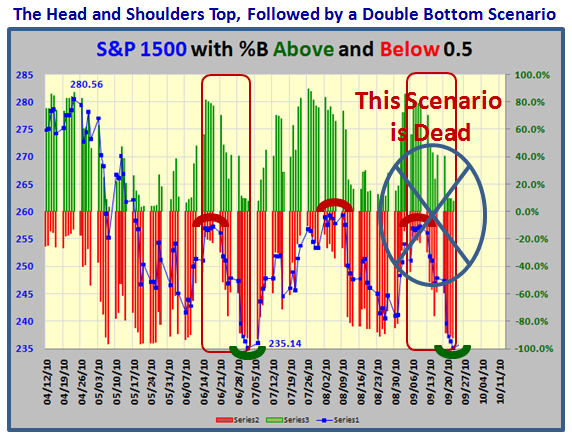

Here is the orginal “Template” for what we should expect for the High Road Scenario. This is a depiction only, but it is important to note that the Rally was nine weeks up before it faded and that seems to be the time when things peter out. As you can see we should fade anywhere between tomorrow and next week if it goes according to form:

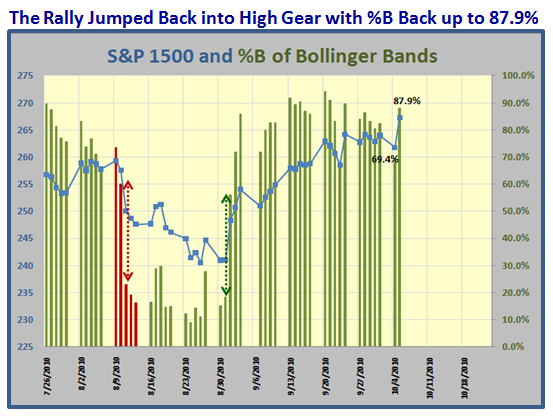

…And you can see we have had a good run, though we have not reached the old high for a double top. 273.03 is last night’s number and we are currently at 272.33 for the S&P 1500:

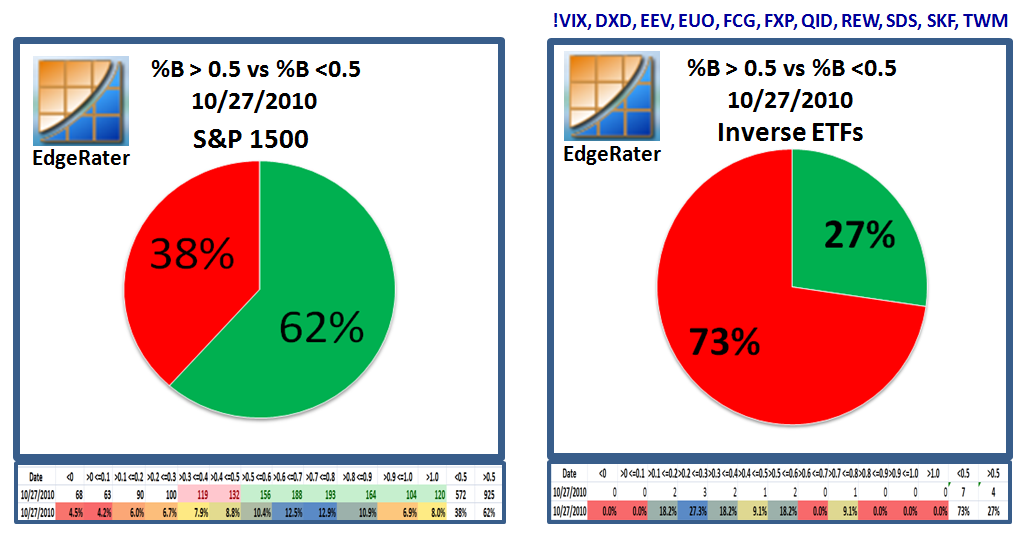

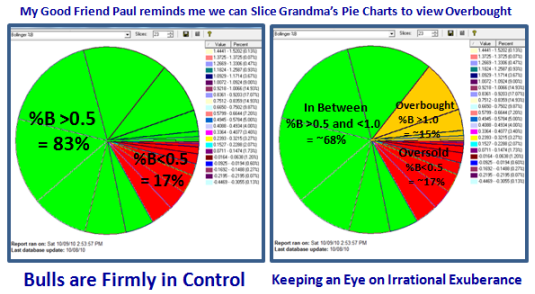

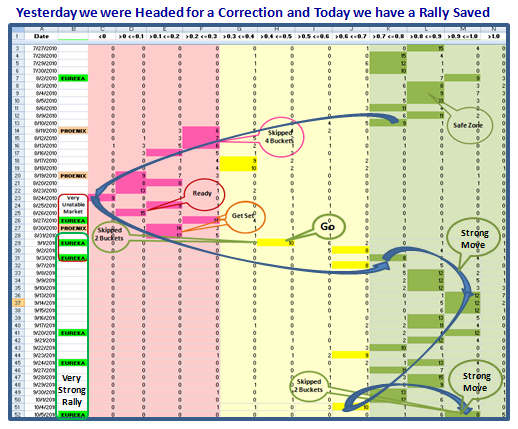

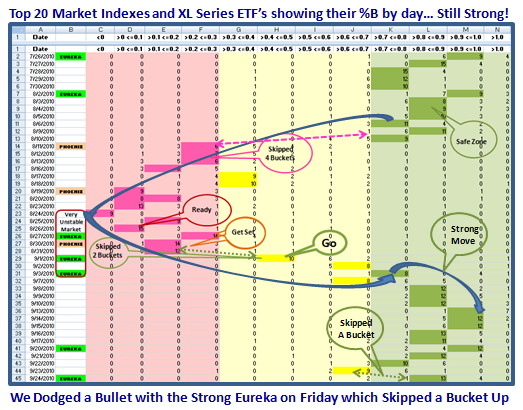

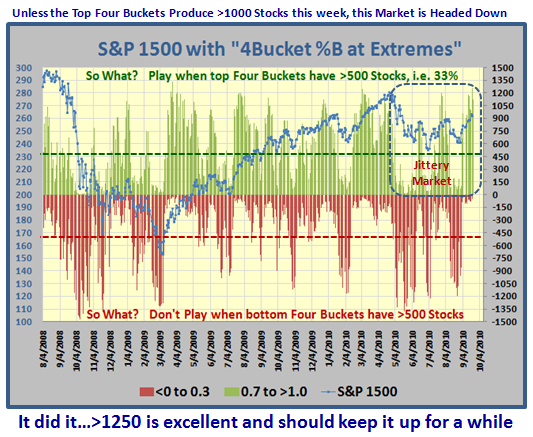

The % of stocks above %B >0.5 is a weak 62%, so we are knocking on the door of heading down, and there is a strong possibility of a big fall in Bucket Skipping as shown below in red, unless we see a strong come back tomorrow:

Here is the Late Breaking News from today’s action as the %B is down to 0.63, and that is on the hairy edge of falling down. We really need a strong day tomorrow or the Bears will have a field day and we are due for a correction. Of course we know that the Large Players are beginning to sway to the Short side, but it is not convincing yet:

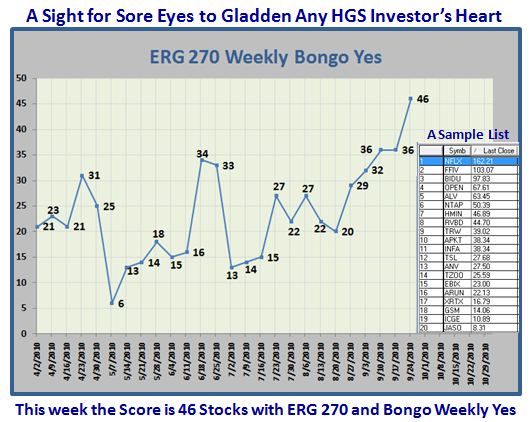

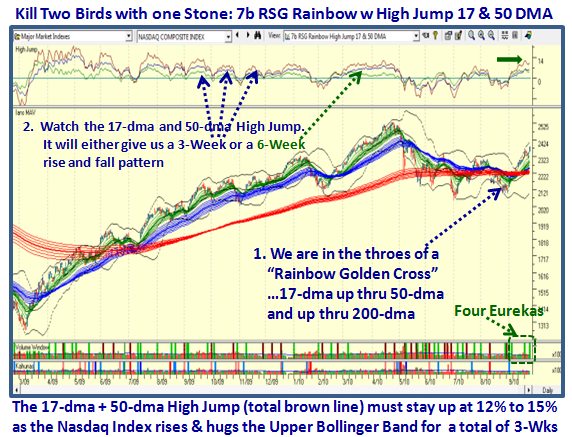

One way we can tell that things are stirring to the downside is to watch how a Portfolio of Inverse Ultra Shorts along with the VIX are beginning to come off the bottom. With sincere thanks to my good friend Chris White who is the CEO and owner of his Edgerater product, here is that picture which is worth its weight in gold:

Well there you have it; stay on your “Light Feet” and watch tomorrow’s action like a hawk. The Bulls had better push back hard tomorrow or we head down.

Ron joins me in thanks to you all for your support and good wishes at the Seminar!

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog