Mail-Bag Question from a Newbie:

Hi Ian: I’ve become a regular visitor to your blog. I don’t know much about investing. However, I have a fair sum of money available in bonds and also some cash (+$200.000). Considering the current crisis, do you think that it is a good time for a novice like me to start investing in stocks…? And what is your best advice to the newbies. I’ve tried to follow the ups and downs of the stock market together with the commentary from the news pundits in the last couple of month. The 22nd of September you wrote on this blog:“I’m not suggesting that we head down to 800 on the S&P 500 any time soon, but the odds of 1150 is now almost a certainty and again, if we see any signs of bickering in Congress we are headed for 1000 and possibly lower.” I’m asking since I’ve become a little wary of the risk involved with stocks.

Response: Hi Matt: I apologize for the long delay in responding to your comment on my blog. I got inundated with work at this end preparing for the seminar we just held and I am afraid your note got buried until now.

Thank you for being a regular visitor to the blog and I appreciate your concern about dipping your toe into the market with the high degree of VOLATILITY and UNCERTAINTY of the market direction.

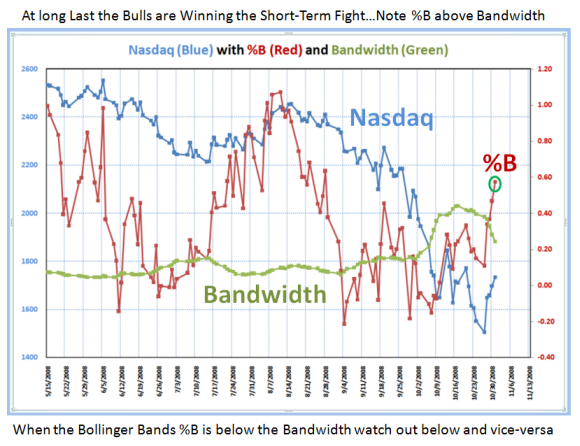

As you can see from the one piece you picked out from the blog note, nobody can predict how fast a Market can go down or up, but as you have seen by watching my blogs, I can give you the three scenarios for what I perceive are the current Up, Down or Sideways scenarios. I also will show my leanings of the odds of any scenario, but it is the Market which tells me the direction. Never, ever fall in love with one scenario. However, having evaluated the three you will find that you will invariably be on the right side of the market or are ready to change course quickly if you have made a mistake.

Since you are a newbie to investing in stocks here are some pointers I would give you:

1. The worst time for you to start was a year ago when the market was at a peak. The best time to sharpen your pencil is NOW when the market has corrected so violently.

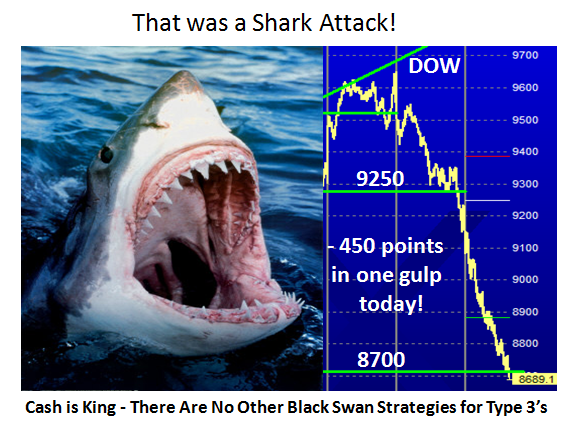

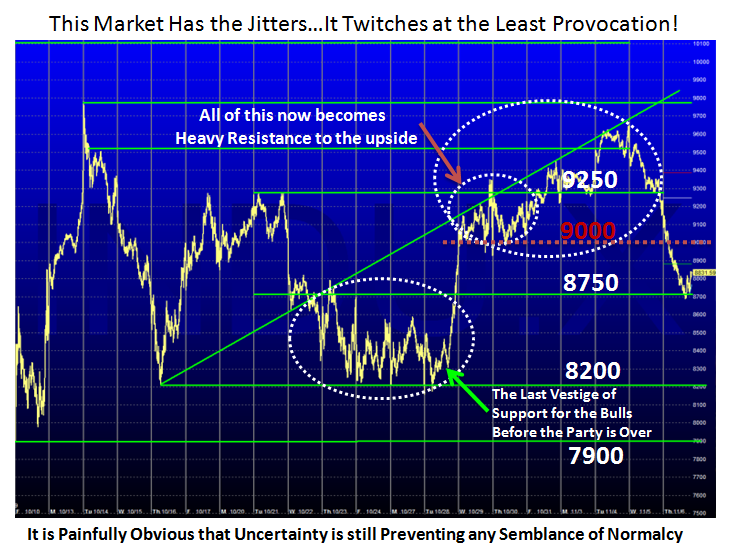

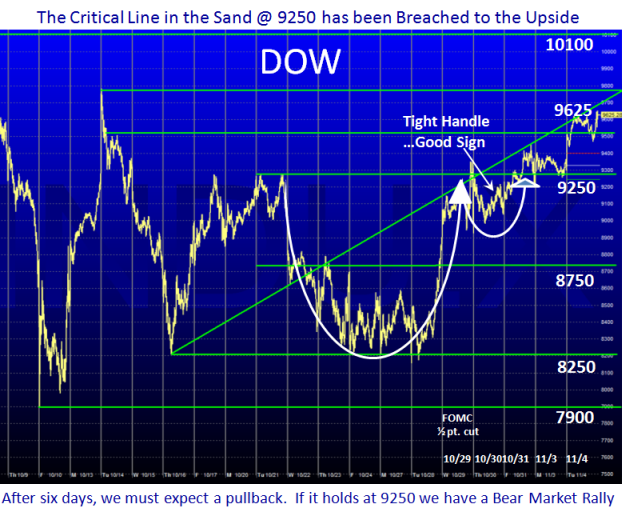

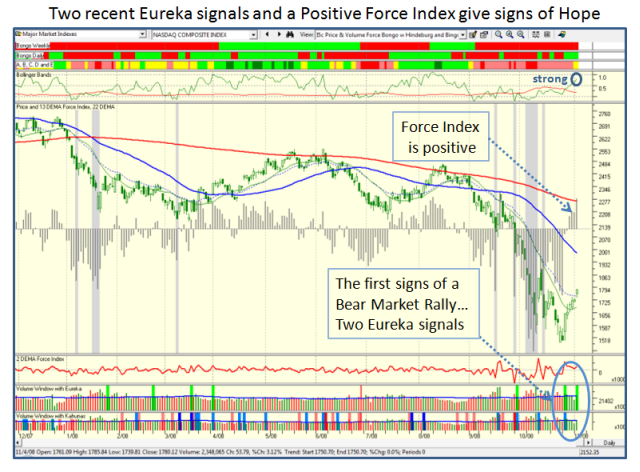

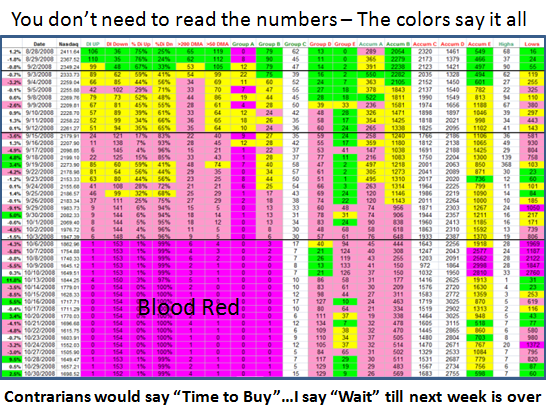

2. The worst time for a Newbie to engage is when the Volatility is so high. 500 to 1000 point swings per day in the DOW are commonplace these days and that is 4 times more than it was six months ago. Accomplished Day and Moment Traders are having a ball as they enjoy being jack-in-the-boxes hopping in and out of being long and being short. That is no place for a newbie to start putting their hard earned money.

3. One of the key reasons that one has seen such a change in volatility is due to the attraction of using leveraged ETF’s (Electronic Traded Funds) both long and short. One can now trade them with twice the return if you wish to do so with these ETF’s being surrogates for the Market. One can be in and out of the market quickly and yet have the comfort that you are buying a basket of stocks that emulate an Index such as the QID or QLD for the Nasdaq. Ergo, Mutual Funds are a thing of the past. Another reason for the volatility is the “No Up Tick Rule” for shorting stocks has been eliminated, so one can short at anytime rather than having to wait for the stock to “uptick” before you can purchase a short. It goes without saying that a third reason is the flagrant over-indulgence in buying on “tick” on a world-wide basis where most can ill afford to do so, nor have the discipline to have proper money management.

4. As a newbie, you MUST understand that over 50% of the gain/loss in a stock’s price is influenced by the Market. A further 30% is due to the Industry Group the stock is in. Only 20% is due to the stock itself. With those odds and this volatility, it is fool-hardy at this point in time to think of long-term buy and hold unless you are prepared to possibly sit with dead money for a long time, unless you are a clever stock picker…which you are not since you declare you are both scared and a newbie. Over the years, we have found that the trump card “retail investors” such as ourselves have is “Nimble”.

5. That is why our approach to stock investing is what we call “Tops Down” starting first with an understanding of the Market behavior, then identifying the strongest Groups or Wolf-Packs as we call them, and then selecting the best stocks in those groups for a decent gain dependent on how the market is behaving. If the wind is at your back, you attack…if it is a hurricane in your face, you will be blown over. The trick is to understand what the Market and Industry Groups are telling you and this is the tremendous power of the HGSI software.

6. To become accomplished as a Stock Investor/Trader, you must first be a master of one approach before you can blossom out into becoming a Jack of all Trades. In other words, I find that one of the biggest mistakes Newbies make is to flitter around from one “guru” to another, and one talking head to another. They are never around to tell you that they have changed direction while you are still holding the bag which is invariably dwindling, or they will always tell you “don’t sell now, it will come back” and it seldom does.

7. However, NOW is the TIME for Newbies to get educated if not started into learning the Strategy, the Process, and the Implementation of how to make money in stocks. Rome was not built in a day. There is no dodging the fact that if you don’t first learn and paid some dues to study an approach, you will pay costly dues for learning from your mistakes. That is why we have a three pronged approach to teaching Newbies like yourself how to get started:

a. There is this Blog which you came across and find that my message is on point and useful. Presumably, you like what you see.

b. My partner, Ron Brown, does a WEEKLY FREE Stock Market Reports Movie every Saturday morning when he is not on holiday, that gives you his pulse of the market within 30 minutes of your time. In addition by watching his approach you begin to pick up how to maneuver between the different elements of the HGSI software we use.

c. We offer you a 60-day free trial of the High Growth Stock Investor software so that you can follow both Ron and I as we give you pointers of “What’s Working Now”.

Beyond that we continue to hold one’s hand by offering High Growth Stock Seminars twice a year (which as you can see are very successful) and a stock newsletter that comes out once a month on key relevant strategies and Case Studies of what to look for at that point in time. We have also started a series of short Internet “Go To Meeting” courses to help trial members understand how to use the software.

The rest is up to you. What you yourself put in is what you will get out. It takes hard work. Few of us can make a fortune without understanding and learning how to avoid the costly mistakes up front. On the other hand, you will not start to increase your wealth to develop a nest-egg for your retirement unless you take the time to learn. Ready, aim, aim, aim and never firing will never get you there.

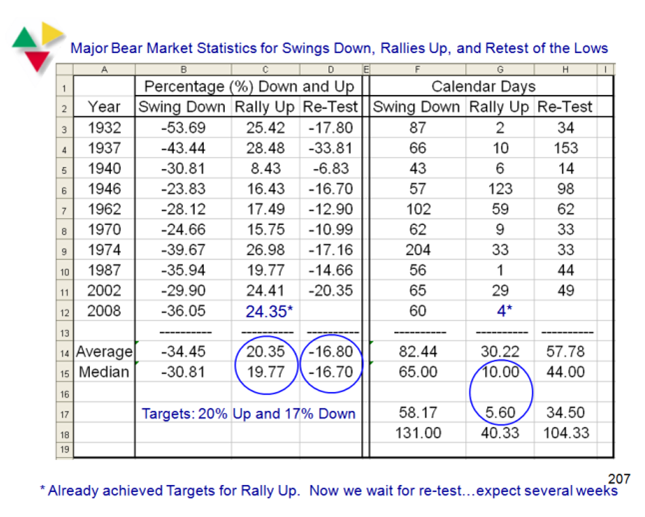

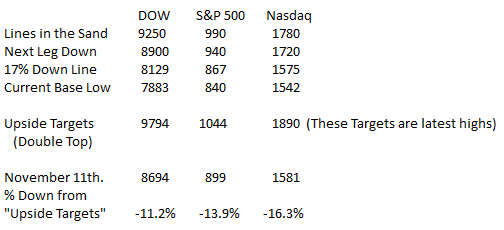

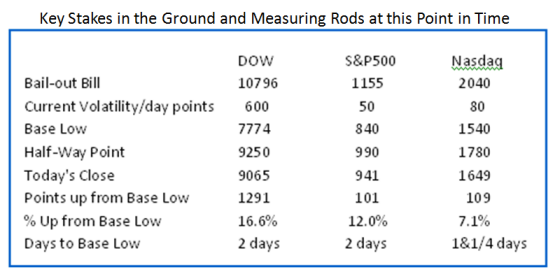

Two last points: There is a wealth of information on the Learning Center on different topics Ron and I cover at the highgrowthstock.com web-site. Also, I strongly suggest you go back to the blog and find the note I wrote on “Ignore the Fog and Follow the Signposts” written on Thursday, September 20th, 2007, and read that post and then STARE at the table (which is hard to read), and you will see that each of those milestones have come to pass as we have trundled down from the high of 1576 on the S&P500. We had a PLAN and were able to ACT accordingly.

I’m sure there are other points I could cover. If you have any questions, you have only to ask.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog